Source: Thibaut Lepouttre for Streetwise Reports 09/26/2017

Thibaut Lepouttre of Caesars Report profiles an new exploration company with three promising gold projects in Colombia.

Red Eagle Exploration Ltd. (XR:TSX.V) could be seen as the “exploration division” of Red Eagle Mining Corp. (R:TSX; RDEMF:OTCQX; R:BVL), whose management and technical team will now apply its extensive experience on the three exploration projects in Red Eagle Exploration’s portfolio. In this article, we will discuss the three projects, and why they all are exciting exploration properties.

The California Gold Project

The California project is the newest addition to Red Eagle Exploration’s project portfolio as it was only acquired earlier this year.

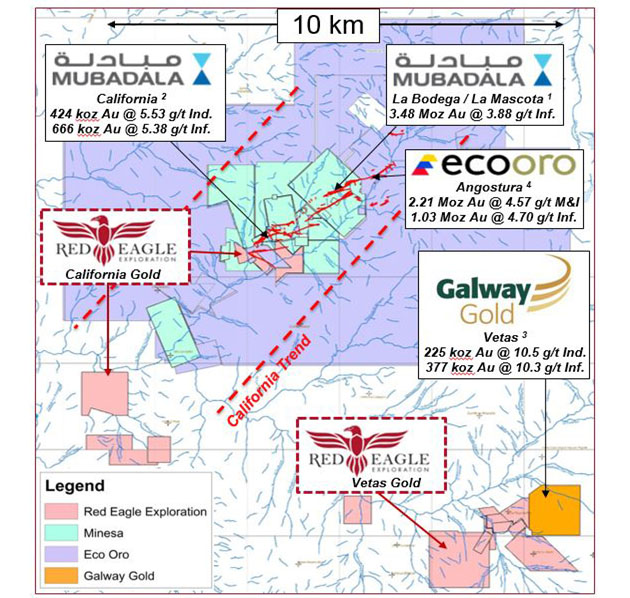

The total surface area of the project is approximately 250 hectares situated on eight exploitation mining concessions, which are directly adjacent to the La Bodega and Angostura gold projects. These projects are currently owned by Mubadala after Eike Batista’s gold company had to sell its assets to protect itself against a liquidity crunch.

Red Eagle Exploration purchased the California concessions in February by paying a total of US$5.7 million in cash and an additional US$7.6 million payable in shares. A first tranche was made available to the sellers (local miners), while the remainder of the purchase price will have to be paid within two years after the completion of the title transfer (2019). Additionally, Red Eagle will have to complete a final payment valued at 1.5% of the gold and silver value in the Measured and Indicated resources within three years after the completion of the title transfer.

No NI 43-101 compliant resource estimates have been completed for now, but for illustration purposes; if XR would end up with a total Measured and Indicated resource of 300,000 ounces gold-equivalent with the gold price trading at $1300/oz, the company would be required to make a final cash payment of approximately US$5.9 million.

A second land package was acquired in March, and the total consideration to own 100% of both land packages will cost Red Eagle a total of approximately US$9.4 million in cash and US$11.3 million in shares.

It’s also important to note the 250 hectares of the California project are located at an altitude of just 2,400–2,700 meters above sea level, which is way below the Paramo-level. That’s important as some of the projects located at higher altitudes won’t be able to clear the permitting hurdles.

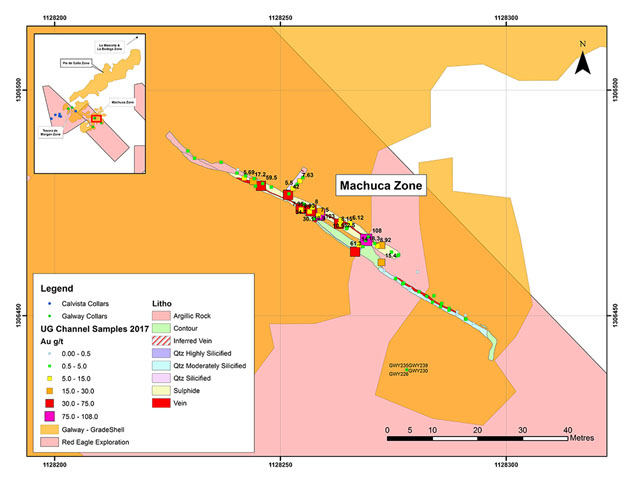

Red Eagle Exploration has already released the assay results from an underground sampling program at the Machuca zone, which is a part of the California project located approximately 300 meters south of the Pie de Gallo zone (and less than 200 meters away from the planned portal to mine the Pie de Gallo zone!) and less than one kilometer away from the La Mascota zone. This definitely is the right region to be exploring in and according to the July edition of the Colombia Gold Newsletter, the combined resources on Mubadala’s land package now total 12.2 million ounces at an average grade of 6.15 g/t gold, resulting in a production rate of approximately 450,000 ounces of gold per year for at least 23 years.

