Headlines about a Chinese economic slowdown may get good web traffic, but the real story is that China is buying up uranium and other resources around the world, says Gold Stock Trades writer Jeb Handwerger. Meanwhile, tensions in Russia highlight the massive country’s resource dominance in natural gas, oil, uranium, platinum group metals, rare earths and nickel. Handwerger tells The Mining Report that North America is already acting to develop resources that can meet both domestic and international demand — and this global geopolitical uncertainty is an investment opportunity.

Handwerger is an author, speaker and founder of Gold Stock Trades. He studied engineering and mathematics at University of Buffalo and earned a Master’s degree at Nova Southeastern University. After teaching technical analysis to professionals in South Florida for over seven years, Handwerger began a daily newsletter, which grew to include thousands of readers from over 40 nations.

Interview by Tom Armistead of The Energy Report

The Mining Report: Jeb, how will the companies you follow be affected by the crisis in the Ukraine and the growing tensions in East Asia over China’s claims on islands held by Japan and the Philippines?

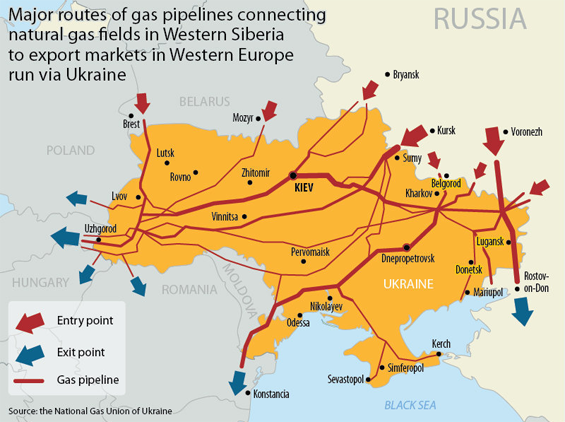

Jeb Handwerger: This is really all about natural resources and the ability to control the trade. There’s a whole list of 10 to 15 strategic minerals that come from China almost exclusively. Russia, on the other hand, has a major control on palladium, platinum group metals and nickel, as well some of the agricultural fertilizers, such as potash. Russia also has a critical supply of uranium; it produces about 3,000 tons of uranium, close to double United States production of uranium. Not only that, but Russia has strategic ties with Kazakhstan, which produces close to 20,000 tons of uranium — over 36% of global supply.

Source: North American Palladium Ltd.

Source: North American Palladium Ltd.

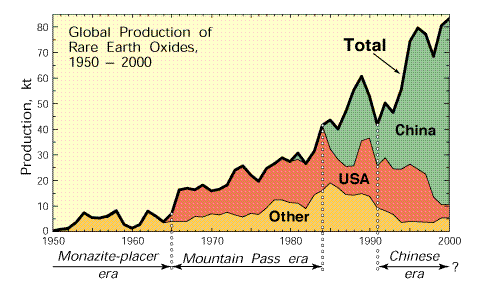

I’ve written for years that these metals and these materials are at risk of critical supply shortfall. It’s even more the case now as these tensions increase. There is greater risk of China or Russia turning off the natural gas pipelines or cutting exports of the rare earths and graphite.

Their control of these critical metals is going to force the West, the European Union and the U.S. to develop their own strategic, secure supplies of these materials needed for the critical technologies.

We’re already beginning to see that take place. Many junior miners have made strategic advancements with some jurisdictions in the rare earth sector. For instance, the state of Alaska made a proposal to help fund a rare earth mine in Alaska controlled by Ucore Rare Metals Inc. (UCU:TSX.V; UURAF:OTCQX). In Canada, there’s a push in the Parliament to look for secure supplies, an effort which may benefit Pele Mountain Resources Inc. (GEM:TSX.V). In Europe, I like Tasman Metals Ltd. (TSM:TSX.V; TAS:NYSE.MKT; TASXF:OTCPK; T61:FSE) as the company could be a strategic supplier of technology metals to the EU, which may be very concerned about supply as tensions increase with Russia over Crimea. If investors are not yet positioned, they should position themselves either through the strategic metal ETFs or even better, the specific REE junior miners that are positioned for upside breakouts.

Another angle: In times of war and tension and geopolitical crises, commodities are often a very good hedge against inflationary price rises. We’re already seeing outsized gains in the commodity sectors in 2014. The smart money may be already positioned for the black swans we are currently observing.

