This post It’s Time for Biotech’s “Big Dogs” to Step Up to the Plate appeared first on Daily Reckoning.

While the big biotech stocks took a breather in September, some of the smallest pharma names on the market launched to new highs.

I scan the biggest gainers on the market every day so I can get a feel for the sectors and industry trends that are sometimes masked by the major averages. And throughout late September, small-cap and microcap biotech stocks stole the show. One of these biotech lotto plays would pop 50%, 60%, or even 70% every single day.

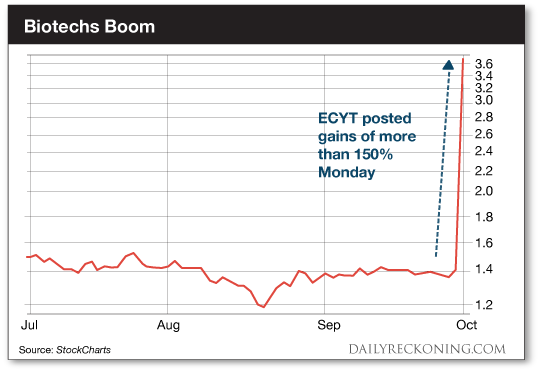

This trend is extending into the fourth quarter as Endocyte Inc. (NASDAQ:ECYT) launched higher by more than 150% yesterday. The triple-digit move was sparked by a licensing agreement for the firm’s phase 3 prostate cancer drug.

These incredible breakouts are exciting news for an industry that just emerged from a nasty bear market earlier this year. Yet while many of these smaller stocks are becoming overextended, another group of biotech breakouts is waiting in the wings to keep the party alive…

More on this opportunity in just a minute. First, to fully understand the new developments in this young biotech bull, we have to go back to the very beginning of the year…

A resurgent biotech sector was our boldest prediction for 2017.

Back in January, we reasoned that after 18 months of pain, the biotech bear was ready to head back into its cave.

Our biotech bet was met with the perfect storm of negative sentiment and capitulating investors during the first quarter. The pharma industry found itself in the crosshairs of some of the most powerful politicians in the country as multiple drug pricing scandals dominated the financial news.

Of course, most investors thought the intense scrutiny couldn’t possibly be bullish for Big Pharma. But the reaction from the market was muted. As far as we were concerned, the drug pricing scandals had officially jumped the shark. For months, price gouging soundbites sent health care and biotech stocks into a tailspin.

But the worst of the storm was over. Thanks to Trump’s frenetic legislative agenda, our pharma woes were short-lived. A powerful rally had emerged from the rubble.

The biotech sector successfully fought off the bears and quietly gained traction during the first half of 2017.

Over the summer, we began to see small signs hinting that a bigger move was afoot.

When the popular mega-cap tech stocks like Facebook, Amazon and Netflix started to lose traction back in July, biotechs were the first stocks to pick up the slack.

The smallest biotech names sprinted ahead first. The SPDR S&P Biotech ETF (NYSE:XBI) – a good measure of small-cap biotech stocks – gained more than 13% during the third quarter, building on its impressive year-to-date gains that are quickly approaching 50%.

The small-cap biotechs that make up XBI have stayed two steps ahead of their larger cousins all year. Meanwhile, the large-cap iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) continues to lag XBI by double-digits. It’s up 27% so far this …read more

Source:: Daily Reckoning feed

The post It’s Time for Biotech’s “Big Dogs” to Step Up to the Plate appeared first on Junior Mining Analyst.