By Jody Chudley

This post Thanks, Yellen… Here’s What to Do After Yesterday’s Rate Hike appeared first on Daily Reckoning.

Yesterday’s announcement from the Federal Reserve was certainly no surprise…

Just as expected, the FOMC decided to raise interest rates 0.25%, bringing the Federal Fund rate to a meager 0.75%.

Following Yellen’s announcement, the markets rallied half a percent. Gold was the bigger star, rising 1.5% over the course of an hour.

Now that the drama of the meeting is over, the headlines will have to find something else to fret over…

For us, it’s time to focus on where the markets are headed.

While investors cheer as the market climbs to new highs, the elephant in the room remains…

By almost every metric, the market is over-valued.

Listen, I am all for buying and holding on for the long term. But these days, it’s almost impossible to find a fairly priced company that offers a decent yield.

It’s an uncertain time for investors. But you CAN find decent yield at a fair price— you just need to know where to look.

Below, Jody Chudley reveals a hidden gem in the world of income.

Market Looking A Little Top Heavy? Sidestep The U.S. With This Huge Dividend From Across The Pond…

Here we are… eight years into the bull market that started in March 2009.

To appreciate how rare a bull market of this length is, we need to realize that this is the second longest bull run in the history of the S&P 500.

Let’s not beat around the bush. There is going to be a bump in the road at some point, and perhaps soon. Bull markets end when a bear market arrives.

They always do.

As usually happens when stocks go up for eight straight years, valuations end up looking pretty expensive. Remember, the S&P 500 hasn’t just gone up for the past eight years — it has soared. From the 666 low in March 2009, the S&P is now bumping up against 2,300.

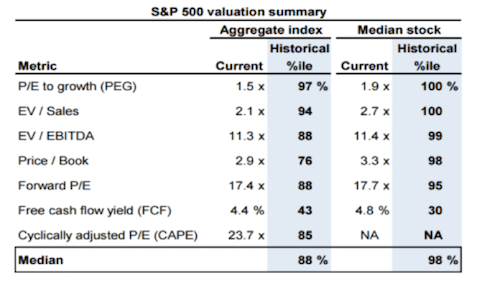

I stumbled onto the chart below from Goldman Sachs, which compares the market today on seven valuation metrics against historical averages. I thought it was well worth sharing.

Source: Goldman Sachs

What this shows us is that the S&P 500 today is more expensive than it has been at almost any time historically. We need to have our eyes open to this fact.

Now, I’m not suggesting that there is going to be any immediate market crash. What I am willing to say is that we need to be prepared for an S&P 500 that has much tougher sledding over the next few years.

Which is why dividend-paying stocks are going to be so important.

First, dividend income is going to provide a solid amount of investment returns on its own.

Second, if the market does decline at any point, dividend-paying stocks are going to hold up a whole lot better than the overall market. The dividends that these companies pay provide a floor for their stock prices that growth stocks with frothy valuations do not have.

And third, that …read more

Source:: Daily Reckoning feed

The post Thanks, Yellen… Here’s What to Do After Yesterday’s Rate Hike appeared first on Junior Mining Analyst.