Source: USGS

TMR: China is a major buyer of uranium. How do the tensions there affect business conditions in the uranium market?

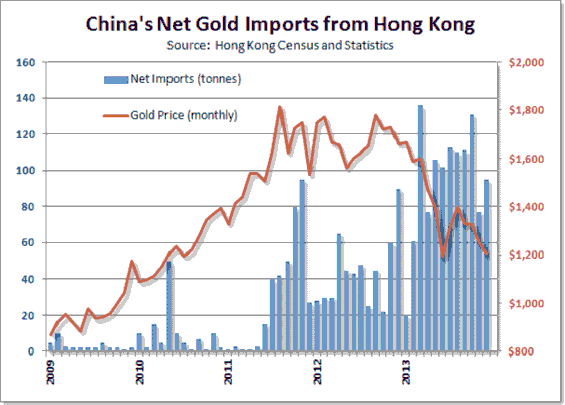

JH: China is building more nuclear reactors than ever before, and over the next 10 years it’s going to need a major increase in its supply of uranium. Uranium is one of the few materials that China is not self-sufficient in. Unlike the rare earths, it’s going to have to look abroad for that.

China has already tried to go into Africa, which is also one of the largest suppliers of uranium: Niger and Namibia together produce about 14% of global uranium supply, but those areas are not so stable. Last year, AREVA SA’s (AREVA:EPA) Niger uranium facility was the target of an Al-Qaeda terrorist attack, a double-suicide bombing that shut down the plant.

We believe that the Chinese trade agreement with the Canadians, Cameco Corp. (CCO:TSX; CCJ:NYSE), is critical. McArthur River in the Athabasca Basin is the world’s largest high-grade uranium mine. Canada provides about 17% of global supply. This is second only to Kazakhstan, but the Athabasca Basin is going to be able to cover the supply gap that may be coming. There are huge discoveries there, with the highest-grade uranium deposits; concentration is more than 100 times the global average. There are other areas within North America with significant resources, such as the Elliott Lake region in Ontario, where Pele Mountain is operating. Meanwhile, companies are coming into production in Wyoming. And there are a lot of uranium assets in Utah and New Mexico, which may benefit from a bounce in the depressed uranium spot price. We think that the U.S. and Canada over the coming years are going to increase production to alleviate the supply shortfall that may be coming from unstable areas.

TMR: Can companies like Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) and Laramide Resources Ltd. (LAM:TSX; LAM:ASX) afford to begin production in their new mines with uranium prices stuck where they are?

JH: Uranerz already has offtake agreements at higher uranium prices. It can afford to begin production. Laramide is still a few years away from production in Australia, which has reversed the uranium ban. The uranium price may be depressed now, but investors realize the price could be significantly higher in two to three years. Uranerz is an in-situ mine so it’s lower cost. It can afford to begin production now because it has offtake agreements. We don’t think uranium prices are going to stick around where they are for much longer. Japan is slowly restarting its reactors. The Russian HEU Agreement has come to an end. There are more reactors being built today than ever before. We think the uranium spot prices are going to reverse higher making an astonishing move.

Right now, you can get in at eight-year lows on the top uranium assets that are in the control of the juniors. Uranerz Energy has some of the top assets in the Powder River Basin that are coming into production, and Laramide has one of the top resources with over 50 million pounds (50 Mlb) near surface in Australia, which has now overturned a ban on uranium mining in the district. Now Laramide can go ahead with that Westmoreland project.

Laramide has one of the top advanced resources that provides huge leverage for an investor for the uranium price. For investors who are looking for leverage and for advanced assets, Laramide is a good candidate. There are very few candidates in the junior sector that have 100% control of such a large asset. Investors must realize that there are so few high-quality junior uranium miners. When investors and funds return, the move could be dramatic — like an elephant trying to get through the eye of a needle.

JH: Before I discuss Enterprise, let me reiterate that the key is trying to understand the long-term trend here: China is going to have to go abroad to support its expanding economy with natural resources over the long term. Short term, we are seeing market weakness in industrial metals as investors fear a slowdown. However, over the long term, commodity mine supply is not able to keep up with demand.

