“The Guerrero Gold Belt has some of the cheapest gold production costs in the world.” — Merrill McHenry

The Guerrero Gold Belt, a sexy, new, developing mining district in the state of Guerrero, Mexico, has attracted some exciting explorers that have unearthed key discoveries. While several companies have gone on land-grabbing sprees, there’s still good news: the Guerrero is growing. Merrill McHenry, metals and mining analyst with Industrial Alliance Securities in Toronto and an expert on the area, believes the Guerrero could be more than twice as large as it’s currently defined — potentially becoming one of the largest gold districts in the world. McHenry tells The Gold Report which companies are strategically positioned to grow and develop within the Guerrero Gold Belt. He also discusses the impact of the evolving Cyprus financial crisis on gold.

The Guerrero Gold Belt, a sexy, new, developing mining district in the state of Guerrero, Mexico, has attracted some exciting explorers that have unearthed key discoveries. While several companies have gone on land-grabbing sprees, there’s still good news: the Guerrero is growing. Merrill McHenry, metals and mining analyst with Industrial Alliance Securities in Toronto and an expert on the area, believes the Guerrero could be more than twice as large as it’s currently defined — potentially becoming one of the largest gold districts in the world. McHenry tells The Gold Report which companies are strategically positioned to grow and develop within the Guerrero Gold Belt. He also discusses the impact of the evolving Cyprus financial crisis on gold.

Interview by Brian Sylvester of The Gold Report

The Gold Report: Merrill, you joined Industrial Alliance at a time when many junior companies are having difficulty getting financing.

In fact, newsletter writer John Kaiser reported that of the 527 companies exhibited at the PDAC International Convention this month in Toronto, 114 had less than $200,000 in working capital and about half had market caps of less than $20 million ($20M).

None of the companies that you cover are that low on cash, but one will need to go to market within a year or so. Is that a concern?

Merrill McHenry: That is a concern for many companies, but most of those that I have under coverage have enough in the till such that their development and/or exploration are fully funded for up to two years, in some cases much longer.

Minaurum Gold Inc. (MGG:TSX.V), for which I have a Speculative Buy recommendation, is doing a near-term raise for its maiden Vuelcos del Destino (Vuelcos) Guerrero Gold Belt (GGB) prospect. However, the company has exceptional assets; at least three are serious potential “company makers” I really like, with confidentiality agreements signed that could lead to a joint-venture with a major mining company at any time. The company’s senior management is some of the most accomplished in Mexico. Collectively they’ve discovered more than 200 million ounces silver (200 Moz), more than 8 Moz gold and have raised more than $400M in the capital markets for companies in Mexico.

Minaurum’s senior geologist, David Jones, discovered Los Filos, the main deposit of Teck Resources Ltd. (TCK:NYSE; TCK.A:TSX) at the time. Now it’s 13% of Goldcorp Inc.’s (G:TSX; GG:NYSE) production. He’s one of the world’s leading skarn and porphyry experts.

TGR: There’s a lot of geological and deposit-finding expertise in that company.

MM: Yes, there are actually three deposits that could be company makers. As I say, I would be surprised if two of them are not contending for material economic mineralization. There are actually six good projects in total.

TGR: Yet the shares are trading near 52-week lows. What’s the drag on Minaurum?

MM: The impending finance of its drill program in the GGB of Mexico at Vuelcos. It’s a given that publicly traded shares on most exchanges are going to be pressured going into a financing.

“There are 30–40% more drill rigs operating in the Guerrero Gold Belt than there were one year ago.”

The Vuelcos project has some of the best-oxidized skarn and calc-alkaline retrograding, which is the cooling crystallization of the rock. Several different areas at Vuelcos look as attractive as most anything you can find down there. Even though it’s not blockbuster in total size, it’s a choice project with many attractive outcroppings of potential economic mineralization, and arguably one of the best looking exploration projects in the region. Anyone visiting the Vuelcos project, as well as analyzing the airborne and geophysics, I expect will understand why this project above all others was staked as the company’s lead GGB project by arguably the leading expert in the region, David Jones.

Minaurum has another project to the south, Santa Marta, that is a former producer from the 1960s that had 1% to 7% copper. A lot of the production was 4% to 7% and it has 11% copper outcroppings, exceptional surface outcropping, and airborne geophysics. Its mineralization at surface won’t require any overburden removal. There are majors looking at Minaurum’s Adelita project. I think that one will pan out as well this year.

