This post The Financialization of America… and Its Discontents appeared first on Daily Reckoning.

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization.

The Achilles Heel of our socio-economic system is the secular stagnation of earned income, i.e. wages and salaries. Stagnating wages undermine every aspect of our economy: consumption, credit, taxation and perhaps most importantly, the unspoken social contract that the benefits of productivity and increasing wealth will be distributed widely, if not fairly.

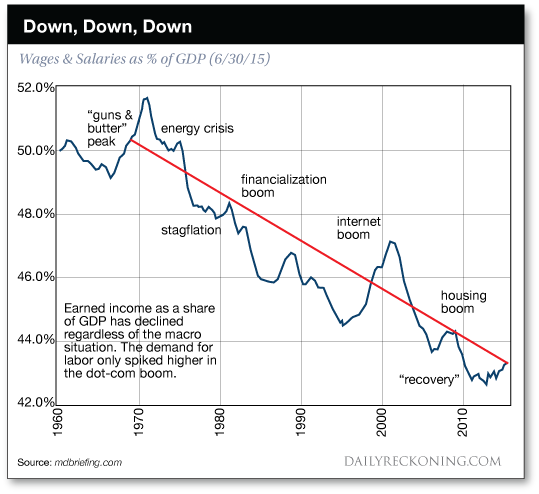

This chart shows that labor’s declining share of the national income is not a recent problem, but a 45-year trend: despite occasional counter-trend blips, labor (earnings from labor/ employment) has seen its share of the economy plummet regardless of the political or economic environment.

Given the gravity of the consequences of this trend, mainstream economists have been struggling to explain it, as a means of eventually reversing it.

The explanations include automation, globalization/offshoring, the high cost of housing, a decline of corporate competition (i.e. the dominance of cartels and quasi-monopolies), a failure of our educational complex to keep pace, stagnating gains in productivity, and so on.

Each of these dynamics may well exacerbate the trend, but they all dodge the dominant driver of wage stagnation and rise income-wealth inequality: our economy is optimized for financialization, not labor/earned income.

What does our economy is optimized for financialization mean?

It means that capital and profits flow to the scarcities created by asymmetric access to information, leverage and cheap credit — the engines of financialization.

Financialization funnels the economy’s rewards to those with access to opaque financial processes and information flows, cheap central bank credit and private banking leverage.

Together, these enable financiers and corporations to get the borrowed capital needed to acquire and consolidate the productive assets of the economy, and commoditize those productive assets, i.e. turn them into financial instruments that can be bought and sold on the global marketplace.

Labor’s share of the national income is in freefall as a direct result of the optimization of financialization.

Meanwhile, the official policy goal of the Federal Reserve and other central banks is to generate 3% inflation annually. Put another way: the central banks want to lower the purchasing power of their currencies by 33% every decade.

In other words, those with fixed incomes that don’t keep pace with inflation will have lost a third of their income after a decade of central bank-engineered inflation.

But in an economy in which wages for 95% of households are stagnant for structural reasons, pushing inflation higher is destabilizing.

There is a core structural problem with engineering 3% annual inflation. Those whose income doesn’t keep pace are gradually impoverished, while those who can notch gains above 3% gradually garner the lion’s share of the national income and wealth.

Wages for the bottom 95% have not kept pace with official inflation (never mind real-world inflation rates for those exposed to real price increases in big-ticket items such as college tuition and health care insurance).

Most households are losing ground as their inflation-adjusted ( real) …read more

Source:: Daily Reckoning feed

The post The Financialization of America… and Its Discontents appeared first on Junior Mining Analyst.