By Zach Scheidt

This post Macy’s Gets Its Groove Back appeared first on Daily Reckoning.

This weekend, my favorite college team won the SEC Championship and secured a slot in the National Championship playoffs. Congratulations to my University of Georgia fans out there (and condolences to those of you pulling for Auburn).

One of the ways any successful football team claims victory is by anticipating where the play is going to be, and heading towards where the ball is going to be (for defensive players) or running to where the open spot is going to be (for offensive players)..

As investors, our success rides on our ability to anticipate where the market is headed instead of simply investing in what’s been working for the last few months.

With that in mind, I’ve got a brand new investment area that will make you a lot of money this holiday season. But I’ll warn you, just like an aggressive football player, success in this market takes a lot of guts and foresight.

Do you have the guts to take advantage of this opportunity? Let’s see…

Hell Hath No Fury Like a Classic Short Squeeze

If you’ve never been caught in a classic short squeeze, count yourself lucky!

A short squeeze is typically set up when too many investors sell a stock short (or make bets that a stock will trade lower). In this scenario, the investors make money when the specific stock falls. And they lose money when the stock rises.

This kind of trade can work very well in bearish environments.

But if the stock in question — or an entire group of bearish stocks — reverses course and moves higher, investors who are short get “squeezed.” There’s theoretically no limit for how bad their losses can be. The higher a stock trades, the more losses accumulate. With a big enough bet, investors could lose everything!

Stocks that are experiencing a short squeeze can rip higher at a blistering pace.

That’s because in order to close a short position, investors have to buy shares of stock. If too many investors are short a certain stock (or a group of stocks), the frantic buying pressure can lead to a rapid move higher.

I’m sure you can see where this leads…

As the stock trades higher, more short sellers lose money. These short sellers are forced to buy to protect against further losses, and the stock continues to move higher. It’s a vicious circle that can cause some of the most unloved stocks to rally at a pace no one expected.

Of course, if you can anticipate a short squeeze beginning to take place, you can lock in some very big profits.

And that’s exactly the type of opportunity we’re looking at today.

A Short Squeeze in the Making

Can you think of an area in today’s market that has been particularly bearish?

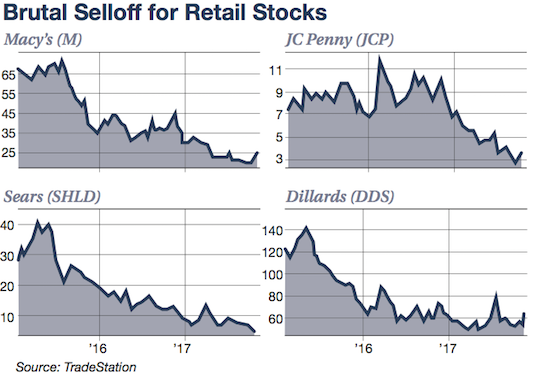

I can… It’s brick-and-mortar retail stocks.

Competition from Amazon has made it difficult for many retailers to generate profits. And bearish investors have capitalized on this trend, shorting retail stocks and enjoying some nice profits.

Take a look at the …read more

Source:: Daily Reckoning feed

The post Macy’s Gets Its Groove Back appeared first on Junior Mining Analyst.