It’s not typical to cover a company without a known resource. It is only because of the quality of the management and the quality and diversity of the assets with six projects, three of which I believe many an exploration company would be happy to work as a lone asset. There’s a surprising amount of substance to this company that the current small market cap completely misses, in our opinion. We believe in a more “normal” market environment the company would be trading at multiples of its current valuation, even in its current state. It’s not a single project, a one-trick pony with a binary outcome for the company.

TGR: What catalyst could lift Minaurum’s stock price?

MM: There should be drilling at Vuelcos early in the second quarter. At PDAC, I picked up a rock from the Vuelcos site and went into the hardware vendor area where there was an XRF machine. It peaked out the XRF machine at 15 grams per ton gold (15 g/t). I believe there’s gold there. It’s just a matter of how long the gold intercepts are and if it proves up an economic resource.

Minaurum is my absolute most leveraged story, but it’s for investors with a higher risk tolerance and diversification. It’s one of my favorites.

TGR: You specialize in the GGB and have an extensive geological knowledge of Mexico. Mexico’s ranked 10th in global gold production with 86.6 metric tons (86.6 mt) or roughly 2.78 Moz produced annually. However, Mexico’s year-over-year gold production is growing at almost 14%, the fastest growth rate in the world. What role does the GGB play in that?

MM: A role of great significance. Currently, the GGB is at 15.39 Moz in the Reserve category. The highest category, NI 43-101 compliant, is 34.2% of total gold Reserves in Mexico. We forecast, based upon the 10-year average, an annual growth rate in resources in the GGB of 600,000 ounces (600 Koz) a year, as well as 2.5 Moz being added by Newstrike Capital Inc. (NES:TSX.V) any day in its maiden resource estimate.

If Torex Gold Resources Inc. (TXG:TSX) was able to achieve an 85% conversion rate in its upgrade from resources to reserves, the total reserves in Mexico by the end of this year possibly, but certainly by next year, would be roughly 45.7%.

That’s not even taking into account that there are 30–40% more drill rigs operating in the GGB than there were one year ago.

Companies like Minaurum, Citation Resources Inc. (CTT:TSX.V) and Cayden Resources Inc. (CYD:TSX.V)are on maiden drill programs in 2013. Throw in Osisko Mining Corp. (OSK:TSX), currently operating three exploration drill rigs, on top of that and it’s much more than double the amount of activity that has gone on in the past in the GGB. We expect a transformative year for the GGB with a significant upward rerating.

We expect substantially more growth for total gold reserves in the GGB than the projection that I just gave you. The GGB currently has 20.59 Moz NI-43-101-compliant resources.

TGR: An interesting aspect about Mexico is the cost of production. You peg cash costs at about $325/oz (based on Thomson Reuters data) versus the industry average of more than $600/oz. That’s a pretty massive difference.

MM: In Mexico, because of the plate tectonics and the mineralogical events that occurred, many projects are oxidized instead of being sulfide. If they’re oxidized, as in the case of the GGB, a lot of the resources can just be dug up, trucked over to the leach pad and dumped. They don’t have to mill and use a lot of chemicals and processing in the milling. Quite often, you really can’t get much cheaper than the oxide resources that are prevalent in the GGB. It gives us some of the cheapest gold production costs in the world.

Moreover, with the 29% year-over-year mining industry cost escalation in the last seven years, companies need low-cost ounces. That’s what the GGB and district scale offer. Synergies in scale and mining resources bring low oxide mining costs even lower.

TGR: The GGB is a 40 kilometer (40 km) long trend?

MM: Osisko has staked 20–30km southeast of existing development and exploration companies, so it’s becoming more than double that size. It is a 70–100km long area. The intrusives that created the mineralization in the GGB are prevalent over a large area and therefore the GGB could — we expect will — extend significantly.

TGR: Is there land still available to stake along this trend?

MM: Osisko did a big land grab. It even grabbed a joint venture with Tarsis Resources Ltd. (TCC:TSX.V). I may be proven wrong, but thus far I believe that project’s rocks are not from the mineralizing tectonic era of roughly 62 million years ago. Dave Jones at Minaurum passed on Tarsis in the 1990s, so Osisko grabbed just about all the remaining land that has intrusives and airborne magnetic anomalies, many of which have varying geophysical structural controls and characteristics of others in the region.

TGR: Osisko has proven to be aggressive with the takeovers of Brett Resources and Queenston Mining. Do you expect Osisko to pursue a similar pattern in Mexico?

MM: It would make sense. It also makes sense for companies to leverage Goldcorp’s existing, or Torex’s planned mill, especially its neighbor Newstrike. Not everybody is going to build a mill and not everybody should build a mill. The synergies and cost savings will easily justify a fair amount of consolidation in the region.

TGR: Newstrike is burning about $1.1M a month. How much cash do you think it will have at the end of this year?

