This post Amazon Is a Creation of Bubble Finance appeared first on Daily Reckoning.

Joseph Schumpeter, one of the great economists of all times, once described capitalism as “the perennial gale of creative destruction.” In Capitalism, Socialism, and Democracy (1942), he wrote:

The opening up of new markets, foreign or domestic, and the organizational development from the craft shop to such concerns as U.S. Steel illustrate the same process of industrial mutation — if I may use that biological term—that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.

I believe fully in the virtues of free market capitalism. Its “creative destruction” creates gains in efficiency and leads to technological innovation. It produces rising incomes and living standards for everyone.

And I strongly oppose attempts by the state to implement bailouts, subsidies and protectionist devices designed to keep buggy-whip makers in business after their time has gone.

Yet I quote the passage above because the day before yesterday I heard a stock peddler on bubble vision praising Amazon as an example of Schumpeter’s ideal.

Namely, that the destructive mayhem now underway in bricks and mortar retail is just the laws of capitalism at work. And that Amazon’s e-commerce juggernaut is creating far more new economic wealth and utility than it is destroying.

But I beg to differ.

Schumpeter assumed financial markets were honest and that the monetary system was sound. But he died in 1950 — long before Milton Friedman co-authored a grossly misleading book on how the Fed’s stinginess had caused the Great Depression (A Monetary History of the United States, 1963).

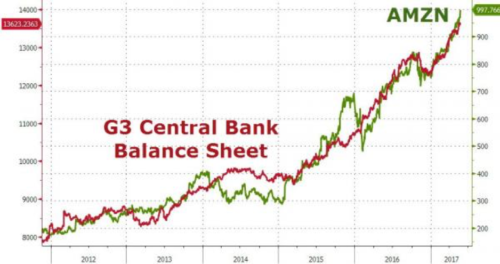

And Schumpeter died even longer before Friedman’s disciples at the central banks ushered in the era of Bubble Finance and monetary central planning we have today.

At the heart of monetary central planning is the massive falsification of financial asset prices. This is profoundly destructive because it distorts the signaling system of everyday capitalism. In turn, that causes sweeping malinvestments, irrational economic decisions and the vast waste of real economic resources.

Applying that insight to the retail sector, it is now estimated that 30,000 retail stores will close over 2017-2019 due to Amazon’s relentless attack. That’s nearly 3x the 12,000 stores that closed from 2014-2016.

But in carrying out its scorched earth policies across the retail landscape, Amazon is not doing God’s work, or even Schumpeter’s. It’s functioning as a giant predator motivated by false incentives to destroy perfectly serviceable assets, business operations and jobs.

Once again today, Amazon’s stock is trading above the $1,000 mark. That means its market cap is in the financial stratosphere at $478 billion.

But Amazon is 24 years-old, not a start-up. And it hasn’t invented anything explosively new like the i-Phone or personal computer. Instead, 91% of its sales involve storing, moving and delivering goods — a sector of the economy that has grown by just 2.2% annually in nominal dollars for the last decade. There is simply no …read more

Source:: Daily Reckoning feed

The post Amazon Is a Creation of Bubble Finance appeared first on Junior Mining Analyst.