And the expansion is expected to continue. Back in February, I shared with you research from PricewaterhouseCoopers (PwC), which predicts that by 2050, China and India will become the world’s

The 19th century belonged to the United Kingdom, the 20th century to the United States. Many market experts and analysts now speculate that the 21st century will be remembered as the “Asian Century,” dominated by rising superpowers such as Indonesia, India and China.

It’s those last two countries, India and China—home to nearly 40 percent of the world’s population—that I want to focus on. Both emerging markets offer attractive investment opportunities, especially for growth investors who seek to derisk from American equities.

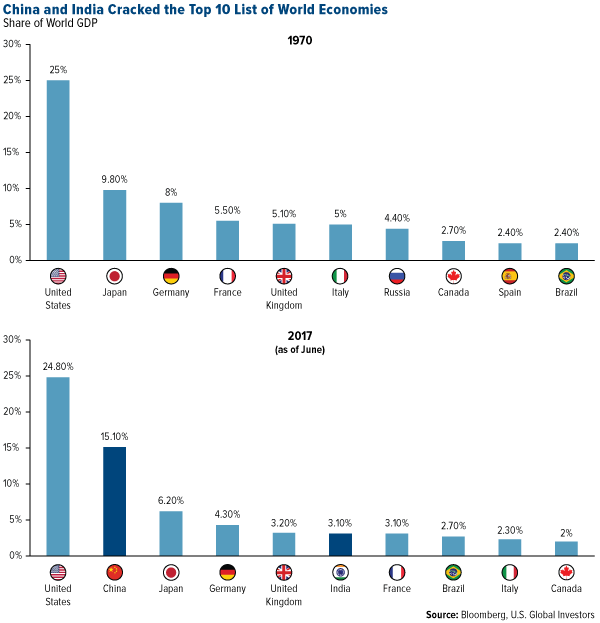

Look at how dramatically the two have expanded in the last half century. As recently as 1970, neither country controlled a significant share of world gross domestic product (GDP). As of June of this year, however, China represents more than 15 percent of world GDP, India more than 3 percent. This has displaced Russia and Spain, itself the world’s wealthiest economy in the 16th century.

click to enlarge

And the expansion is expected to continue. Back in February, I shared with you research from PricewaterhouseCoopers (PwC), which predicts that by 2050, China and India will become the world’s number one and number two largest economies based on purchasing power parity (PPP). (PPP, if you’re unfamiliar, is a theory that states that exchange rates between two nations are equal when price levels of a fixed basket of goods and services are the same.)

click to enlarge

Also note Indonesia, which is expected to replace Japan as the fourth-largest economy by midcentury.

A Surge in Middle Class Spenders

What should excite investors the most is the growing size of the middle class in China and India. More middle class consumers means more spending on goods and services and more investing.

Remember, China’s middle class is already larger than that found here in the U.S., according to Credit Suisse. In October 2015, the investment bank reported that, for the first time, the size of China’s middle class had exceeded that of America’s middle class, 109 million to 92 million. As incomes rise, so too does demand for durables, luxury goods, vehicles, air travel, energy and more.

Living standards have risen dramatically in China. According to Dr. Ira Kalish, a specialist in global economic issues for Deloitte, hourly wages for manufacturing jobs in China are now higher than those found in Latin American countries except for Chile. They’re even nearing wages found in lower-income European countries such as Greece and Portugal.

Looking ahead to 2030, China is expected to have a mind-boggling 1 billion people—more than three times the current U.S. population—enjoying a middle class lifestyle filled with middle class things, from cars to designer clothes to electronics and appliances.

click to enlarge

India, meanwhile, will have an estimated 475 million people among its middle class ranks. The South Asian country is currently the fastest-growing G20 economy, with Morgan Stanley analysts estimating year-over-year growth to hit 7.9 percent in December. Driving this growth is a steady increase in wages and pensions, which will support consumption of goods …read more

Source:: Frank Talk

The post One Easy Way to Invest in the “Asian Century” appeared first on Junior Mining Analyst.