The underground chip sampling program has now been completed and as the results confirmed the existence of a mineralized zone with a strike length of approximately 45 meters, open in all directions, the sampling program has proven its value as not only was the continuity of the mineralization confirmed, the average grades were impressive as well as numerous samples contained a double-digit gold value. The final results of the sampling program were the mineralization having been sampled over the aforementioned 45 meters with an average width of 2 meters and an average gold grade of 9 g/t, and it shouldn’t be surprising to see XR planning to drill this zone as soon as possible.

The Vetas Gold project

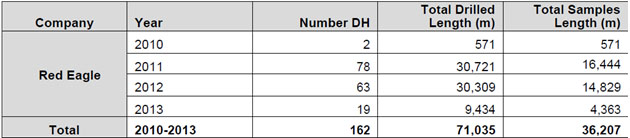

The Vetas Gold project was CB Gold’s flagship project as it was the most advanced property with in excess of 70,000 meters of drilling completed on the property.

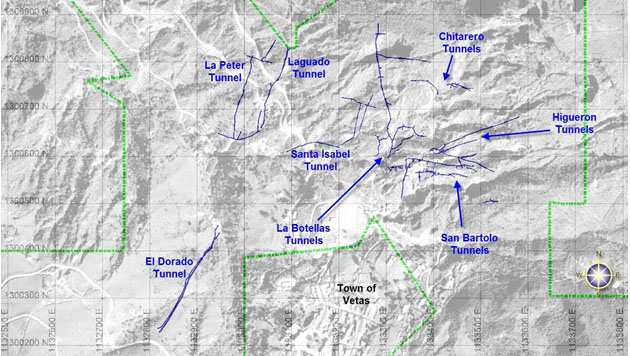

The underground workings that comprise the Vetas project are the remains of 11 past-producing mine. In fact, gold mining has occurred since the 1500s as the Spanish conquistadores discovered more gold, which they started to mine. This small-scale production process continued for several hundred years and ended when the First World War broke out.

Although there are no “official” records from this period, the total historical production from the veins in the Vetas area was estimated at 1–2 million ounces, mined and recovered from high-grade ore.

It wasn’t a huge surprise to see the use of modern exploration techniques allowed Red Eagle Exploration (and its predecessors) to discover much more gold, and its 71,000-meter drill program intersected several high-grade intercepts with, for instance, 2 meters containing in excess of 300 g/t gold and 1.1 meters assaying 228 g/t gold. Red Eagle encountered no less than 177 intersections with an average grade of over 5 g/t gold and 33 intersections with gold values of in excess of 10 g/t as part of this 162-hole drill program.

Santa Ana Silver

The third property owned by XR is perhaps the least known, but nevertheless very exciting. Red Eagle Exploration acquired the 700-hectare Santa Ana Silver project from Condor Precious Metals for CA$250,000 in cash, 8.1 million shares and a 2% Net Smelter Royalty.

This was a very reasonable price tag considering the history of Santa Ana which, just like Vetas, has already been mined in/since the 1500s as the very high-grade silver values on the property caught the attention of the Spaniards.

Contrary to the Vetas project, there effectively are historical reports from the silver production at Santa Ana as 430-year-old reports indicate a grade of ‘4 marcos per quintal,’ which would be the equivalent of almost 20,000 g/t silver as 1 marco is 230 grams while one quintal is 45.9 kilograms.

The previous owner completed a sampling and drill program on the property and although the drill program consisted of just eight holes (for a total of 1,170 meters drilled from just one drill platform), which were testing the potential deeper extension of the known silver vein, the assay results were impressive with 0.85 meters at 1.3 g/t gold and 667 g/t silver and 3 meters at 3.68 g/t gold plus an additional 1.5 kilos of silver per tonne of rock.

Of course, this was just a small drill program specifically targeting the zone where mineralization could be expected but it’s clear the average grades encountered during this drill are very exciting. The width of the veins that were mined in the Spanish colonial era was approximately 1.5 meters, so this shouldn’t be any issue at all considering the modern mining techniques can easily handle these widths.

Conclusion

It’s important to emphasize all three projects have confirmed mineralization while both California and Vetas are located within wheelbarrowing distance of a 12-million-ounce development-stage gold project. On top of that, virtually no pure silver projects have been developed in the past 5–10 years, so if Red Eagle (Exploration) would be successful in figuring out the geological features of the Santa Ana silver project, the company has a good shot at becoming Colombia’s premier silver developer.

Having Red Eagle Mining as its main shareholder will definitely be advantageous for Red Eagle Exploration as the ‘Mining’-team now has plenty of experience in Colombia it could apply on the Exploration properties. On top of that, Red Eagle Mining could provide financial assistance as well as the San Ramon mine will be restarted before the end of this year after completing the construction of the paste backfill plant.

We are looking forward to seeing Red Eagle Exploration’s exploration plans and hope the Machuca zone will be drilled first. This will be a very important drill program due to the expected average grade and the proximity to the Mubadala zone. Exploration is not an exact science, but the historical exploration and production results are a great help to prioritize the drill targets on all three properties.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Red Eagle Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with Red Eagle Exploration. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Red Eagle Mining. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images provided by the author.

( Companies Mentioned: XR:TSX.V,

R:TSX; RDEMF:OTCQX; R:BVL,

)