And because it takes seven years on average for a new mine to begin producing—thanks to feasibility studies, project approvals and other impediments—output could recede even more rapidly in the years to come.

“It doesn’t really matter what the gold price will do in the next few years,” Pierre says. “Production is coming off, and that means the upward pressure on the gold price could be very intense.”

Have We Reached Peak Gold?

|

|

What Pierre is talking about, of course, is the idea of “peak gold.” I wrote about this last year and suggested another factor that could be curtailing new discoveries—namely, the

My good friend Pierre Lassonde, cofounder and chairman of Franco-Nevada, doesn’t know how we’ll replace the massive gold deposits of the past 130 years or so. Speaking with the German financial newspaper Finanz und Wirtschaft this month, Pierre says we’re seeing a significant slowdown in the number of large deposits being discovered. Legendary goldfields such as South Africa’s Witwatersrand Basin, Nevada’s Carlin Trend and Australia’s Super Pit—all nearing the end of their lifecycles—could very well be a thing of the past.

Over the medium and long-term, this could lead to a supply-demand imbalance and ultimately put strong upward pressure on the price of gold.

According to Pierre:

If you look back to the 70s, 80s and 90s, in every one of those decades, the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits and countless 5 to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits.

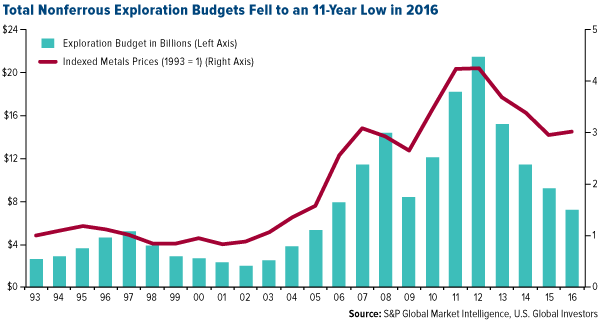

So few new large mines are being discovered today, Pierre says, mostly because companies have had to slash exploration budgets in response to lower gold prices. Earlier this year, S&P Global Market Intelligence reported that total exploration budgets for companies involved in mining nonferrous metals fell for the fourth straight year in 2016. Budgets dropped to $6.9 billion, the lowest point in 11 years. Although we’ve seen an increase in spending so far this year, it still dramatically trails the 2012 heyday.

click to enlarge

And because it takes seven years on average for a new mine to begin producing—thanks to feasibility studies, project approvals and other impediments—output could recede even more rapidly in the years to come.

“It doesn’t really matter what the gold price will do in the next few years,” Pierre says. “Production is coming off, and that means the upward pressure on the gold price could be very intense.”

Have We Reached Peak Gold?

What Pierre is talking about, of course, is the idea of “peak gold.” I wrote about this last year and suggested another factor that could be curtailing new discoveries—namely, the low-hanging fruit has likely already been picked. Gold is both scarce and finite—one of the main reasons why it’s so highly valued—and explorers are now having to dig deeper and venture farther into more extreme environments to find economically viable deposits.

Other factors contributing to the decline include tougher regulations and higher production costs. And unlike with the oil industry, no “fracking” method has been invented yet to extract gold from hard-to-reach areas, though Barrick—the world’s largest producer by output—has been experimenting with sensors at its Cortez project in Nevada.

Take a look at how drastically annual output has fallen in South Africa, once the world’s top gold-producing country by far. In the 1880s, it was the discovery of gold in South Africa’s prolific Witwatersrand Basin—responsible for more than 40 percent of all gold ever …read more

Source:: Frank Talk

The post The World Is Running out of Gold Mines—Here’s How Investors Can Play It appeared first on Junior Mining Analyst.