This post Can A New War Finally Kill the Bull Market? appeared first on Daily Reckoning.

We’re on the brink of nuclear war.

Or at least that’s what the media wants you to think.

Haven’t we seen this movie before?

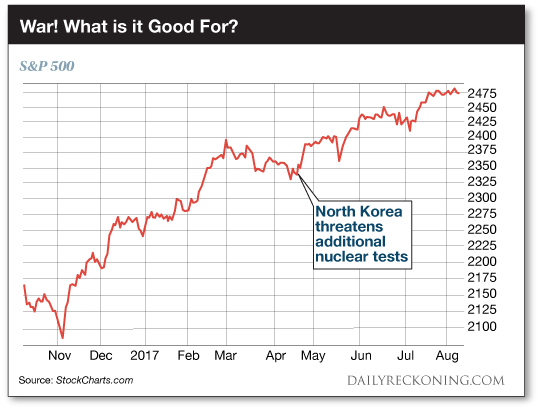

Not four months ago, stocks stuttered during a week of headlines warning of war. First there was an airstrike in Syria. Then the U.S. dropped the mother of all bombs in Afghanistan. (You already forgot about the MOAB, didn’t you?) Not to be outdone, North Korea threatened to test new missile technology every single week.

But the terrifying news couldn’t stop the bull market. In fact, North Korea’s threats marked the end of a six-week pullback in the S&P 500.

Sure, world events were causing plenty of anxiety among the investing class. But we took the opportunity to buy the dip. Now the S&P is up more than 5% since it bottomed out in late April.

This week, fresh war worries are sprouting up everywhere we turn. In fact, there’s enough terrifying news rolling in to convince the average investor sell every share in his portfolio and use the cash to stock up on canned goods and bottled water.

The political pundits have plenty to scream about. The current freak out over North Korea threatening a missile strike on U.S. military bases in Guam is a welcome break from the slow August news cycle, as far as the media is concerned.

Trump’s fire and fury remarks quickly jumped from the front page to the financial section. The summer doldrums needed a jolt in the arm. CNBC blamed the market’s abrupt slide on North Korean tensions. But at the end of the day, the S&P 500 dropped less than one lousy point. So much for that theory. On a day where the world was supposedly falling apart, the market didn’t even budge.

The saber rattling continued after the bell, of course. North Korea fired another salvo in the war of words, claiming “sound dialogue is not possible” with Trump due to his “failing to grasp the on-going grave situation”.

Investors will probably head for the hills if bombs fall out of the sky. They’ve been spooked by far less serious situations over the past 18 months. We don’t have to search too far to find instances when scary or unexpected situations temporarily rankled the markets. Just last year, the Brexit bombshell slapped the Dow down more than 5%. And the surprise defeat of Hillary Clinton tanked world markets long before anyone uttered a single word about a Trump Bump.

But you must remember that the world didn’t stop spinning during these short moments of panic. That’s why we prefer to search for opportunities when the investing herd runs for cover. Market history shows us that geopolitical events like the ones we’re witnessing right now can provide smart investors with a strong buying opportunity. You just need to know what to look for…

I know what you’re thinking – the market’s worried about war right now, not political surprises. But these …read more

Source:: Daily Reckoning feed

The post Can A New War Finally Kill the Bull Market? appeared first on Junior Mining Analyst.