By Brian Maher

This post The Wisdom — Then the Folly — of Crowds appeared first on Daily Reckoning.

Stay away from the herd.

Always graze against the grain. Avoid spots where the crowd is thick.

Here is the contrarian’s creed… the market maverick’s manifesto.

But it is only partly true.

Most of the time, the crowd drifts safely with the prevailing currents.

It is only at the extremes that the folly of the crowd is exposed.

Examples:

Where was the crowd on Oct. 11, 2007, when the S&P peaked at a bubbly 1,576?

The question implies the answer — drunk on stocks.

Where was that same crowd on March 6, 2009, when the S&P bottomed at a devilish 666?

Sitting on cash like a brooding hen — and swearing off stocks forever and ever.

Wrong at the extreme, that is. As that same crowd was wrong at the bullish extreme in 2007.

The year is now 2017… 8½ years after stocks sank to extremes.

Stocks have since scaled a Mount Everest of worry… thumbed a nose at every roaring bear… and once again traded at record heights.

So… is the crowd now swinging back to the euphoric extreme?

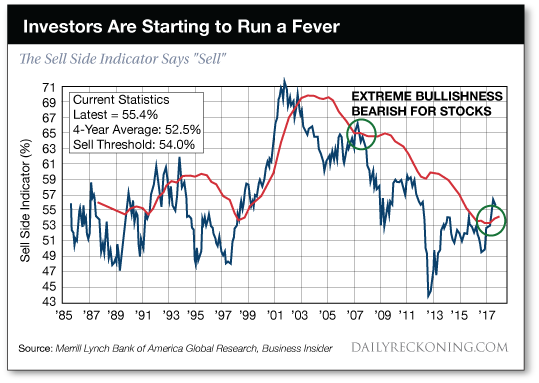

Bank of America Merrill Lynch (BofA) runs something it calls the “Sell Side Indicator.”

It is a thermometer of sorts, a thermometer of investor emotion.

In the depth of bear markets, the patient shivers with fear.

At the height of bull markets, the patient grows delirious with fever.

BofA claims, “It has historically been a bullish signal when Wall Street was extremely bearish, and vice versa.”

It is the “vice versa” that steals our attention today…

The S&P hasn’t suffered a 5% or greater correction in more than 460 days. Over 330 days have lapsed since its last 3% decline.

Meantime, MarketWatch reports that September saw some of the quietest trading in history.

And the S&P 500 has closed with a move of 1% or more only eight times this year.

At the going rate, that would be the fewest since 1995, according to LPL Financial.

You see where this tale is running, of course…

The thermometer indicates investors are beginning to run a fever again…

BofA’s “Sell Side Indicator” is at its second-highest level in six years.

Cold fear has faded… and warm optimism settles in.

When this BofA thermometer is one standard deviation above its four-year average, the S&P 500 declines almost half the time, according to analyst Joe Ciolli via Business Insider.

It is now nearly two standard deviations above its four-year average.

History has witnessed 13 previous price collapses, according to famous Yale economist Robert Shiller.

And he says, “The U.S. stock market today looks a lot like it did at the peak before all 13 previous price collapses.”

In the meantime, promises of the tax cuts, infrastructure and mass deregulation that fueled the Trump “reflation trade” are nothing but gossip among the Baltimore orioles outside our window.

Here we paint a scene of impending doom.

Is it time to sell?

The answer is obvious.

Obvious… but quite possibly wrong.

Stocks may be in a bubble.

But we reported yesterday that some of the market’s largest gains occur in the bubble’s terminal phase:

In the …read more

Source:: Daily Reckoning feed

The post The Wisdom — Then the Folly — of Crowds appeared first on Junior Mining Analyst.