The fact is, other than easy credit-fueled auto sales, which are now also rolling over, and purchases through Amazon’s cut rate e-Commerce juggernaut, the American consumer has been quasi-comatose for nearly three years now.

Reported sales at general merchandise stores in February were no higher than they were 30 months ago in August 2014 — and I do mean “nominal” sales. Since the Consumer Price Index (CPI) is up 2.8% during the last year alone, inflation adjusted sales are actually already well into recession territory.

More importantly, the plunge in department store sales — which comprise the anchor and driver of 70% of mall traffic — have not abated in the slightest. As of the most recent reading, the monthly sales rate was down 30% from the pre-crisis peak.

Again, that’s in nominal dollars. In real terms, department store sales have fall by upwards of 50% since the early years of this century.

Moreover, debt-encumbered American consumers are dropping, not shopping, because this entire so-called recovery has been wasted. That is, consumers can’t spend energetically because there has been no significant deleveraging since the 2008 crisis.

Despite all the Fed’s madcap money-printing, they are impaled on Peak Debt.

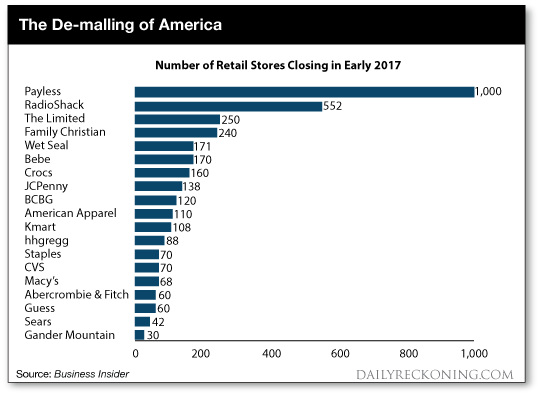

In a word, the retail mall sector is facing insuperable headwinds and the worst of both worlds. That is, flagging demand and immense over-capacity.

It now appears, in fact, that nearly 150 million of retail square footage could close during 2017 — an all-time record.

Does the foregoing paint a picture of economic health? Hardly. Quite the contrary, in fact.

So contrary to what the Wall Street stimulus junkies would have you think, the U.S. and global economies are hardly “accelerating.”

Of course, they have been preaching the same gospel since 2013. But this time, reality will come breaking in and finally shatter the delusion.

The U.S. economy is sliding toward recession. And with the Imperial City impossibly gridlocked, the chances that the “stimulus” baton will be handed off to some ballyhooed Trump Reflation are lower than those of the proverbial snowball in the hot place.

Which leads me to my sincerest piece of advice: get out of the casino before it’s too late.

Regards,

This post The Anything President And The Everything Bubble appeared first on Daily Reckoning.

[Ed. Note: To see exactly what this former Reagan insider has to say about Trump and the fiscal threats from politics and the debt ceiling, David Stockman is sending out a copy of his book Trumped! A Nation on the Brink of Ruin… And How to Bring It Back to any American willing to listen – before it is too late. To learn how to get your free copy CLICK HERE.]

The lemmings were running hard towards the cliffs yesterday. Despite a renewed burst of bombs and drones careening into the already rubble-strewn wastelands of Afghanistan, Yemen, Syria and Iraq.

Or the outbreak of cold war style nuclear brinksmanship on the Korean peninsula — what one commentator properly called a Cuban missile crisis in slow motion.

Likewise, forget that the vacationing Congress is set to return on April 25 to an endless sequence of shoutdowns, showdowns and shutdowns on continuing resolutions and debt ceiling increases.

That is, it will be struggling to keep the fiscal lights on in the Imperial City, not enacting the Donald’s DBA (dead before arrival) fantasy about making the American economy great again.

Indeed, while the Donald has been out huffing and puffing in his new role as global Spanker-in-Chief, the domestic front has turned from bad to worse. His economic policy machinery has now been seized entirely by the Vampire Squid’s latest chieftains in the White House — Gary Cohn, Steve Mnuchin and Jared Kushner.

I am quite confident that none of these three has ever voted Republican in their life or have even the foggiest idea of how to craft a fiscal plan and tax program that could coalesce the warring GOP factions from the hardline Freedom Caucus to the moderate Tuesday Group.

And if the Goldman trio should even attempt to go the old Boehner-Obama “bipartisan” route, as Wall Street devoutly wishes, Speaker Ryan will come to understand what it means to be drawn-and-quartered.

As I stated earlier, it should be crystal clear by now that there will be no great Trump Stimulus. And what lies ahead is an unprecedented outbreak of dysfunction, paralysis and unmitigated mayhem in the Imperial City.

Moreover, the fact that the Donald is now flipping, flopping, pivoting and whirling on issues in an almost random manner is surely compounding the dysfunction.

While the clucking commentariat at CNN may find the Donald’s betrayal of core campaign positions and constituencies to be evidence of a “refreshing” flexibility — or even as “presidential” — it is actually just the opposite.

It’s proof that the Donald didn’t mean a thing he said during the campaign.

And that for GOP politicians on Capitol Hill, lining-up behind a whirling dervish of impetuous unpredictability is fast becoming a career hazard with vanishing appeal.

After all, the Donald has now flip-flopped not on campaign brochure footnotes, but on five core issues:

China’s blatant currency manipulation over two decades, the Fed’s egregious bubble finance that left Flyover American behind, the Export-Import bank’s crony capitalist subsidies …read more

Source:: Daily Reckoning feed

The post The Anything President And The Everything Bubble appeared first on Junior Mining Analyst.