This post Game Over: This Trump Trade Will End in Disaster appeared first on Daily Reckoning.

The Trump trade is back on track!

At least that’s what the so-called smart money is saying…

While the White House can’t boast about any major political wins related to tax cuts or infrastructure spending yet, investors are once again bidding up the stocks and sectors that follow Trump’s growth-focused agenda.

The materials and finance sectors are both resting near year-to-date highs after enjoying strong September rallies. But another one of these rising Trump trades is headed for disaster in the years ahead. Regulation rollbacks, subsidies or other hair-baked political schemes can’t save it from a painful demise.

But that doesn’t mean we can’t book short-term gains as a dead cat bounce lifts the coal industry from its lows.

“The EPA and no federal agency should ever use its authority to say to you we are going to declare war on any sector of our economy,” EPA head Scott Pruitt told a crowd in Kentucky yesterday.

The war on coal is over, Pruitt said. But if this administration thinks it can permanently revive the dying coal industry by cutting some regulations, they’re in for a surprise.

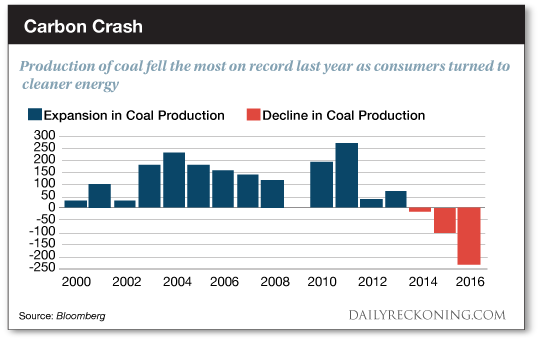

Even in developing nations, coal is losing its appeal as a cheap power source. In fact, world coal production just endured its biggest drop of all time earlier this year. Coal demand in the U.S. dropped by more than 33 million tons last year, Bloomberg reports, while global coal consumption dropped 1.7%, falling in every continent except Africa.

Across the globe, the coal industry is dying. The industry is teetering on the brink as most of the developed world moves on to cleaner energy sources. And in an age of cheap and plentiful natural gas, coal would have trouble staying in play even if we tossed every regulation out the window.

But Trump is still trying to flip the script.

In late March, Trump signed an executive order aimed at rolling back Obama-era rules curbing carbon emissions. Specifically, Trump’s order requires the EPA to repeal the Clean Power Plan, a hefty set of rules imposed on coal power plants.

The White House framed the executive order as a move to bolster the country’s energy independence and restore coal mining jobs. The news even provided a temporary boost to coal mining shares.

Trump has helped juice the VanEck Vectors Coal ETF (NYSE:KOL) not once but twice on so-called bullish news. The first peak materialized when Trump was elected. And the most recent climax materialized after the Clean Power Plant repeal back in April. The coal ETF’s spring slide gave even produced a quick 15% correction.

But coal started sneaking higher once again over the summer. By August, KOL had pushed to prices not seen since late 2014. After consolidating these gains over the past several weeks, coal looks ready to make and fourth-quarter run.

The stock market’s biggest moves rarely play out as perfectly as the stories we read in the finance pages.

Remember, the day of Trump’s victory was the …read more

Source:: Daily Reckoning feed

The post Game Over: This Trump Trade Will End in Disaster appeared first on Junior Mining Analyst.