By Cory

There’s Lots of Precedent for the Trump Rally

This article from Bloomberg helps to out the Trump rally in perspective. I personally think this rally that dates back to 2009 is all thanks to QE around the world. Yes there is optimism for tax cuts and the such but those do not have the same impact as free money… Now that the easy money spigot is being turned off (slowly) there will be a breaking point where buyers have no more access to pretty much free money. We are already seeing corporations scale back their share buybacks and insiders are selling. It won’t happen tomorrow but I am looking to mid next year as a time to determine if liquidity is drying up.

Click here to visit the original posting page over at Bloomberg.

…

Market gains since Election Day have been nothing out of the ordinary.

The other days, President Donald Trump shared a few thoughts about the stock market.

It would be really nice if the Fake News Media would report the virtually unprecedented Stock Market growth since the election.Need tax cuts

— Donald J. Trump (@realDonaldTrump) October 11, 2017

Like so many of the president’s statements, this one is objectively false. Our charge today is to set aside the political debate, and instead use his statement as an opportunity to explore ways to compare markets and rallies. Cognitive issues and innumeracy affect all investors, including presidents; this isn’t our first discussion of issues like denominator blindness, nor will it be our last.

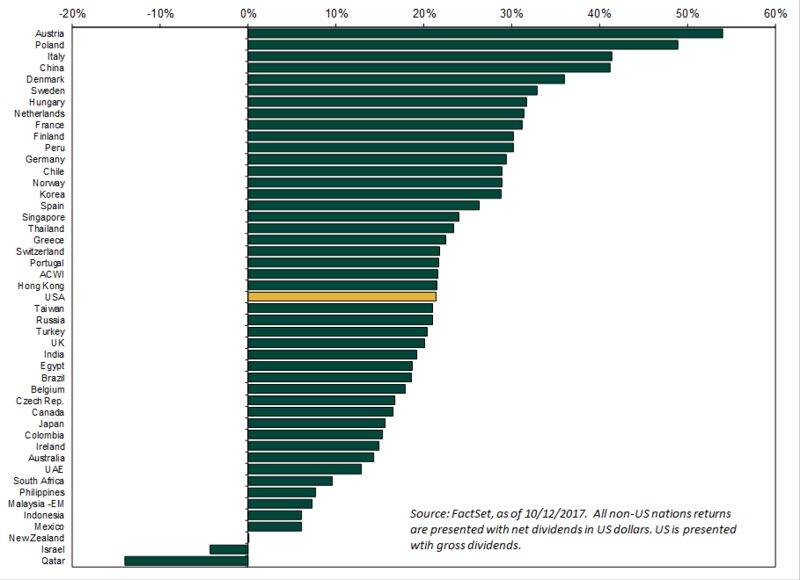

Instead, we can use data to see how the so-called Trump rally compares to others.

No. 1. U.S. Presidential Rallies: As Bloomberg News reported the other day, “the ‘unprecedented’ stock market rally since his election right now isn’t big enough to crack the top five in presidential history.” As the accompanying chart shows, the Standard & Poor’s 500 Index has gained 19 percent 2016 election. That rates better than three other post presidential elections: George W. Bush in 2004 (7 percent), Bill Clinton in 1992 (10 percent), and Barack Obama in 2012 (16 percent).

Tallying Trump Rally

It’s ranked seventh-best in presidential history behind Kennedy.

However, the post Trump-election market has lagged others, in some cases by a lot. At 11 months after the election, the market under John F. Kennedy’s 1960 victory was up was 24 percent. That trailed Franklin D. Roosevelt’s 1944 rally of 28 percent. The next four presidents on the list all enjoyed rallies by this time in office that were about double or better than that of Trump’s: George H.W. Bush in 1988 at 31percent, Herbert Hoover in 1928 at 35percent, Bill Clinton (again) in 1996 at 38 percent, and Roosevelt (first election) in 1932 at a whopping 41 percent.

In other words, the Trump rally clocks in at No. 7. While that is pretty good — remember that markets fell after some presidents won election — it is hardly unprecedented.

Just as an aside — I am on record as reminding people …read more

Source:: The Korelin Economics Report

The post Valuable Insights from Around the Web – Fri 13 Oct, 2017 appeared first on Junior Mining Analyst.