By Cory

The Issues in China Continue

We have discussed the issues that China is facing pretty much all this year. It seems things are not getting better. Weak expected Q2 GDP along with debt continuing to skyrocket all contribute to a recent Moody’s downgrade of China’s credit rating. Read the Factset post below that outlines why the concerns about China are more than just rumors.

… Click here to visit the original posting page…

China’s Indebtedness in the Face of Slowing Growth

Last month, Moody’s downgraded China’s credit rating from AA3 to A1 for the first time since 1989. Investors have long feared the world’s second largest economy is heading toward a “hard landing,” so the downgrade does not come as a surprise. However, Moody’s cautionary outlook once again puts the spotlight on Beijing’s difficulties, which officials in there argue are a natural by-product of rebalancing of its economy.

In its statement, the ratings agency cited a weaker growth outlook and mounting debt pressure as the most urgent issues for the Chinese economy. Here, we’ll examine the numbers behind those concerns and the prospect of a turnaround.

For more, see our previous post: How to Measure and Manage Your True Exposure to the Slowdown of China.

Slow GDP Growth Leads to a Slow Re-Balancing Act

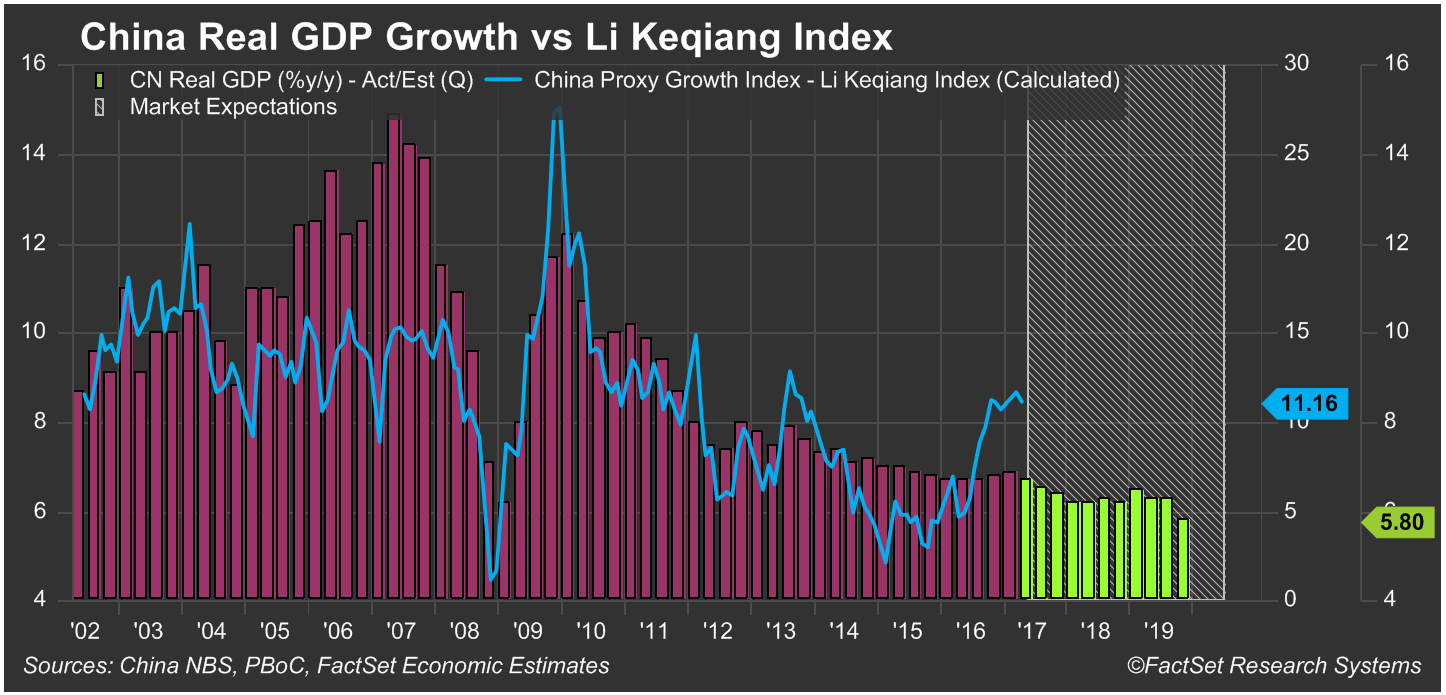

China’s Q1 GDP growth reached 6.9%, the highest growth rate in two years and marginally higher than expectations. While the economy grew in Q1 (which can also be seen in China’s alternative measure of growth, the Li Keqiang Index), Q2 expectations suggest that GDP will grow by only 6.7% and that 2017 annual growth will decrease to 6.5%. After a period of rapid growth and an ongoing rebalancing of its economy from an investment-driven to a consumption-based model, lower Chinese growth rates are, perhaps, to be expected. Officials in Beijing have repeatedly stressed that lower growth rates are probable during this period of transition, reflected in the GDP target cut to 6.5% for 2017. The medium-term outlook suggests that GDP growth will decline further to 6.2% in 2018 and 5.8% in 2019.

The latest GDP figures also suggest that reform is proceeding slower than expected, particularly in the service sector, which is expected to play a crucial role in the country’s economic future. The service industry accounts for more than 50% of China’s total GDP according to 2016 figures, compared to 42% 10 years ago and 34% 20 years ago. Despite the impressive growth, this is significantly lower than the global average of 74% for developed countries. Chinese GDP growth in the tertiary industry (service sector) grew at a slower pace in Q1 than the secondary industry (construction and manufacturing sector); tertiary GDP saw a slight increase from 7.6% to 7.7% compared to last year while secondary GDP grew at a faster pace of 6.4% vs 5.8% in the previous year. Despite the slower growth in tertiary GDP, recent key releases suggest that Q2 values will see a steady rise; retail sales increased 10.7% compared to last year and fixed …read more

Source:: The Korelin Economics Report

The post Valuable Insights from Around the Web – Mon 26 Jun, 2017 appeared first on Junior Mining Analyst.