This post The Great Bitcoin Crash of 2018 appeared first on Daily Reckoning.

A bitcoin “flash crash” briefly rattled cryptocurrency traders last night. Bitcoin lost more than $3,500 before quickly recovering. As of early this morning, the digital currency is back above $17,000.

Speculators may have gobbled up this brief bitcoin dip. But it isn’t the last time we’ll see wild price action in the crypto world. In fact, I think we’re going to experience an epic bitcoin crash in the coming months.

This brings us to my next wild prediction for 2018: Bitcoin will crash at some point in the next 12 months, losing at least half of its value.

Make no mistake — I don’t think this crash will mark the end of bitcoin. In fact, I think another hard reset for the digital currency has the potential to strengthen bitcoin in the long-term.

To explain, we first need to break down bitcoin mania to its core…

It’s safe to say that bitcoin and other cryptos are in the “Wild West” phase all speculative assets go through as they mature. The rules and regulations are fuzzy. Rapid price appreciation has attracted scammers and hackers. For many investors who are just learning the bitcoin basics, it feels like crypto “outlaws” are looking to rip off anyone to make a quick buck…

With prices moving so fast, countless analysts and money managers are sounding the alarm.

Naturally, investors who have witnessed the meteoric rise of bitcoin and other cryptocurrencies have one big question on their minds:

Are cryptocurrencies experiencing a massive speculative bubble right now?

It certainly looks like it.

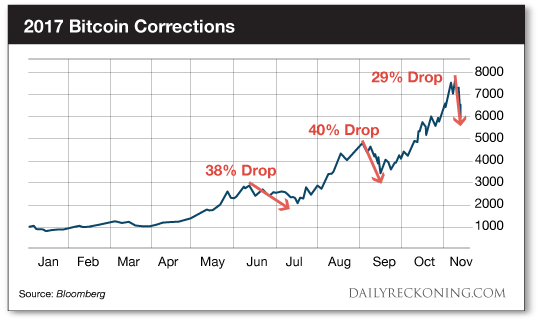

But that’s not necessarily a bad thing. All bull markets and manias eventually come to an end. And somewhere along the way, highflying assets will get hit with a hard reset or two before consolidating and moving higher. So it’s not that crazy to assume a major correction is on the way for bitcoin.

Just think back to the dot-com boom of the 1990s. Internet stocks were soaring higher every month. Companies would add “dot-com” to their name just to attract new investors (much like we’re seeing “blockchain” getting added to company names this year). In hindsight, the March 2000 market top is easy to see.

But plenty of smart market analysts who saw trouble couldn’t get the timing right. Even Alan Greenspan delivered his famous “irrational exuberance” speech in late 1996, more than three years before the market topped.

It’s also important to note that the best investments of the dot-com era have matured into some of the biggest, most profitable companies in the world. Amazon.com was a darling of the dot-com boom. So was Adobe Systems. And Microsoft! These companies thrived and minted millions for investors— even after enduring the popping of the ’90s tech bubble.

No one knows how much higher crypto can go from here. We can only assume we’re somewhere in the middle of a massive bull run. As with all red-hot investments, it can’t go higher in a straight line forever.

In fact, it’s already shown speculators …read more

Source:: Daily Reckoning feed

The post The Great Bitcoin Crash of 2018 appeared first on Junior Mining Analyst.