This post Stocks in 2018: The Rally Goes Crazy appeared first on Daily Reckoning.

We’re kicking off a wild week of stock market predictions in style today.

Our first swing at a market forecast for 2018 begins with stocks. Specifically, I’m talking about the S&P 500.

Most serious analysts have already said they believe 2018 will be a decent year for equities. The predictions we’ve read so far peg the S&P’s 2018 performance between 5% – 8%. Another “average” year for the averages…

But that’s not what I’m seeing.

Yes, I believe the major averages will finish in the green when 2018 ends. But I don’t think we’ll see the S&P, Dow Jones Industrial Average, and Nasdaq Composite churn out wimpy, single-digit gains. In fact, I see stocks finishing much, much higher.

My first big prediction for 2018 is that the S&P 500 will finish higher by 20% or more, edging out this year’s returns to post an incredible two-year run approaching gains of 50%.

I know that might sound crazy — especially since so many pundits and analysts are expecting stocks to cool off. But there are a couple of key facts about the current market rally that suggest we are still in the early phases of a melt-up move.

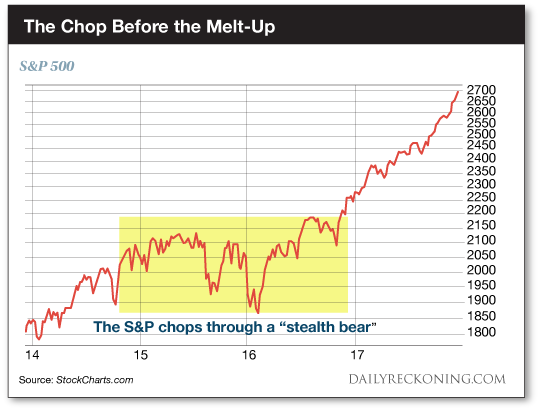

First, it’s important to note that prior to breaking out to new highs in late 2016, the S&P 500 endured a choppy, two-year “stealth bear” market that featured major selloffs in speculative names such as biotech and small-cap stocks.

The financial media loves to talk about how the major averages have enjoyed a massive bull run since the 2009 market bottom. One glance at this chart proves this is not the case.

Stocks have not shot higher in a straight line for nine straight years. In fact, stocks have endured multiple pullbacks and corrections since 2009, including a drop of more than 19% in the S&P 500 during the summer of 2011 (which apparently doesn’t count as an official correction since it missed dipping 20% by the skin of its teeth).

Furthermore, it’s important to measure the beginning of bull markets from where the averages first break out to new all-time high. That didn’t happen until 2013 for the S&P. So much for the theory that the current secular bull market is long in the tooth.

Still not convinced stocks have more room to run? Consider these key data points from LPL Research’s Ryan Detrick:

Including this year, the S&P has risen 20% or more 19 times. After each of these 20% rallies, the S&P was higher the very next year on 16 occasions, posting double-digit gains during ten of those years.

While there’s no guarantee the S&P will repeat this year’s performance in 2018, it’s wouldn’t be an unprecedented market event.

But there’s a catch to my market melt-up prediction…

It won’t be an easy ride.

The S&P 500 hasn’t experienced a 5% pullback in more than 13 months. Over the next year, I’m guessing we’ll see at least two pullbacks of 5% or more.

Each of these pullbacks will bring …read more

Source:: Daily Reckoning feed

The post Stocks in 2018: The Rally Goes Crazy appeared first on Junior Mining Analyst.