Last week we wrote that precious metals should see upside follow through but to be wary of the 200-day moving averages and February highs before becoming excited. The metals did follow through as Gold gained 1.5% and Silver gained 1.9% (for the week) but the miners disappointed. GDX gained only 1.1% while GDXJ finished in the red as did junior silver companies (SILJ). As spring beckons, the gold stocks are showing relative and internal weakness.

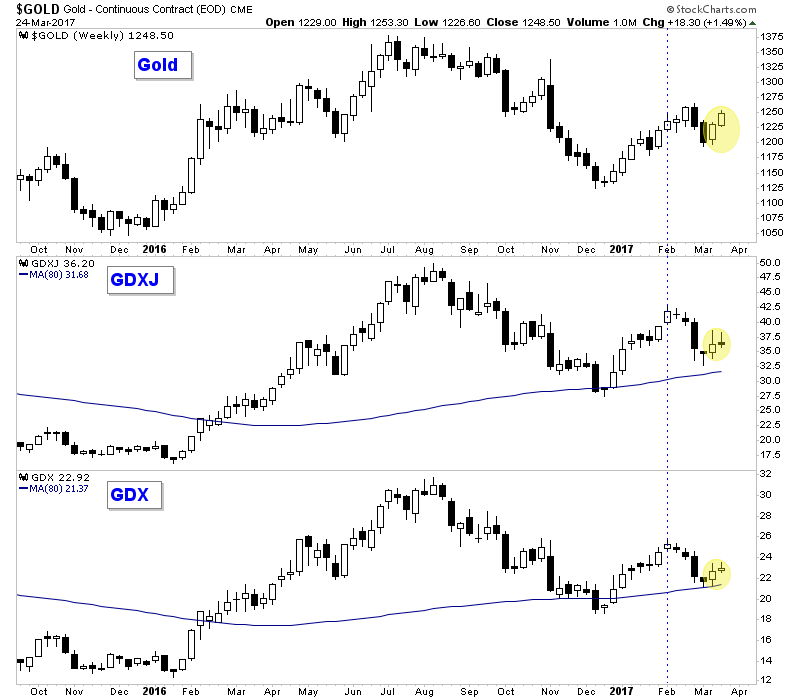

Two signs of weakness in the miners are visible in the weekly candle charts below. First, while Gold has already rallied back to its high the first week of February, GDX and GDXJ are down 11% and 15% respectively. The miners and the metals will not always be perfectly aligned but that is a rather stark divergence. Secondly, although Gold closed at the highs of the week in each of the past two weeks the miners failed to hold their gains. This is not exactly the type of price action that inspires more gains in the short term.

Gold, GDXJ, GDX Weekly Candles

Gold stocks are also showing some internal weakness. In the chart below we plot the advance/decline (A/D) line for GDX and its bullish percentage index (BPI). Both are breadth indicators. The A/D line is the holy grail of leading indicators while I have found the BPI to be more of a confirmation or overbought/oversold indicator. At present, the A/D line is below both its 50 and 200-day moving averages which are flattening and soon to slope lower. That is ominous if the A/D line can’t regain those moving averages. Meanwhile, the BPI is only at 36%. This means it has room to move up but it also shows weakness as it has barely changed despite gains in recent weeks.

GDX A/D Line, GDX BPI

Part of the cause of weakness in the gold stocks (and relative strength in Gold) is the weakness in the stock market which is actually a welcome and positive development for precious metals. As we discussed in a recent video, precious metals are currently setup to benefit from weakness in the stock market as they were in the 1970s and early 2000s. Patience is needed though as stock market weakness is not necessarily an instant or immediate catalyst for the gold stocks.

The current weak technical action in the gold stocks is further evidence that precious metals are unlikely to see a blast off anytime soon. Gold could continue to rally on the back of stock market weakness but don’t expect that to pull miners much higher. I reiterate that at present it’s not wise to chase strength in the miners. Instead, traders and investors should be patient and wait for (presumably) lower prices and a better entry point. We continue to look for high quality juniors that we can buy on weakness and hold into 2018. For professional guidance in riding this new bull market, consider learning more about our premium service including …read more

Source:: The Daily Gold

The post Technicals for Gold Miners Remain Weak appeared first on Junior Mining Analyst.