MM: It has roughly $28M in cash and is burning around $13M this year. It could run this year’s and next year’s drill program on the cash balance.

TGR: Newstrike is also expected to put out a maiden resource very shortly. What are you expecting?

MM: We anticipate the maiden resource estimate shortly. We’re expecting roughly 2.5 Moz on the in-pit resource, which is the amount calculated for the initial valuations that are in the NI 43-101. We expect the Ana Paula deposit could be mining 5+ g/t for more than five years. The global resource, what’s around the main pit, could be 4 Moz or more.

As a consequence, with a mill that could process 8,000–10,000 tons/day, it could have very robust economics with a higher internal rate of return up to, or over 40%.

TGR: Newstrike has said it really doesn’t want to develop this. It wants to sell it. Who are the potential suitors?

MM: The majors — Barrick Gold Corp. (ABX:TSX; ABX:NYSE), Newmont Mining Corp. (NEM:NYSE), and Goldcorp. Goldcorp is the first go-to company because it has a fair amount of mill operations down there. Osisko could become the second big player in the region. It believes it can find and develop resources cheaper than buying an existing company. I’d agree there’s a good chance for that, but there’s also tremendous leverage to be had in combining sunk mill site operations that we expect to strongly drive consolidation.

TGR: Newstrike has the largest land package next to Osisko’s big stake.

MM: It’s a very big land package. It has two exploration areas that it is working on. One is over the border by Torex, but has a 13km discontinuous oxidized skarn outcropping. We don’t know exactly the length of the intercepts and the amount of the grade, but there is quite likely some measure of gold along that 13km strike.

I expect that it will prove up other resources, as Torex is doing, and that could add significantly to the valuation of Newstrike and its appeal as an acquisition target for a major. It could have a fair amount of gold and a fair amount of grade over what it already has.

TGR: Torex, which has over a $1 billion ($1B) market cap, has more than 4 Moz in Proven and Probable reserves at the Morelos gold project. It has other promising projects as well. It worked out a $250M loan facility with several different banks. This is one of the brighter stories in a sea of doom and gloom.

MM: Torex is on third base, to use a baseball analogy. It has the economics — 85% to 90% of the total value of capital expenditures and operating expenditures to go into production. South of the Balsas River in what’s called Media Luna, the company is having these phenomenal intercepts. It’s working with 11 drill rigs to prove up another resource and will likely more than double its current resource. There’s quite a good chance.

A couple of weeks ago, one of Torex’s holes intercepted more than 36 g/t over 26.7m — a phenomenal grade. It adds to a resource very quickly when you’re hitting that kind of intercept at that kind of grade.

TGR: How different is the picture of Torex going to look by the end of 2013?

MM: I expect at least an additional 4 Moz resource at Media Luna. There’s a very good potential that it could be multiples more. Some firms on The Street are putting phenomenal multiples of the current resource as the potential for Media Luna. I prefer to be more conservative at 5–10 Moz at Media Luna until additional gold intercept and extensions are confirmed.

That would definitely put Torex in play for a major. It would be unlikely that the company would remain independent if it came up with that kind of resource and that kind of grade absent a significant market rerating.

Bear in mind, Torex is sitting on roughly $390M in cash, so an acquirer can essentially deduct the cash because it would recapture that as part of the acquisition cost. The actual enterprise value is roughly $700M.

TGR: Goldcorp dumped tailings on Cayden Resources’ property. Is there anything new to report there?

MM: Goldcorp recently purchased the land from Cayden for $7.88M. It’s enough to fund operations for roughly two years.

TGR: Is Cayden going to continue to drill off a resource with that money?

MM: Cayden doesn’t have a discovery hole yet. It has drilled roughly seven holes on the Magnetita project. All of the gold mineralization in the GGB has an airborne magnetic signature. Magnetita has the largest airborne magnetic signature of any project in the GGB. There’s an excellent chance that it will have a sizeable resource.

At Goldcorp’s Los Filos, there are four, going on five, mines on that project. They are all clustered together. Speaking of clusters, you can see Cayden’s project from under 2km away. When you get a cluster around a magnetic anomaly, it would defy reasonable expectations for Magnetita to not have anything. Trench results have confirmed gold—the question is size—hitting longer intercepts and creating an economic resource.

