Source: Michael Ballanger for Streetwise Reports 03/23/2018

Precious metals expert Michael Ballanger takes a look back at the highs and lows of the TSX Venture, contemplates the zinc and silver markets, and comments on “bullish” acquisition.

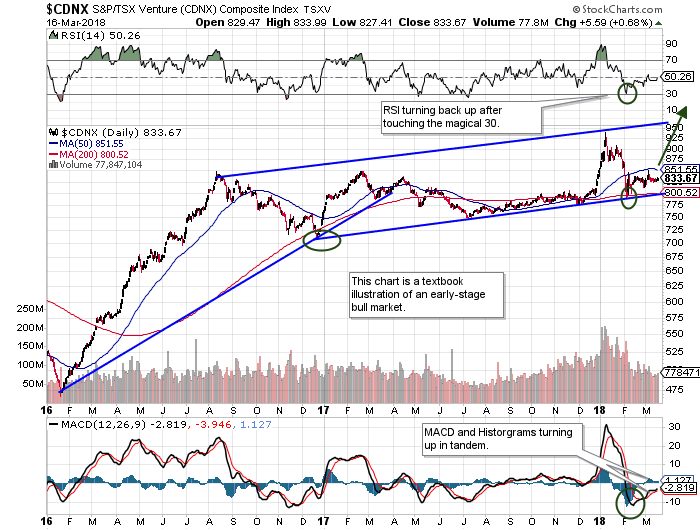

To start, take a look at the chart I have posted below and tell me that is not a great-looking chart. It is the chart of the TSX Venture Exchange, the exchange that has financed a great many of the world’s biggest discoveries. Up until the late 90s, it was the #1 “gunslinger” exchange in the world, but relinquished that honor to the NASDAQ on April 1, 1997, when the now-infamous Bre-X scandal was exposed, sending the Canadian stock exchanges into a severe crash mode.

Even more severe were the reactions of the old Vancouver and Alberta Stock Exchanges, which were the incubators of numerous frauds over the years. But long forgotten then and completely forgotten now is the enrichment delivered by those exchanges with discoveries such as Hemlo, Eskay Creek, Voisey’s Bay, DiaMet, Aber. . .and the list goes on, with billion upon billions of dollars in new wealth created in an environment of laissez-faire capitalism and animal spirits.

The chart posted below is the “new” bull market in the TSX Venture, which began around the time the Gold Miners bottomed in January 2016 and at a time when sentiment was almost as bleak as it is today.

Today, due largely to competition from ETFs and alternative currencies and technologies, what used to be the go-to exchange for legitimate risk-taking in oil & gas and mineral exploration now resides far off in the distance. Investor demand for above-average risk/reward opportunities has been met with new outlets for speculation, the result of which is that new risk capital available for exploration for supply-starved commodities such as zinc, copper, gold and silver is dwindling.

