This post The Era of Complacency Is Ending appeared first on Daily Reckoning.

Physicists say a “subcritical” system that’s waiting to “go critical” is in a “phase transition.” A system that is subcritical actually appears stable, but it is capable of wild instability based on a small change in initial conditions.

The critical state is when the process spins out of control, like a nuclear reactor melting down or a nuclear bomb exploding. The phase transition is just the passage from one state to another, as a system goes from subcritical to critical.

The signs are everywhere that the stock market is in a subcritical state with the potential to go critical and meltdown at any moment. The signs as elevated price-to-earnings (P/E) ratios, complacency, and seasonality — crashes have a habit of happening around this time of year.

The problem with a market meltdown is that it’s difficult to contain. It can spread rapidly. Likewise, there’s no guarantee that a stock market meltdown will be contained to stocks.

Panic can quickly spread to bonds, emerging markets, and currencies in a general liquidity crisis as happened in 2008.

For almost a year, one of the most profitable trading strategies has been to sell volatility. That’s about to change…

Since the election of Donald Trump stocks have been a one-way bet. They almost always go up, and have hit record highs day after day. The strategy of selling volatility has been so profitable that promoters tout it to investors as a source of “steady, low-risk income.”

Nothing could be further from the truth.

Yes, sellers of volatility have made steady profits the past year. But the strategy is extremely risky and you could lose all of your profits in a single bad day.

Think of this strategy as betting your life’s savings on red at a roulette table. If the wheel comes up red, you double your money. But if you keep playing eventually the wheel will come up black and you’ll lose everything.

That’s what it’s like to sell volatility. It feels good for a while, but eventually a black swan appears like the black number on the roulette wheel, and the sellers get wiped out. I focus on the shocks and unexpected events that others don’t see.

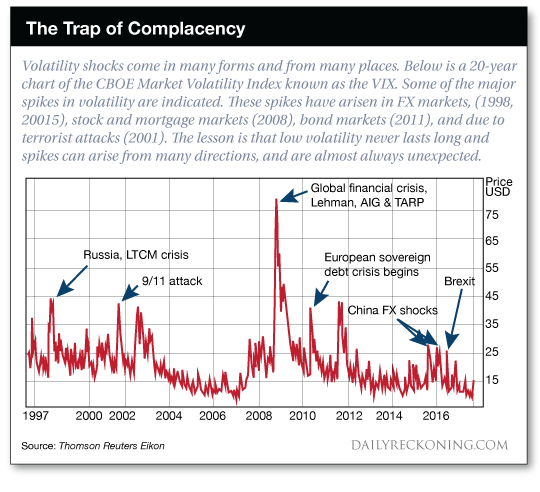

The chart below shows a 20-year history of volatility spikes. You can observe long periods of relatively low volatility such as 2004 to 2007, and 2013 to mid-2015, but these are inevitably followed by volatility super-spikes.

During these super-spikes the sellers of volatility are crushed, sometimes to the point of bankruptcy because they can’t cover their bets.

The period from mid-2015 to late 2016 saw some brief volatility spikes associated with the Chinese devaluation (August and December 2015), Brexit (June 23, 2016) and the election of Donald Trump (Nov. 8, 2016). But, none of these spikes reached the super-spike levels of 2008 – 2012.

In short, we have been on a volatility holiday. Volatility is historically low and has remained so for an unusually long period of time. The sellers of volatility have …read more

Source:: Daily Reckoning feed

The post The Era of Complacency Is Ending appeared first on Junior Mining Analyst.