By analyst

By Frik Els

With nearly nine out of every 10 of the world’s ounces as measured by production or reserves present, size mattered at the recent Denver Gold Forum.

Denver Gold Group, the organizers of the invitation-only event in Colorado Springs, brings together the global gold mining industry and the sector’s largest investors. The DGF has been held every year since 1989 and it’s worth remembering that gold was trading at $400 that year and was destined for a decade-long slump.

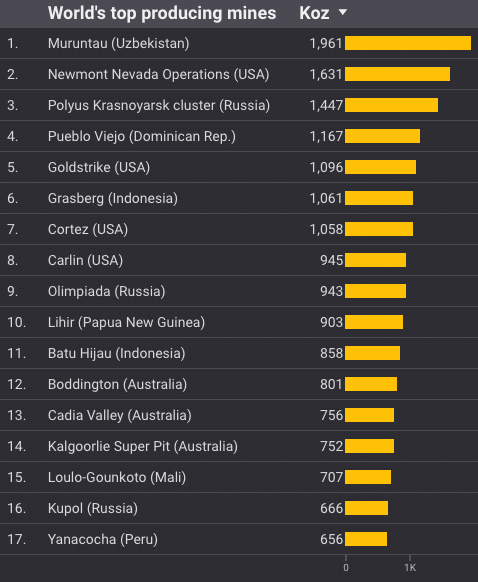

2016 Source: Company data, AMC CPR, Metals Focus

Despite the tumult in the industry in the intervening years the top tier of producers has stayed relatively stable. Thanks to a penchant for M&A the ranks of the world’s largest gold miners has only consolidated further in recent years.

Many gold producers are also beginning to talk about gold equivalent ounces to bulk up for the sake of investors. And after many quiet years mid-tier tie-ups are happening again and project acquisitions in exploration hot spots like the Yukon, Burkina Faso and Turkey are becoming more common.

The next few years will likely see the biggest shake-up at the top of the global gold pile in a decade.

In Russia with love

Polyus last month launched hot commissioning of its 10mtpa Natalka processing mill in Russia’s Far East. Once fully ramped up, Natalka is set to turn the country into the world’s number two gold producer behind China.

At full tilt the $2.3 billion Natalka mine will help lift Polyus production by a third to 2.8m ounces per year by 2019 and improve its ranking to around number five from the current 8th.

But the Moscow-based miner is not stopping there.

MINING.com sat down with Polyus chief executive Pavel Grachev at the DGF to find out what’s next for the company.

Polyus is not interested in embarking on an overseas spending spree and is not hung up about geographic diversity

Grachev is a lawyer by training and served three years as CEO of potash giant Uralkali before taking over the reins at Polyus in 2013. Grachev is unapologetic about the firm’s ambitions: “Polyus will be number three globally.”

As Russia’s number one producer Polyus is not interested in embarking on an overseas spending spree and is not hung up about geographic diversity says Grachev.

Grachev believes Polyus’s growth can be achieved organically and in its own backyard.

Olimpiada produced 943koz last year. Image: Polyus Gold

Of course, a “very busy pipeline” and the industry’s second largest reserve base (71moz vs Barrick’s 77moz) makes that a much easier strategy to follow.

And an average mine life of 37 years – which Polyus claims is more than twice those of its peers – means the company’s half-a-dozen brownfield projects in the feasibility stage and seven brownfields either completed or in the final stages will only add to annual ounces, not make up for losses elsewhere.

Polyus was spun out of Russia’s top miner Norilsk Nickel in 2006.

Since then production has grown at annual rate of 6% to just shy of 2m ounces in 2016. That’s despite the fact …read more

Source:: Infomine

The post The Polyus power play appeared first on Junior Mining Analyst.