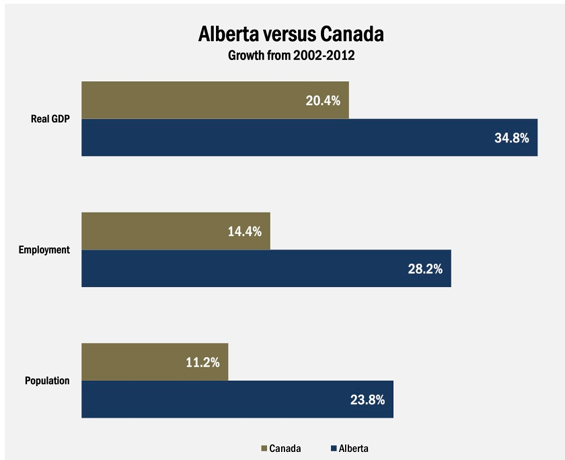

While the media dazzles us with a Chinese slowdown, China’s buying up North American energy resources and precious metals during this pullback. One of the areas that has benefitted the most from this ongoing trend has been Western Canada, most notably Alberta. It may be one of the best economies in the world right now. Hundreds of billions of investment dollars are earmarked for this region to build liquefied natural gas (LNG) facilities and major pipelines to transport petroleum to the growing economies in Asia.

Source: Statistics Canada

There are already five major pipeline proposals. The major pipeline proposals have been the Enbridge Inc. (ENB:NYSE) Mainline expansion and the TransCanada Corp. (TRP:TSX; TRP:NYSE) Keystone XL pipeline. In addition, there are the proposed LNG facilities with owners such as Apache Corp. (APA:NYSE), Chevron Corp. (CVX:NYSE), Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), Mitsubishi Corp. (MBC:LSE), PetroChina Co. Ltd. (PTR:NYSE; 857:HKSE), Imperial Oil Ltd. (IMO:TSX; IMO:NYSE.MKT) and Exxon Mobil Corp. (XOM:NYSE). This rising demand for electricity in automobiles and emerging Asian nations could continue to support a major boom for Western Canada.

TMR: In a January issue of your newsletter, Gold Stock Trades, you expressed very high expectations forEnterprise Group Inc. (E:TSX.V). What do you like about that company, and is it meeting your expectations?

JH: Enterprise Group continues to have a phenomenal year. It’s making several strategic acquisitions in an area that’s going to benefit from this buildout in energy infrastructure. It has a tunneling company, which clears the way for the pipes to run under highways, trains and bodies of waters. It also has a pipeline business, Artic Therm, which has a patent-protected flameless heat technology to assist the operators working in cold weather conditions. It has Backhoe, a directional-drilling company. It has a heavy-equipment rental service for drill sites. Enterprise Group has developed and taken over these specialized hard-margin businesses that are generating earnings for shareholders. It has attracted a blue chip stable of companies, including Apache and Suncor Energy Inc. (SU:TSX; SU:NYSE). This is why it had a major run in 2013, and it may just be the beginning.

As Enterprise continues to announce strong revenues, earnings per share and projects that are getting awarded, the story’s just beginning to get noticed in the United States. Enterprise announced that it’s going to become a reporting issuer in the U.S. and so it will hopefully attract a larger audience. It has very strong revenue growth. It has a return on equity over 35% and very strong revenue growth. Revenue is currently at $30M and management wants to grow that to $150M by the end of 2015. This could be a major growth company and could get a lot of attention in the U.S.

TMR: You mentioned the possibility of International Tower Hill Mines Ltd. (ITH:TSX; THM:NYSE.MKT)bringing in a partner to open a mine in Alaska. How important is that and what are some good candidates?

JH: Since International Tower Hill Mines released the feasibility study, the stock was sold off and hit a 52-week low. We took a contrarian view of that selloff. The concept behind International Tower Hill Mines is that it’s a low-grade, bulk-tonnage system, which at current prices may not be economic, but as prices begin rising to $1,500, $2,000, $2,500/ounce ($2,500/oz), the company’s Livengood project becomes one of the best deposits in North America, with huge leverage to the price of gold. It has over 20 million ounces (20 Moz) gold, and great leverage to an upward-trending gold price.

With this feasibility study and management team, which consists of people who have built major Alaskan mines, such as Teck Resources Ltd.’s (TCK:TSX; TCK:NYSE) Pogo Project and Kinross Gold Corp.’s (K:TSX; KGC:NYSE) Fort Knox, International Tower Hill is one of the better candidates for strategic partners who are looking for large amounts of assets in friendly jurisdictions. We believe that there are strategic partners that want the International Tower Hill type of asset that’s able to produce over 0.5 Moz gold annually. One of its shareholders is AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE). AngloGold may consider it because it may want a mine outside of Africa on its books that can have large production numbers in a stable jurisdiction. International Tower Hill is one of the few projects that have that potential.