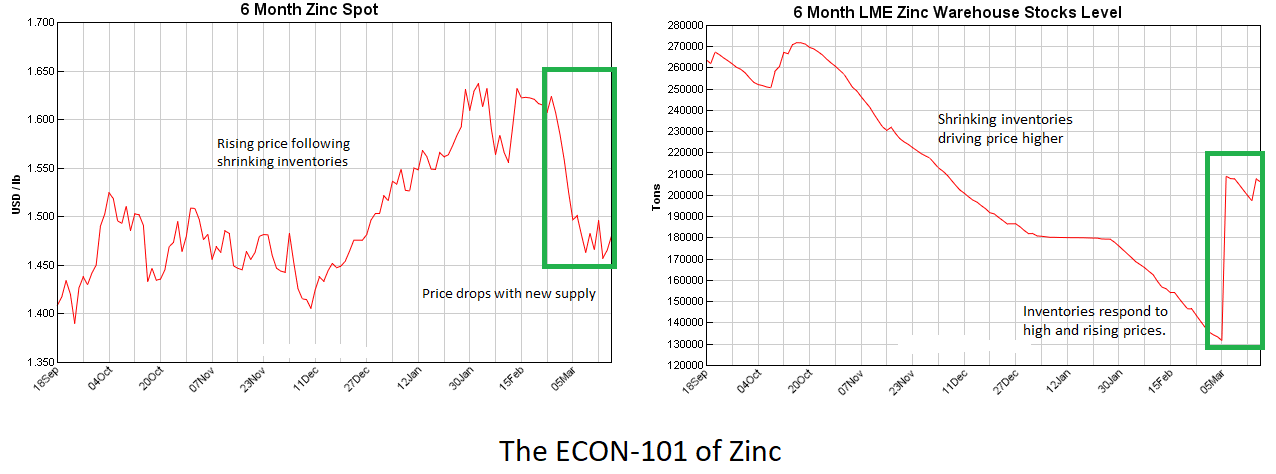

Despite this apathy toward speculation in new discoveries, it will eventually result in supply scares, with sharp price advances inevitably attracting and creating new sources of supply. This is exactly what has been happening in zinc. From 2013 until around one month ago, zinc prices and inventories were completely uncorrelated. In a classic example of Economics 101 principles, the relatively low price of zinc over the past two decades had curtailed exploration and development, whereby US$0.80/lb. zinc was too low to justify capex estimates associated with known resources. Similarly, high exploration costs deterred explorers from seeking out new sources of zinc supply.

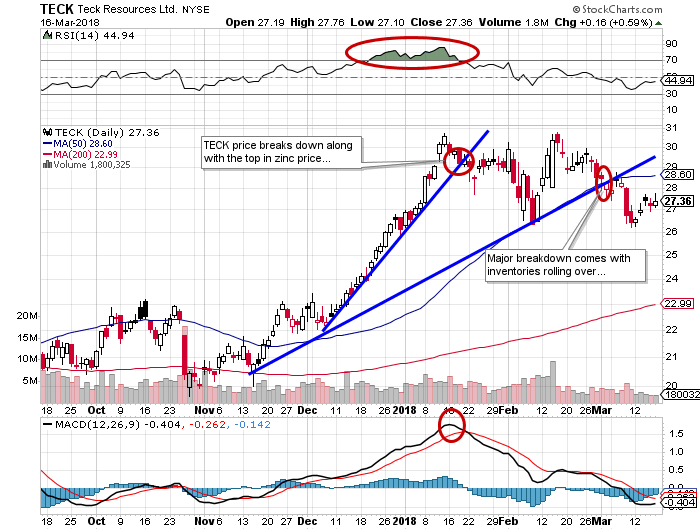

Then, in January 2016, zinc finally responded to reduced supply as the big shutdowns at Century, Bathurst, and Lisheen finally took their toll, leading to an advance from US$0.65/lb. to over US$1.60/lb. and driving notable zinc names like Teck Resources Ltd. (TCK:TSX; TCK:NYSE) from US$3.05 in January 2016 to over $30 by late 2017.

Senior zinc producer

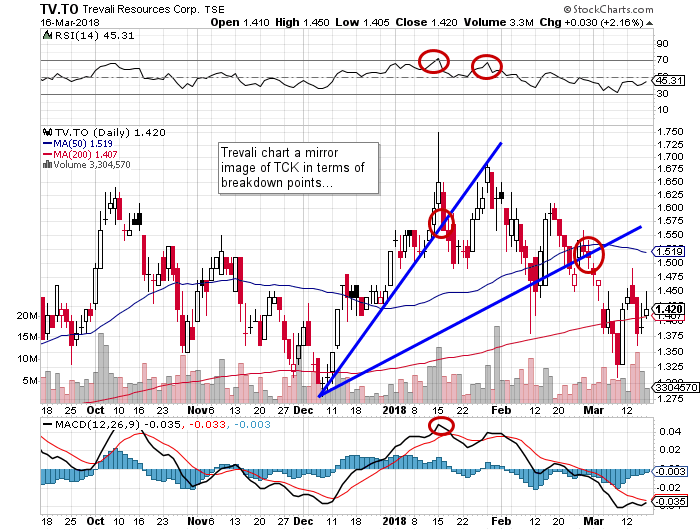

Junior zince producer

These last four charts are irrefutable evidence that the underlying commodity price and inventory levels are critical to the “life” of the trade. Zinc is just one example of a trade that took a while to develop, as I first identified it in 2011 with my interest in Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK).

