By Jeb

Gold miners have kept in line with gold bullion and stocks so far this year. Copper, zinc and palladium have outperformed both stocks and gold. However, silver and silver stocks have lagged behind but I believe they could not only play catch up but they could far surpass the gains of these other metals as their is a record short that may soon have to cover if the US dollar finally breaks down.

Silver may be the cheapest and best opportunity in the market right now from a value perspective. If you notice the silver to gold ratio has not reached this high since 2008 and 2002.

These silver shorts may be required to buy back their margined short positions increasing demand in a market that is already seeing increased industrial uses in solar clean energy and as a monetary metal much far superior than bitcoin or weed. Silver could far outpace gains in gold if we head back into an inflationary cycleZinc, palladium and copper are showing major gains entering a bull market for the first time in ten years. This may be a good sign for silver. Silver below $18 may be a real bargain one day especially if the gold-silver ratio returns to normal.

That average is like 18 to 1 in nature but the markets are valuing it at alost 80 to 1. This whacky ratio indicates to me its time to buy physical silver and look for the highest quality exploration silver plays in mining friendly jurisdictions as the gains could be enormous.

Once we start moving into an inflationary cycle silver will outperform especially as it has greater industrial uses now a days in solar and smartphones. Also for many working class investors silver is the affordable metal of choice to store away not higher priced gold and definitely not bitcoin.

The US dollar looks ugly despite increasing interest rates. I think the US dollar decline could accelerate if the economy starts slowing and stock markets top out increasing demand for alternative assets such as silver coins and bullion. Right now safe haven capital is seeking out capital preservation in the form of cryptocurrency however these alternative fiat currencies are eventually crushed.

Already it appears housing is flat and may be topping. Those with gains should look at silver especially before it starts moving higher breaking above the $20 mark possibly by the end of this year.

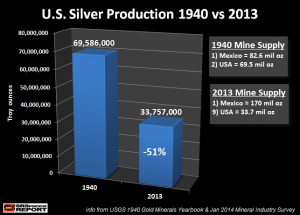

I’ve been searching for high grade silver situations specifically in mining friendly jurisdictions more specifically in the USA and Canada for over a year now. The reason is that a lot of silver comes from risky jurisdictions in South and Central America where mines can be expropriated at any moment with a change of guard.

I expect some of the larger silver producers will look to diversify into stabler jurisdictions. This USA Silver explorer recently got my attention as they …read more

Source:: Gold Stock Trades.com

The post Silver Stocks May Be Cheapest Opportunity In Decade appeared first on Junior Mining Analyst.