There’s a reason why the Livengood asset is attracting the people who built Fort Knox and Pogo. This management team makes me more confident that this will be a mine. We believe that there’s a potential for this stock to regain its uptrend and to continue to move and significantly outperform to the upside as the gold market turns higher. Huge optionality and leverage here.

TMR: You have had high praise for Comstock Mining Inc. (LODE:NYSE.MKT). What do you like about this company?

JH: What I like about it is that there are very few producers that have the strength in the balance sheet that Comstock has. It may be the gem of the entire mining industry. This balance sheet may begin to really start improving this quarter. Comstock recently announced it secured more than 300 acres of land, so there’s expansion opportunity. The company has an expanded mine plan, which includes additional operations, such as the Spring Valley and the Dayton Projects.

What it’s demonstrating to the institutional investors, who are increasing their holdings in this stock, is that it may be one of the fastest-growing producers in the entire industry on track to go from 20,000 up to 200,000 ounces annually (20–200 Koz/year). The management of the company continues to seek guidance and build institutional shareholders. Now it’s on the verge of generating free cash flow in the coming quarters because it’s increasing production. It went from 20 Koz to 40 Koz. This brings its average costs down, generating greater profit.

I’ve been to the property. This is a historic district, the Comstock district, which in the 1800s produced billions of dollars worth of gold and silver, largely underexplored by modern methods. It’s one of the few companies that’s actually able to generate cash flow, even in a lower cost environment, as most of the ounces are near surface and heap-leach amenable.

TMR: Royal Nickel Corp.’s (RNX:TSX) Dumont Nickel project in Québec is getting good press. When will the company begin production?

JH: Royal Nickel’s Dumont Nickel project is one of the best advanced nickel projects under the control of a junior. It could begin construction by the end of this year and start production in 2016. The company has a management team that knows nickel possibly better than any other junior, as it has some of the top Falconbridge Ltd. and Inco Ltd. personnel and management on the board of directors.

Dumont is one of the largest nickel deposits in the world. Again, nickel is one of the metals of which Russia is a big producer. Also, Indonesia, one of the largest exporters of nickel, just announced an export ban. We expect the nickel price to start heading higher, and we expect much more interest in the nickel sector. There are very few assets like the Dumont project in the control of a junior.

TMR: What do you expect to happen to the share price when it begins production?

JH: Royal Nickel has the capability of bringing this production onstream, but I don’t think it’s going to be in control of Royal Nickel by then. I think the project is going to be acquired by a Vale S.A. (VALE:NYSE) or a BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) as soon as this nickel market starts turning higher. It could be acquired at maybe a 50% to 75% premium from where it is today.

TMR: Probe Mines Limited (PRB:TSX.V) has made a major discovery that some are calling a game changer for the company. What can you tell us about that?

JH: In my last interview with The Gold Report in December, I mentioned that I had taken a position in Probe Mines. Since that time there have been a lot of developments. Probe is developing the Borden Lake project in Ontario, another jurisdiction that’s getting a lot of attention. Potential is huge for this. Probe’s stock has already made a dramatic run since our last interview from around $2 to $3.35/share. Again, it’s similar to what we found with some other companies that I’ve invested in, such as Corvus Gold Inc. (KOR:TSX), where it had this low-grade, bulk-tonnage deposit, but then it had this high-grade discovery. Keep a close eye on Canamex Resources Corp. (CSQ:TSX.V; CX6:FSE), which is doing something similar and has made a major high-grade discovery in Nevada from a low-grade historical resource. Canamex has attracted Hecla Mining Co. (HL:NYSE) and Gold Resource Corp. (GORO:NYSE.MKT; GORO:OTCBB; GIH:FSE) as major shareholders during this down bear market. You can be sure they do a lot of due diligence before putting millions of dollars into a junior miner.

TMR: Zimtu Capital Corp. (ZC:TSX.V) has been in the $0.50/share doldrums for 16 months, but it has been two or three times higher for most of its history. What does the company need to do to break out?