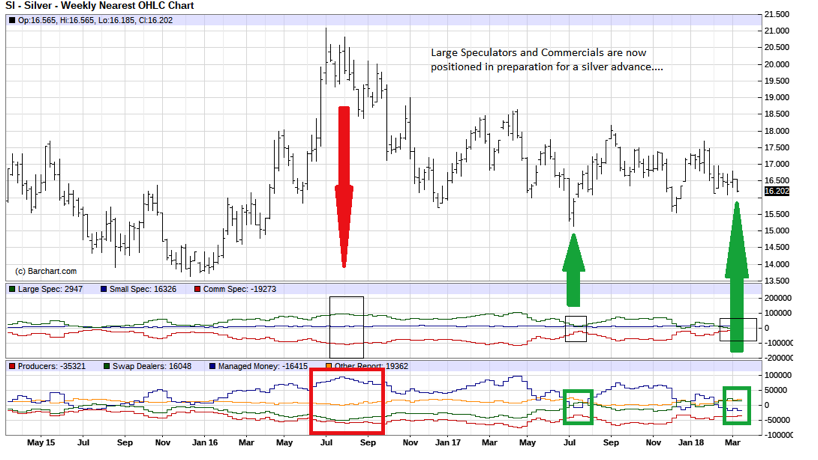

While the fundamental backdrop for zinc was terrific, all commodity trades are going to undergo a rationalization once the existence of high prices lures supply out of the woodwork. We saw that in 2011, with copper and gold, with both yet to come anywhere close their respective highs. And while you have LME (London Metal Exchange) inventory levels for base metals, similar data for gold and silver are unavailable. The best alternative for determining what is happening to gold and silver supplies had been the weekly Commitment of Traders (COT) report published every Friday afternoon by the CME. While I don’t trust the COT data completely, it has been a useful tool in forecasting the intermediate swings in prices that we saw in early December 2015 in gold and silver, where commercial traders removed virtually all meaningful shorts in the precious metals, clearing the way for a phenomenal advance in the precious metals in the first half of 2016.

Now, go back to the first chart posted and note the approximate point in January where the TSX.V rolled over and began its 100-point descent. Ironically, it coincides with the zinc trade rolling over. If I am correct on the demand-supply attributes of the silver market, and equally correct in the historical behavior of silver relative to large speculator extremes (such as three weeks ago, when they were net short CME silver for the first time ever), then we have an excellent chance of seeing a trading opportunity not unlike the zinc trade of 2016-2017, where a senior such as Pan American Silver Corp. (PAAS:TSX; PAAS: NASDAQ) can perform like TECK did, and junior silver producers do even better.

If one is right on the commodity (and has the patience), the leverage contained in the share price appreciation is superb, and usually occurs without the attendant volatility of the futures and/or options markets (as fun as they can be). The fun, however, lies in the exploration companies, or in the companies that have a higher-cost resource in need of a commodity price rally in order to render the resource “economic.”

I saw one of these moves in late 1979 with the “old” Dolly Varden Minerals, whose silver resource was sub-economic in 1977 at $3.00/oz. silver. But, we were buyers in the $0.50 per share range because we thought silver would move by 1978, and move it did (to $50). Once silver cleared the marginal cost of production for Dolly Varden, which was at $16/oz., the shares went to the high $20s and stayed there for quite a while. . .until, of course, the early 1980s, when precious metals collapsed and Dolly Varden returned to being a penny stock. However, the ride to $25 was a great deal of fun, and made us a great deal of money along the way. And all based upon the move in the underlying commodity.

By the way, my 2018 candidate to repeat the Dolly Varden move remains Canuc Resources Corp. (CDA:TSX.V). Its San Javier project includes the extremely high-grade Santa Rosa silver-gold vein, which averages over 300 g/t silver, and whose recent press release revealed a second zone containing 210 g/t silver and 5 g/t gold. Of course, they need to prove up more mineralization to get people excited, but that vein is so high grade that a move in the underlying price of silver has the potential to move the share price substantially higher, in a manner not unlike the move that occurred in 2016-2017 for Trevali Mining Corp. (TV:TSX; TV:BVL; TREVF:OTCQX). Trevali began its move with zinc in early 2016 at $0.25 and traded up to $1.75 late last year, all based on capital flows betting on the commodity.

As easy as it was to critique Trevali (and Tinka) in early 2016, it is equally easy to critique many of these micro-cap silver companies based on the dismal performance of silver since the peak in 2011. Sure, prices are down (like zinc) and nobody cares (like zinc), but visionary investing is always where the biggest returns lurk, and for reasons far too familiar to many of us frustrated silver bulls, I have to grit my teeth and recall the pain of 2014-2016, waiting for zinc as a means of rationalizing dollar injections into silver.

