By Nathan Bell

The Sydney Morning Herald

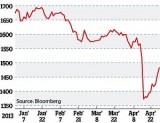

It has been the most violent fall in prices in three decades. Since hitting $US1900 an ounce in September last year, the gold price has fallen below $US1400 an ounce, a fall of 26 per cent in just six months.

It has been the most violent fall in prices in three decades. Since hitting $US1900 an ounce in September last year, the gold price has fallen below $US1400 an ounce, a fall of 26 per cent in just six months.

Predictable proclamations followed. The investment banks, despite being bulls last year, have slashed their price ”forecasts”.

The Reserve Bank has all but called gold a bubble, despite holding over $4 billion worth of the stuff in its vaults. Critics long silent reappeared with earnest smugness to agree on one thing: the gold bubble has burst.

But why? And was it really a bubble?

Inflation, or the lack of it, is the immediate explanation. Despite unprecedented quantitative easing, inflation remains stable. For many, that’s enough to explain plunging prices. Yet inflation was in check last year when gold reached $1900 an ounce.