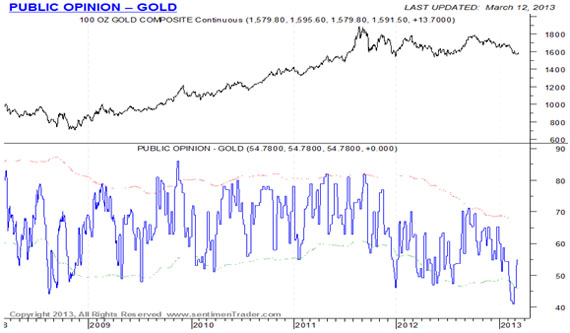

TGR: Market sentiment for gold is somewhat flat, but you believe gold will rebound. Make your case.

MM: Actually, I don’t need gold to rebound. For 29 years, I’ve operated under Keynes’ mantra of “I’d rather be vaguely right than precisely wrong.” I don’t need the 100% returns post Global Financial Crisis, nor do I expect the gold price to appreciate significantly from here. The requirement that the price of gold goes up doesn’t necessarily need to manifest itself. It just needs to not collapse in order to have very attractive earnings for the majors.

There is a debt-cycle restructuring going on in the U.S. For approximately 40 years, debt fueled growth. The debt to gross domestic product (GDP) ratio was approximately half of what it was at the end of the last debt cycle that ended in 2008. In the Depression, it was 255% of GDP. In 2007, it was 380% of GDP. The U.S. private sector balance sheet is trying to heal from roughly 150% of the debt/GDP ratio it had in the Depression. No one wants to use the big “D” word, but the debt cycle and long and slow restructuring are similar in effect.

We don’t need to say with certainty the amount of years or the length of time that it will take for the private sector balance sheet repair to transpire in the U.S. I don’t see it being resolved any time soon. Private sector debt growth has been flat since the global financial crisis. Arguably that is the reason for the quantitative easing and federal deficits to stimulate growth that would otherwise not be occurring.

It takes a while to slog into a downturn and it takes a while to slog out of a downturn, but we could have a rotation faster than many think.

TGR: The price of gold jumped above $1,600/ounce after the tax on Cyprus bank assets was announced. Although the Cypriot Parliament has voted it down, is that a sign of things to come if the same “bail-in” is applied to Spain and other euro countries?

MM: The Cypriot problem is extremely complicated, as well as precedent setting with bail-ins and a good bit of Germany’s first “just say no” to EU backstopping. Exogenous material market events can definitely be market movers—and this may light a fire under gold, the degree of which is still fluid. In this case there are significant international twists in addition to the EU and European Central Bank; there is also a lot of Russian money stowed away in the Cyprus banking system. The ability to put a bail-in haircut on Russian deposits is a wildcard as Cyprus has a much needed €2.5 billion Russian loan, a €1.4 billion international bond payment in June, and Angela Merkel and the EU get 36% of their natural gas from Russia, which could use it as a bargaining chip. This has many plots and subplots to it.

In its broadest sense, this is a manifestation of the increasingly unbridgeable expectations by populaces worldwide regarding benefits and obligations, aka spending vs. revenue. Cyprus was considered a “tax haven” so clearly its fiscal policies have not backed its banking system, which is awash with foreign, largely Russian, monies. In Cyprus, a bail-in fix by depositors would have indicated that the country intended to continue the favorable 10% top tax-bracket tax regime.

With gold as the only non-sovereign reserve for central banks, it is at a minimum a reserve asset without an increasing liability in a world where that is a norm. While we cannot tell if gold becomes an increasing asset de jour and commensurately takes off in price, we do at least have the visibility that it should remain in demand, holding its ability as a store of value—while many sovereign credits and currencies appear to be in a race to the bottom.

TGR: Can you leave us with one reason for optimism in a gloomy market?

MM: Valuations for the gold majors are as cheap as during the global financial crisis. We’re pushing the end of a quarter. Historically, portfolio managers and active mining managers tend to both preserve gains and avoid losses at the end of a quarter and, importantly, rotate and seek out new alpha or new returns above the benchmark for which they’re compensated and bonused at the beginning of quarters. Next month will be the beginning of a new quarter, and perhaps some reallocations will come back into the gold sector.

TGR: Thanks for your insights, Merrill.

Merrill W. McHenry, MBA, CFA, has been in the investment business for more than 28 years. Early in his career, as a portfolio manager he managed more than $1.5 billion in three U.S. mutual funds, and set up an international mining merchant bank visiting mine project sites on multiple continents. As a mining analyst, he has worked both the buy and the sell sides, providing research for Tier 1 and Tier 2 investment dealers, as well as prominent global investors. A couple years ago, he led special projects modeling at BMO Capital Markets for the Global Mining Research Group that was top ranked in Canada by Brendan Wood during his tenure. Currently, McHenry is the metals and mining analyst for Industrial Alliance Securities and is a member of the CFA Institute and the Toronto Society of Financial Analysts.