Back to the TSX.V: People forget that in 1999, the TSX Venture Exchange was born with opening levels in the 630 range. Eleven years ago, in 2007, it hit 3,320; the all-time low was a mere twenty-seven months ago at 472. What is actually wrong with the TSX.V is actually is what is right with it. Relative to levels seen since the turn of the century, the exchange whose legacy includes financing some of the most notable discoveries of the past fifty years has failed miserably to provide consistent winners in the form of new discoveries by exploration juniors or successful development of an existing resource without the dilutive effect of massive new share issuance.

Nevertheless, these were the same reasons given back in 1999, when only the bravest-of-heart plunged into the TSX.V issues, and by 2007, fortunes were made. Similarly, I plunged into the junior gold miners ETFs in late 2015 by way of the GDXJ, and within eight months, it had advanced 170%. Sentiment in late 2015 was not a great deal different it is today, so accumulating a basket of junior silver developer and selected explorers stands a good chance of a repeat in 2018.

It feels like 2001 all over again and if you are wondering how I know this, I have quivering, hiding canines, and fearful and very alert partners armed with rolling pins as proof.

Late Breaking News:

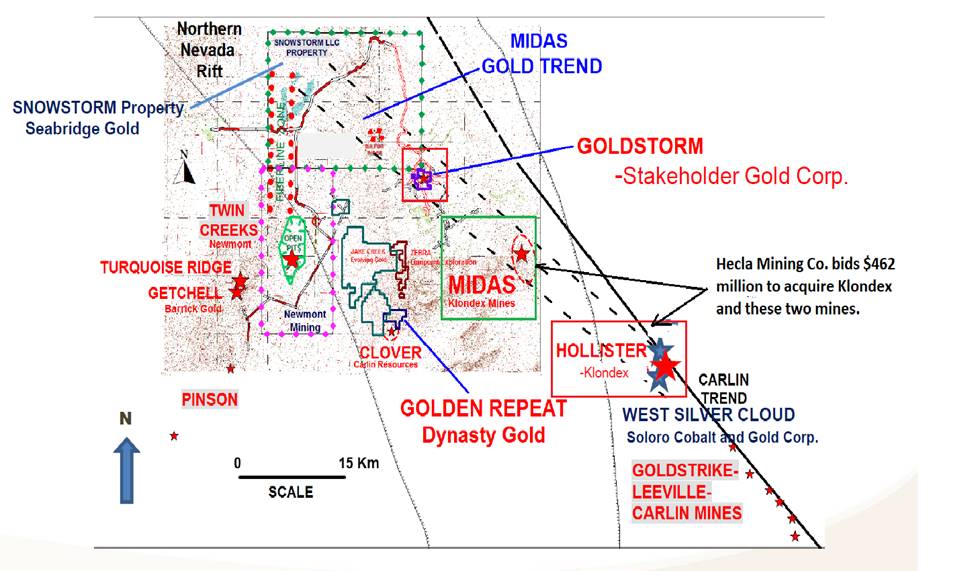

Just as I was about to hit the “send” button on March 19, I received a note that Hecla Mining Co. (HL:NYSE) had just made an offer to acquire all of the outstanding shares of Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT) for US$462 million or $2.47 per KLDX share. This represents a 71.5% premium to its March 15 closing price of $1.44. This is great news for all Nevada explorers and could not have come at a better time for those of us that have participated in the recent financings for Stakeholder Gold Corp. (SRC:TSX.V), whose Goldstorm project is a mere thirty kilometers northwest of the Midas Mine, now the property of Hecla Mining Co. It also bodes well for private Buena Vista Gold Corp., whose Nevada land package includes five significant properties. Buena Vista is expected to be listed as part of a plan of arrangement with Wabi Exploration Inc. in May, after which an extensive drill program will commence, starting with the highly prospective Hot Springs Peak prospect.

The Hecla acquisition of KLDX is a bullish development for both companies, particularly in light of Stakeholder’s low market cap and strategic location.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Stakeholder, Canuc, Buena Vista. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Stakeholder, Canuc, Buena Vista. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Klondex Mines and Trevali Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canuc Resources, Stakeholder Gold and Buena Vista, companies mentioned in this article.

All charts and images courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: CDA:TSX.V,

HL:NYSE,

KDX:TSX; KLDX:NYSE.MKT,

TCK:TSX; TCK:NYSE,

TK:TSX.V; TLD:FSE; TKRFF:OTCPK,

TV:TSX; TV:BVL; TREVF:OTCQX,

)