This post Caught in the Crossfire: Can the Copper Bull Survive? appeared first on Daily Reckoning.

I can’t keep track of all the reasons copper is supposed to go up or down this year…

Copper’s rising because Trump’s talking infrastructure, one headline reads. Another says copper’s going to drop because Chinese demand is weak. Or maybe all this nonsense is already priced in. Who knows?

That’s why it’s so important to ignore the media circus and follow the trends. We shut out the noise back in July and went long copper as the industrial metal for one reason: it was starting to sneak higher, breaking a downtrend that had been in place for more than five years. After all the pain and suffering, a sustainable rally was in the works.

Of course, most sharp comebacks won’t rocket higher in a straight line. Now that the copper cat is out of the bag, we’re running into a selloff that’s quickly turning into the first real test for this brand-new copper bull.

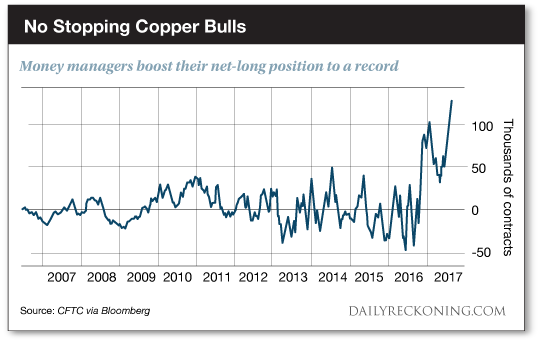

“After amassing their largest holdings ever, money managers saw the value of the metal plunge last week, halting the longest rally in a decade,” Bloomberg reports.

Yes, the smart money is all-in on copper right now. And we’re caught in the crossfire. Now we’re stuck watching the big bucks play musical chairs as analysts warn about “over-hyped” production shortfalls.

Back in August, we noted that copper had just posted new 2017 highs, showing year-to-date gains just shy of 18%. But the past week has proven difficult for Dr. Copper. The metal is down more than 5% over the past four trading sessions. And it’s slipping lower once again this morning as the smart money weighs its options…

To be fair, most investors didn’t believe copper would ever recover from its lows. Can’t say that I blame them. One look at a long-term chart of the industrial metal reveals a nasty bear market. As the commodity super-cycle topped out in 2011, the metal entered a death spiral that lasted nearly six years.

But the post-election rally back in November was the spark that helped copper snap it’s nasty downtrend. After seven months of choppy consolidation, copper jumped back near its March highs in late July and signaled to us that it was ready to pounce on a huge breakout.

We still don’t know if copper is just getting started on another decade-long bull run or if it’s simply undergoing some mean reversion after years of neglect. Either way, we’re willing to ride the new trend to gains. After years of pain and suffering, we believe a sustainable rally remains at play right now.

Our own little copper stock, Freeport-McMoRan Inc. (NYSE: FCX), is feeling a little pressure as copper endures its sharp pullback. But we jumped on this play in July. We’re still sitting on open gains despite this month’s pullback. Remember, buying FCX is like buying a call option on copper without the high commission. When copper jumps, the miner tends to magnify the move. The same …read more

Source:: Daily Reckoning feed

The post Caught in the Crossfire: Can the Copper Bull Survive? appeared first on Junior Mining Analyst.