By analyst

By Frik Els

After its worst week since November, gold was drifting lower again on Monday with the metal coming under pressure from a stronger dollar and a looming interest rate hike in the US which would only the third time since June 2006.

Gold for delivery in April, the most active contract on the Comex market in New York, slumped to a low of $1,225.00 an ounce in early afternoon trade setting the metal up for the lowest close in a month.

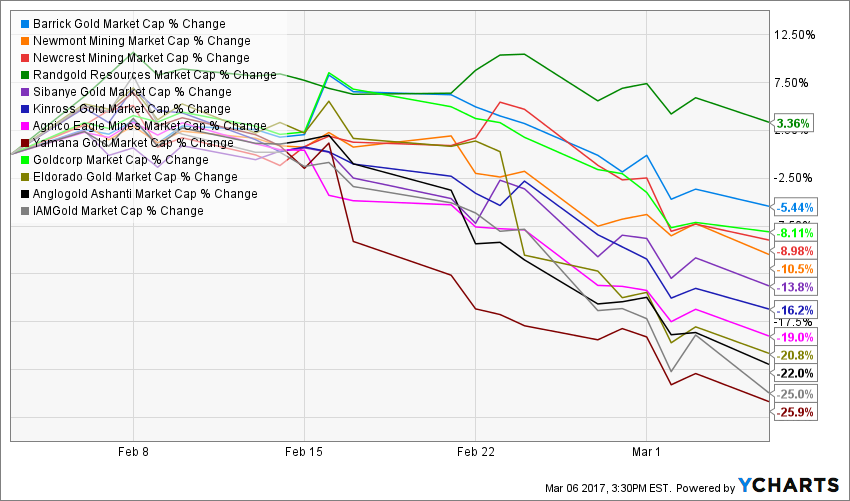

The sell-off in gold stocks have exceeded that of the metal by some margin with the shares of a number of gold miners falling back into negative territory for 2017 and many sporting 20%-plus declines over the past month.

In afternoon dealings Barrick Gold Corp (NYSE:ABX, TSE:ABX) was trading 1.6% lower following a nearly 5% fall on Friday. Barrick is now worth $21 billion in New York, still up a healthy 12% so far this year. The Toronto-based miner last year produced 5.5m ounces of gold, a 9% dip compared to 2015, but aggressive cost cutting saw all-in sustaining costs for the company fall 12% to an industry-leading $730 an ounce in 2016.

Barrick’s output fell 9% last year, but aggressive cutting saw costs fall 12% to an industry-leading $730 an ounce

Newmont Mining Corp (NYSE:NEM) gave up more than 3% on Monday, and is now down by double digits on a percentage basis over the past month . Denver-based Newmont grew output 6% last year to 4.9m ounces on the back of additional production from its Merian and Long Canyon mines, but per ounce costs at the company portfolio of mines are inching down more slowly and averaged more than $900 in 2016.

The world’s third largest gold producer behind Newmont, AngloGold Ashanti (NYSE:AU) dropped another 4.4% in Monday, and the company’s ADRs worth $4.1 billion in New York has lost a whopping 20% in value over the past month. Johannesburg-based Anglogold reported an 8% decrease in annual production to 3.6m ounces in 2016. Production was impacted by safety-related stoppages at its South African mines and lower grades at the giant Kibali operation in the Congo its owns together with Randgold Resources.

South African miner Gold Fields is the only counter among top producers which has not been marked down severely over the past month

Goldcorp (NYSE:GG TSE:G) shares came off relatively lightly on Monday but for the month the value of the Vancouver-based company is down 11.4%. Goldcorp recorded a steep drop in production last year of 17% or nearly 600,000 ounces.

The world’s number five gold producer with 2.8m ounces last year, Toronto’s Kinross Gold (NYSE:KGC, TSX:K) was in the red again on Monday and is now worth $4.1 billion on the NYSE after a 20.1% decline over the past month.

Newcrest Mining (ASX:NCM,OTCMKTS:NCMGY) was also trading down in New York on Monday affording the Australian miner a market cap of $12.3 billion. Newcrest produced close to 2.5m ounces last year and boasts the lowest cost mining operation in the world. Cadia Valley in Western Australia can dig out the yellow …read more

Source:: Infomine

The post Gold price at 1-month low brings more pain for mining stocks appeared first on Junior Mining Analyst.