This post Live From Las Vegas: Have Gamblers Infiltrated the Stock Market? appeared first on Daily Reckoning.

It was 9 a.m. when I rolled into Las Vegas yesterday and the streets were already crawling with adults behaving badly.

The booze was flowing and the blackjack tables were packed. The sun was barely up on Thursday morning and the weekend had already started on the Vegas strip…

But I’m not much of a gambler. I’m not here to bet my life savings at the roulette wheel. Instead, I’m meeting with traders and talking markets.

You see, I prefer placing my big bets on stocks instead of cards. If you trade your plan carefully, the odds are always better than the big casinos can offer.

But back in the spring, I warned you that some market pros believed degenerate gamblers were taking over the stock market.

A Bank of America Merrill Lynch survey conducted in May claimed a record 83% of surveyed money managers said the market is too pricey. Stocks were too damn expensive.

Six months later, stocks continue to defy gravity. We’ve now gone a full year without a 5% pullback in the S&P 500. Traders are scooping up every tiny dip, earnings are strong, and your market leaders continue to push to new highs.

But investors are taking a big gamble buying some of these expensive stocks, according to these folks who are stuck on some of the high valuations we’re seeing on the market today. Perhaps these nearsighted investors should fly out to Vegas with me and we’ll bet in all on black.

Or maybe not…

Anyone who took a chance on these so-called “expensive stocks” at the beginning of the year is sitting on some impressive gains. Meanwhile, the true gamblers who flocked to Las Vegas are going bust.

When gamblers lose, Vegas wins. And right now, business is booming.

During March Madness, sports bettors plunked down a record $439.5 million on basketball bets in just one month.

Nevada sports books won more than $44.0 million in September, ESPN’s David Purdham reports, and they have now come out ahead for 50 consecutive months. Year-over-year revenue gains have now cracked into double-digits. Gamblers love losing money betting on sports!

The degenerate gamblers aren’t the only folks filling Vegas’ coffers. Big conventions and shows are also helping Las Vegas tourism set records for the past three years, according to Bloomberg. Heck, that’s why I flew out here in the first place!

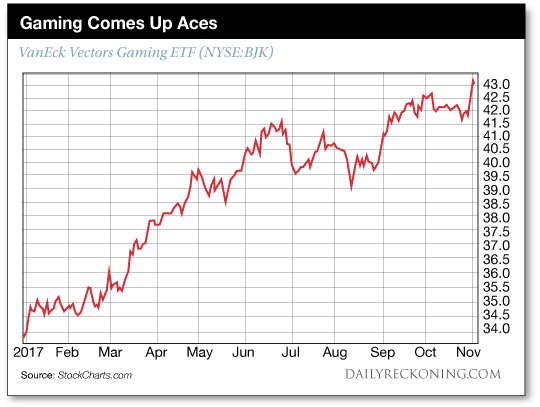

Of course, all of this is big news for gaming stocks.

The VanEck Vectors Gaming ETF (NYSE:BJK) has enjoyed yet another breakout week, leaping to new three-year highs. The gaming ETF is now up more than 27% on the year.

Las Vegas growth isn’t the only factor driving these casino stocks higher. Across the ocean, Macau is also booming once again. It’s the world’s biggest casino town— and bullish data out of the Chinese gaming capital can move the gaming markets.

Gambling revenue in Macau has been on a tear all year. This week was no different. Macau gambling revenue jumped …read more

Source:: Daily Reckoning feed

The post Live From Las Vegas: Have Gamblers Infiltrated the Stock Market? appeared first on Junior Mining Analyst.