JH: Zimtu is one of the forces behind some high-quality, early-stage junior mining companies. This provides a great way for investors to participate and profit in the junior, especially during the starting stage. One of Zimtu’s more advanced projects is Western Potash Corp. (WPX:TSX.V), which has an advanced potash deposit in Canada. Zimtu also has a major position in the Athabasca Basin with a company, Lakeland Resources Inc. (LK:TSX.V), that has performed very well. Zimtu also is active in the graphite space and one of the companies that we’ve invested in, which is Big North Graphite Corp. (NRT:TSX.V) in Mexico. Zimtu has found what we consider some of the higher quality, early-stage junior miners that are in industrial minerals and metals that I’m also very bullish on, such as uranium, graphite and potash. We think Zimtu stock is quite attractive now. It’s trading at a huge discount to its net asset value. It has different types of projects that could take off in this commodity sector.

TMR: Any other companies you like?

JH: Yes, Pilot Gold Inc. (PLG:TSX) has one of the top geologists who helped advanced Long Canyon. We’ve liked Kinsley Mountain for years. Shares in Pilot have soared since December from under $1 to $1.55 as it hit a heavy volume when the company released results from drilling at Kinsley Mountain, where it hit 6.85 grams over 40 meters. This is very encouraging.

I am also a shareholder in NuLegacy Gold Corporation (NUG:TSX.V; NULGF:OTCPK), which is partnered with Barrick on the Cortez Trend and has a top-notch management team that has found major discoveries in Nevada. NuLegacy’s land position is adjacent to Barrick Gold Corp.’s (ABX:TSX; ABX:NYSE) world-class, 14-Moz Goldrush discovery. I am excited for its exploration program this year.

Also, don’t fall asleep on Paramount Gold and Silver Corp.’s (PZG:NYSE.MKT; PZG:TSX) Sleeper deposit, which may be one of the best-leveraged gold plays in Nevada. Paramount may have one of the largest undeveloped resources in Nevada 100% controlled by a junior.

TMR: Jeb, I appreciate your time.

Read what other experts are saying about:

- Enterprise Group Inc.

- International Tower Hill Mines Ltd.

- Pilot Gold Inc.

- Probe Mines Limited

- Royal Nickel Corp.

- Uranerz Energy Corp.

- Zimtu Capital Corp.

COMPANIES MENTIONED: BIG NORTH GRAPHITE CORP. : CAMECO CORP. : CANAMEX RESOURCES CORP. : COMSTOCK MINING INC. : CORVUS GOLD INC. : ENTERPRISE GROUP INC. : INTERNATIONAL TOWER HILL MINES LTD. : LAKELAND RESOURCES INC. : LARAMIDE RESOURCES LTD. : NULEGACY GOLD CORPORATION : PARAMOUNT GOLD AND SILVER CORP. : PELE MOUNTAIN RESOURCES INC. :PILOT GOLD INC. : PROBE MINES LIMITED : ROYAL NICKEL CORP. : TASMAN METALS LTD. : UCORE RARE METALS INC. : URANERZ ENERGY CORP. : WESTERN POTASH CORP. : ZIMTU CAPITAL CORP.

TICKERS: NRT, CCO; CCJ, CSQ; CX6, LODE, KOR, E, ITH; THM, LK, LAM, NUG; NULGF, PZG, GEM, PLG, PRB, RNX, TSM; TAS; TASXF; T61, UCU; UURAF, URZ, WPX, ZC

Want to read more Mining Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To view recent interviews with industry analysts and commentators, visit The Mining Report homepage

DISCLOSURE:

1) Tom Armistead conducted this interview for The Mining Report and provides services to The Mining Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Enterprise Group Inc., Comstock Mining Inc., International Tower Hill Mines Ltd., Laramide Resources Ltd., NuLegacy Gold Corporation, Pilot Gold Inc., Probe Mines Ltd., Royal Nickel Corp., Uranerz Energy Corp. and Zimtu Capital Corp. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Jeb Handwerger: I or my family own shares of the following companies mentioned in this interview: Ucore, Pele Mountain, Tasman, Uranerz, Laramide, Enterprise, International Tower Hill, Comstock Mining, Royal Nickel, Probe, Corvus, Canamex, Zimtu, Lakeland, Big North, Pilot, Paramount and NuLegacy. My company has a financial relationship with the following companies mentioned in this interview as they are sponsors on my website: Ucore, Pele Mountain, Uranerz, Laramide, Enterprise, International Tower Hill, Comstock Mining, Royal Nickel, Corvus, Canamex, Paramount and Lakeland. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Related Articles: