By Clementine Wallop and Francesca Freeman

The Wall Street Journal

Gold’s longest slump since the financial crisis stretched into its eighth day Monday, while silver briefly tumbled to its lowest level since September 2010.

Gold’s longest slump since the financial crisis stretched into its eighth day Monday, while silver briefly tumbled to its lowest level since September 2010.

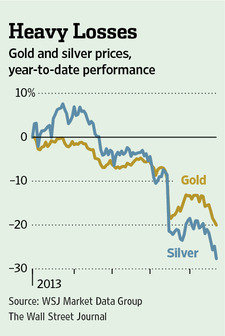

Falling appetite for the safe haven of gold has pushed the metal’s value down 20% since the start of the year, as fading inflation fears and the recovering economy have drawn investors toward other securities.

The biggest drop on Monday occurred in silver, which plunged nearly 9% in the first 10 minutes of Asian trading. It later recouped some losses to trade down 2.7%. Trading volumes for silver are lower than those for gold, and are therefore more susceptible to sharp moves. Gold was trading at $1,350.80 an ounce on the European spot market, down 0.6% on the day. The metal earlier hit a one-month low at $1,338.10 an ounce.