This post The Weakest Sector of 2017 is Now a “Buy” appeared first on Daily Reckoning.

The next stage of the energy breakout begins right now…

While most investors are distracted by rate hike gossip, bitcoin, or flashy tech stocks, the energy sector is quietly pushing higher.

Crude settled just below its 2017 highs on Wednesday. After ripping off its lows and retaking $50, oil has shaken off its first-half slump. It’s now almost 30% higher than its July lows…

The days of $100 oil are long gone, of course. I don’t think anyone’s been particularly excited about the energy sector since oil traded in the triple digits. It’s taken more than three years of lower prices and false starts— but oil and energy stocks are beginning to quietly come back from the dead.

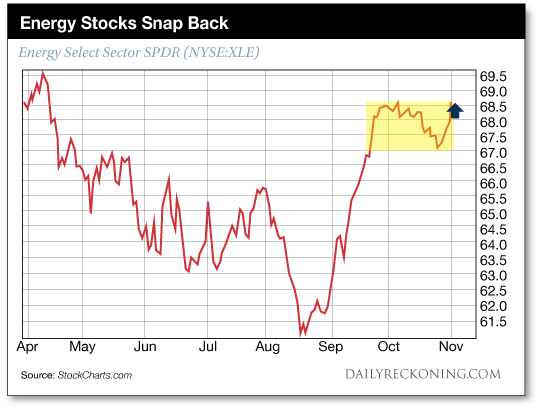

We noted back in September that the sector posted its strongest trading week of the year. By the time the month was up, the Energy Select Sector SPDR (NYSE:XLE) had rallied off its lows and posted one-month gains of almost 10%. It remains up double-digits since Sept. 1st, while the S&P 500 is up just 4.3% over the same timeframe.

Wednesday’s gains in XLE were especially impressive. Even with oil finishing the day in the red, energy stocks logged gains of more than 1% on the day. This move marks XLE’s highest close in more than six months. Yesterday’s strong performance could also help the sector get its mojo back after consolidating its gains in October.

That’s an impressive move for a major sector that has woefully underperformed the major averages in 2017. Now that these stocks are playing catch-up, energy is looking like strong bet heading into the holidays.

As crude jumps toward its year-to-date highs, many forgotten energy names are starting to shine again. The market is telling us it’s time to rotate into the sector. Even as tech names continue to dominate the headlines, energy stocks are the hidden plays you’ll want to have in your portfolio over the next two months.

You already know how critical it is to have your trading dollars in the correct stocks and sectors. If you aren’t catching a ride with the market’s most powerful trends, you won’t have a shot at beating the market.

I understand energy hasn’t been the best place for your money in 2017. In fact, energy is the worst performing major sector so far this year. Bespoke Investment Group noted over the summer that the energy sector underperformed the S&P by more than 23% over the past 12 months. Such a wide performance gap is quite unusual. Since 2000, Bespoke notes that this margin of underperformance has only happened twice.

Poor energy stocks just couldn’t catch a break. The summer slump comes on the heels of an oil price that was consistently victimized by a whipsaw market last year. In summer 2016, oil prices quickly jumped above $50 a barrel for the first time in nearly a year. U.S. stockpiles were down and China demand came in stronger than …read more

Source:: Daily Reckoning feed

The post The Weakest Sector of 2017 is Now a “Buy” appeared first on Junior Mining Analyst.