This post It’s Time to Jump on Ravaged Retail’s Dead Cat Bounce appeared first on Daily Reckoning.

Retail’s hitting rock bottom.

We’ve patiently waited for this moment. Investors have danced on retail’s corpse all year, declaring Amazon’s dominance over the sector. There’s nowhere left for the old-fashioned brick and mortar stores to hide, they said.

Not so fast…

We’re beginning to uncover a few gems from the retail rubble. Some of the beaten-down names the herd left for dead months ago are suddenly coming back to life. That gives you a shot at lightning-fast snapback gains as these dead cat stocks launch off the pavement.

Of course, the retail comeback is materializing after most investors completely gave up on the sector. After all, Amazon has decimated brick and mortar retail sector for the better part of the past year. Even the trendiest competitors took a beating. Food delivery upstart Blue Apron (NYSE:APRN) is the most high-profile example. The doomed IPO imploded shortly after takeoff. Shares are near all-time lows as I type, more than 40% below the June IPO price.

The list of Amazon’s victims grows longer by the day, I noted back in July. Even good news in the retail sector couldn’t drum up any excitement for these pitiful stocks. Shoppers have moved online. There’s no reason to pay attention to these poor, “old school” retail plays anymore.

Unless you follow the money.

As it turns out, developers aren’t abandoning the retail business. They’re doubling down.

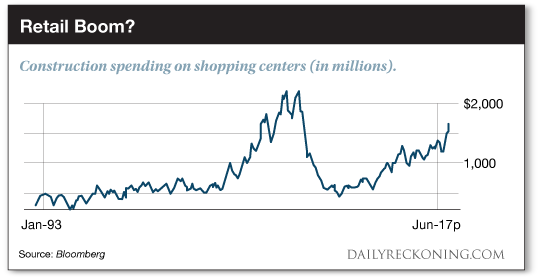

“Across the country, construction spending on shopping centers topped $1.6 billion in June, the largest amount since 2008 and the Great Recession,” Bloomberg reports. “Builders have been especially busy working on malls, spending $404 million in April. In nominal terms, that’s the second highest monthly total ever according to Census data, coming in behind July 2008.”

Malls aren’t dead. They’re just getting a facelift.

I know this info doesn’t mesh with the Amazon narrative. That’s what makes it so compelling as an investor. Sure, traditional retailers are having a tough time adapting to the realities of the online shopping landscape. The evening news shows us abandoned malls and shuttered shopping centers littering the country.

There’s a lot of truth to this story. The death of the old-fashioned shopping mall and the rise of Amazon and the online shopping revolution remains an ongoing cultural event. As it continues to shake out, we will see more poorly run, unfocused retail operations hit the skids.

But the concept of the physical store isn’t going anywhere. As much as we’ve dogged brick and mortar retail, it would be silly to assume every single store in the country will close its doors and declare bankruptcy. Like any industry that finds itself in turmoil, the best businesses will adapt and survive.

That also means we can profit from snapback plays while the rest of the world crowds the other side of the trade. Now that we’re smack in the middle of earnings season, select retail stocks are posting meaningful moves off their lows.

Walmart (NYSE:WMT) shares have quietly pushed to …read more

Source:: Daily Reckoning feed

The post It’s Time to Jump on Ravaged Retail’s Dead Cat Bounce appeared first on Junior Mining Analyst.