By Brian Maher

This post A Force Greater Than the Fed appeared first on Daily Reckoning.

Yesterday the Donald announced he’s ready to reduce North Korea to dust.

Today the Fed announced it’s ready to reduce its balance sheet to normal.

Neither is good for stocks.

So how did they take the news?

Exactly as you’d expect — with another record setting day.

The Dow closed today day 42 points higher… eclipsing its previous high.

The S&P scratched out another record of its own.

Only the Nasdaq ended the day in red. And only by five points.

The larger question:

Why are stocks setting records in the face of such uncertainty?

The news is noise, say the optimists…

“Stocks are making record highs because the U.S. economy is on a roll,” says Yahoo Finance.

It’s because exports are rising… corporate earnings are soaring… and sales are booming, adds one analyst at Contrarian Outlook.

Stocks set records “not because central bank balance sheets are so expansive, but because companies are still lean and profitable, and corporate shares still represent value compared to other assets,” chirps the editor of Momentum Strategies Report.

Perhaps they’re right.

We bring a disbelieving outlook to the business… and a jaundiced eye.

It may blind us to the booming sales, the corporations representing value, the rising exports… the economy on a roll.

But the Atlanta Fed’s GDPNow updated growth forecast came out yesterday.

It projects third-quarter growth at an annualized rate of 2.2%… down from a projected 4% at quarter’s start.

The New York Fed releases its own updated estimate Friday. Its last estimate had third-quarter GDP even lower… at 1.3%.

Meantime, Kiplinger estimates full-year growth will total 2.1%.

Are these the numbers of an economy “on a roll”… or an economy at a crawl?

If the latter, what force is thrusting stocks to record heights?

Is some unseen hand working unseen levers… some mysterious alchemy transmuting Main Street lead into Wall Street gold?

One possible clue:

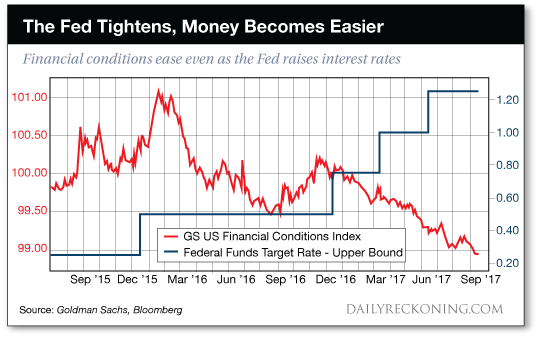

The Fed has taken the federal funds rate to 1.25%, from just about zero in December 2015.

Still low. But higher than zero. And trending higher.

Yet… the Goldman Sachs U.S. Financial Conditions Index is now at its lowest point since 2014.

So despite the Fed’s tightening and all of hell’s angels, money is looser and cheaper than at any point in three years.

How can this be?

Bank of America’s Michael Hartnett may have the answer…

The Fed is not the world’s sole central bank.

It shares the road with the European Central Bank (ECB), the Bank of Japan (BOJ), the Bank of England (BOE), the People’s Bank of China (PBOC) — to name some.

And Hartnett notes that central banks have purchased nearly $2 trillion of financial assets year to date.

That nears the amount of assets the Fed purchased under QE1… during the breathless and foot-free days of the Great Recession.

Those foreign central bank purchases translate to a vast sea of liquidity supporting stocks.

Hartnett calls it the “supernova of liquidity”… the “flow that conquers all.”

By our lights, it better explains today’s record markets than rising exports… booming sales… or the “rolling” economy.

We are not alone.

Analyst Tony Cherniawski, for example, argues:

Source:: Daily Reckoning feed

The post A Force Greater Than the Fed appeared first on Junior Mining Analyst.