This post The Only 5 Stocks You Need to Retire appeared first on Daily Reckoning.

There are around 8,700 stocks listed on the U.S. market today.

But what if I told you that you need only five of them to build a lucrative retirement?

It’s true.

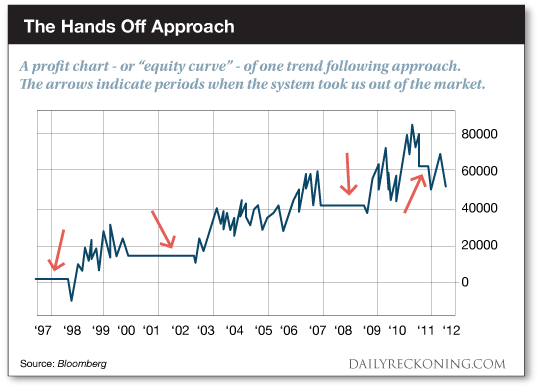

I’ve been telling you all about the power of a strategy known as trend following over the past several weeks. It’s the same strategy used by high-end hedge funds to generate investment gains for millionaires and billionaires in any market.

Now I want to show you how a trend following approach can let you stick with just five stocks to earn outsized profits with a fraction of the risk of buy and hold investing.

“One of the most beautiful things about using a trend following strategy is that it’s hands off,” explains our trend following maven Jonas Elmerraji. “Remember, the goal of this investment approach is simple: You want to identify big trends when they’re just getting started. So once you figure out what rules identify a trend, you can let the computer do the heavy lifting and tell you what to buy and sell.”

But that doesn’t mean that you need to crunch those numbers for all 8,700 U.S.-listed stocks. Just a handful will do fine.

Why so few?

The idea of buying just a few names is probably foreign to most modern investors. After all, we’ve all had the word “diversification” crammed into our brain for the past few decades.

But you can create a well-diversified portfolio with just five stocks. In fact, you can create a better diversified portfolio than most of your neighbors have with just those five names.

To answer why, we have to think about what you’re actually buying when you buy stocks…

“There’s a reason why people lump ‘stocks’ into a big group,” Jonas continues. “It’s because, for the most part, all stocks trade the same. We can measure that by figuring out the implied correlation of a group of stocks like the S&P 500. Right now, the implied correlation of everyone’s favorite index sits at 52.24. That means that around 52% of stock moves are happening together.”

When you buy a handful of stocks right now, around 52% of what you’re buying is going to move together no matter what. You’re buying a lot of the same thing. And buying a bunch of one thing isn’t diversification. In the real world, that’s precisely why almost all stocks fell like rocks in 2008 and why almost all stocks rallied hard in 2009.

To get real diversification, we need to focus on buying things that have very low correlation with one another.

Even with low correlations, five seems like too few to protect us from getting hammered if one crashes. The truth is that owning five stocks has only around 6% more risk than owning 1,000 stocks does; ratchet your number of stocks to 10 and you’ve got only 3% more risk from being underdiversified.

You’re not exactly playing Russian roulette by owning just a handful of names.

As a trend …read more

Source:: Daily Reckoning feed

The post The Only 5 Stocks You Need to Retire appeared first on Junior Mining Analyst.