By Jody Chudley

This post Buffett’s Indicator Is Calling Tops appeared first on Daily Reckoning.

It’s up to you to listen.

Because the indicator that Warren Buffett uses to gauge whether the S&P 500 is expensive is trying very hard to tell you something.

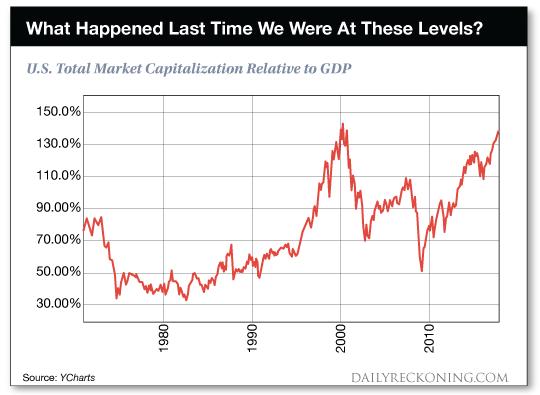

This “Buffett-Metric” is the total market capitalization of U.S. stocks relative to the GDP of the country.

Today that metric sits at almost 139%, a number that has been eclipsed only once before in the entire history of the US stock market.

That was at the peak of the tech bubble in 2000 when the “Buffett-Metric” hit 145%, and it only held that level only for a few short weeks before the market crashed…

The chart below shows the peak of the “Buffett-Metric” in 2000 and the subsequent fall. The chart also shows how frothy the reading is on this metric today.

Today we are but a whisper away from equaling that brief all-time valuation peak of US stock market capitalization to US GDP of 145%.

If you stick your head in the sand and pretend that this isn’t anything to be concerned about, you aren’t going to like what comes next.

So don’t do it. Use that head of yours to think because it’s not too late to do something about this.

The Cause This Time – Too Much Mindless Investing

I’m not a doom and gloom kind of guy.

But I am rational.

The “Buffett-Metric” has only been this high once before, and it only held this level for a very, very short period of time.

I don’t see how a rational person can see that we are at an all-time valuation high and not think that the market is expensive.

If an all-time valuation high isn’t expensive then what exactly is?

This time, the reason for these high valuations is the massive amount of money that has flooded into passive index funds and ETFs in recent years.

These passive vehicles buy the exact same stocks with no thought whatsoever given to valuation.

If you give an index fund a million dollars it is just as happy to buy stocks trading at 3,000 times earnings as it is to buy stocks trading at 6 times earnings.

This is mindless investing.

That isn’t an insult by the way. Mindless investing is the stated objective of an index fund.

But…

When the amount of money managed mindlessly gets to be outrageously large you can see how strange things can result.

Which is exactly what has happened.

Hundreds of billions of dollars have been sucked out of actively managed (thoughtful) funds and put into passively managed index (mindless) funds during this current bull market.

All of this mindless index fund money ends up chasing the same stocks, the stocks that make up the underlying indices. With hundreds of billions of mindless dollars chasing the same stocks, you end up with some crazy valuations.

A crazy valuation like Amazon trading at 242 times earnings. Or a crazy valuation like Tesla having a $54 billion market capitalization despite being a massive cash burning operation.

The extreme valuation of some stocks have made owning …read more

Source:: Daily Reckoning feed

The post Buffett’s Indicator Is Calling Tops appeared first on Junior Mining Analyst.