Source: Fincom Investment Partners for Streetwise Reports 04/01/2018

The stock of this gold explorer with projects in Wyoming and Nevada plunged last week, and Fincom Investment Partners explains why the firm believes it’s a bargain.

Usually when a miner’s shares suddenly plunge, or jump, there is a company-specific reason, such as disappointing news, newsletter recommendations, a big discovery, etc.

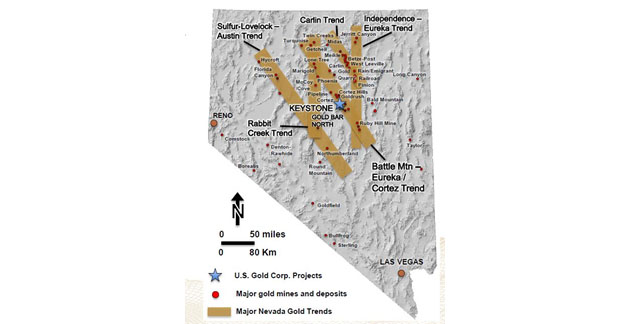

We met with U.S. Gold Corp. (USAU:NASDAQ) at the recent ROTH Capital Conference. We came away impressed. Although not listed as company management, Luke Norman, who co-founded Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE), is both an investor and co-founder of U.S. Gold. Luke brought along former Newmont and Gold Standard superstar geologist Dave Mathewson to manage a promising project—smack in the middle of Nevada’s Cortez Trend.

Since we have followed Luke for the past seven years, and respect him, we listened. We will outline several reasons why we like this story, but first, we believe savvy investors should act—we have—since this past week shares took a sudden, unexpected plunge.

In this case, we could not find anything. No news, no rumors. Nothing on any message boards. Just silence and a plunging stock.

A bloodbath, or a bargain?

Source: Stockcharts.com

With only 17 million shares issued, and a U.S. NASDAQ listing, it is easy for the machines to push a small company around, but even so, the trading patterns were indicating a serious panic-type selling, without regard for price.

By Thursday morning, shares had slid down to a $21 million market value—a bargain since USAU has about $8.5 million in cash, so there’s no financing coming either. Plus, U.S. Gold is a two project Company: a nearer-term producing mine in friendly Wyoming, along with a “lottery ticket” in Nevada, overseen by a geologist who has found more gold in Nevada than just about anyone.

Copper King has some attractive numbers. From the January 2018 PEA: Long life at 17 years; per annum starting at 47 thousand gold ounces plus 10 million pounds copper. Excellent IRR of 33%, backed by low CAPEX of $113 million. The project is open for expansion.

This looked attractive, to us. We like the fact of a solid project advancing towards permits, and thus value keeps growing, but since such projects often get lost in the ADD-afflicted world of hot money mining investors, we also like the combination with the Nevada property—where just one whiff of discovery should send the shares soaring. Thus, two worthwhile projects were selling for a net $13 million valuation!

But we always have to wonder. . .did we miss something?

Turns out we did not. Our source—a third party who actually knows what they are doing—informed us—and they spoke with the seller—a small fund apparently decided to blow out of their shares last week for end-of-quarter “window dressing.”

Looking at the trading action, this made sense. We know many small (and even large) hedge funds are currently under tremendous pressure. This past quarter was not kind. Investors are pulling out of hedge funds; some fund managers may find themselves in the horrible position of actually having to work for a living. Like at Walmart.

Our guess is this fund blew out of anything that wasn’t deeply “green,” in order to convince their investors that “next quarter will be better.” We feel very sorry for U.S. Gold shareholders who have had to sit through a bizarre, sharp share decline. We hope they didn’t panic and sell.

Source: U.S. Gold Corp.

OK. These things happen. Markets can be rough.

In sum: We are dip buyers. Here’s why:

- Tight share structure of only 17 million shares. No investor warrants. Room to develop. Well cashed with about $8.5 million.

- 2018 should be an “inflection” year as Copper King project advances toward Prefeasibility and permitting. Any whiff of discovery in Nevada should be explosive.

- Talented people who know what they are doing. Holy cow, is this ever important.

- Minimal cash guzzling. This we cannot stress enough. Can advance Copper King towards permitting, without spending a small fortune; limited drilling in Nevada. We like this approach, greatly so, as neither ourselves (nor anybody else) knows when the next upleg in gold will occur. As shareholders, we do not want to see the share count get blown out by excessive spending—and money raising—especially at these low levels.

- All recent financings have been at higher prices, including $12 million at $2.64 in 2016. We must confess: We like buying a stock at half what prior investors paid, especially after major fundamental improvements.

Investors should look at the U.S. Gold presentation for themselves: www.usgoldcorp.gold.

Joseph Reagor, the sharp mining analyst at ROT Capital Partners, has a $3 price target. That will look conservative if Dave Mathewson, who is as excited as he ever gets, hits in Nevada. Even better, investors are “getting” the Nevada upside “for free”—Copper King in Wyoming can easily cover, in our opinion, the current $22 million valuation, which, as noted, includes $8.5 million in cash.

With potential value drivers coming in 2018, we are happy to buy, and sit, with USAU shares at what we consider to be “Santa” prices.

This is a bargain.

Frederick Lacy, President of Fincom Investment Partners, began as a Chicago-based commodity broker in 1985 with a division of Noranda Mines. In 1987 he joined Bateman Eichler, Hill Richards in Los Angeles, ultimately “retiring” in 2000 as a licensed Securities Principle and Managing Director of Investment Banking. Mr. Lacy has been involved in numerous successful investments, including raising the institutional start-up capital for what became PetroHawk, subsequently purchased by BHP in 2011 for $15 Billion. Fincom IP was one of the very few correctly calling both sides of oil’s 2003-2014 bull market. We also have a long time involvement with technology, including arranging a $13 million VC financing for a “permanent ledger” technology (now commonly known as “blockchain”), lead by California’s number one performing venture capital fund, Upfront Ventures. Other investments include 3D holographic display technology, early mobile applications and power conversion. In 1989 Mr. Lacy hosted “the Venture Capitalist” which aired on (now) CNBC; he was invited to Beijing in 2006 to advise Chinese companies on entering the U.S. Financial markets. Fincom IP’s long time clients are enormously successful investors; we are not accepting new clients and do not sell any subscription services.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Frederick Lacy: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: U.S. Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. Additional disclosure below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Gold Standard Ventures. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of U.S. Gold Corp., a company mentioned in this article.

Disclaimer:

This report is for informational purposes only and is not a solicitation of any security purchase or sale. Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, Fincom Investment Partners cannot guarantee its accuracy. Any opinions or estimates constitute our best judgment as of the date of publication, and are subject to change without notice. Fincom Investment partners and its officers and employees may buy or sell any securities mentioned in this report at any time without prior notice. We recommend investors conduct thorough investment research of their own, including detailed review of the related Companies’ SEC filings, and consult a qualified investment adviser.

( Companies Mentioned: USAU:NASDAQ,

)