By Zach Scheidt

This post Gold Alert! — Plus, 5 Must-Knows For Monday… appeared first on Daily Reckoning.

“Gold is our way of saying that we don’t trust the man.”

That’s what Peter Grosskoph, CEO of Sprott Inc. told a packed room of gold investors recently. And based on my research, and the conversations I’ve been having with industry experts, I think Peter’s views are spot on.

As the CEO of one of the world’s most respected gold investment companies, Peter’s take on the market is extremely valuable. The audience was hanging on every word he spoke.

Peter’s presentation followed a speech by Rick Rule, the Founder of Sprott. I’ve crossed paths with Rick quite a few times over the years, and every time I see him, I come away with new clarity on the market and the forces driving gold and silver prices.

Today, I want to pass on what I learned from these two heavyweight precious metal titans…

“This has been a particularly vicious bear market for gold” said Rick Rule. “The average gold mining stock is down about 88 percent.”

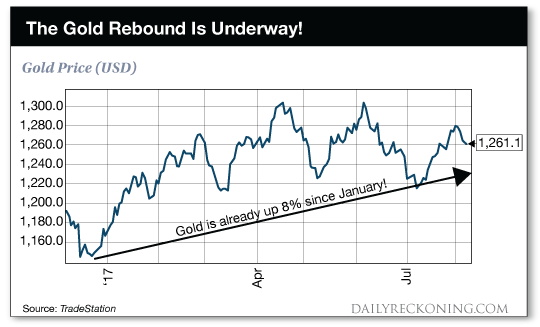

Of course that makes sense if you’ve watched the price of gold for the last few years. Which for one ounce of gold has dropped from a high near $2,000 to a low in December of 2015 below $1,100.

Sure, that’s less than an 88% decline. But think about all of the miners who have to pay for equipment, labor, and land. Many of those miners can no longer turn a profit now that gold prices have pulled back.

Stock prices for those miners have plummeted, and many less profitable companies have gone out of business. It takes a lot of discipline for gold companies to stay profitable through such a long-term bear market for gold.

Of course, this is bad news if you invested near the peak in late 2011.

But if you’ve got cash to invest today, it’s a totally different story!

The Gold Cycle Turns

“If price is below the cost of production, one of two things will happen. Either a commodity will become unavailable, or the price will rise.”

Rick Rule went on to explain how long-term cycles affect the gold market, and how investors can see these trends coming from a mile away.

When prices are high (as they were in 2011), gold miners spend money to develop and optimize their operations. If a particular mine is turning a profit producing 50 million ounces at a certain cost, it’s only natural to spend more on equipment and labor so the mine can produce 100 million ounces!

Of course if you have hundreds of mining companies doing everything they can to produce more gold, the market will be flooded with too much gold. Too much supply and not enough buyers will send prices lower. And that’s exactly what happened.

From late 2011 through the end of 2015, gold prices steadily dropped. For a while, miners continued to produce as much gold as possible, hoping to sell enough gold and silver to pay for their ballooning costs.

Eventually, the low price …read more

Source:: Daily Reckoning feed

The post Gold Alert! — Plus, 5 Must-Knows For Monday… appeared first on Junior Mining Analyst.