Collin Kettell

Palisades Goldcorp Ltd.

Gold investors appear cautiously optimistic. Fundamentals paint a strong narrative for gold – endless money printing, swelling central bank balance sheets, negative rates, and the advent of helicopter money.

This has generated a consensus amongst investors that gold and gold stocks will perform well in the mid to long term. But what about the short term?

The recent past can often blur and distort future expectations. Gold’s capitulation in March, in tandem with the broader equities, raises the question… will gold stocks get pulled down again if the Dow makes a second leg lower?

The ferocious, but short-lived bull market for gold stocks in 2016 is of little help either, leaving gold investors questioning the longevity of any future move.

Avid resource investors, (particularly junior investors), know that gold stocks witness rocket like lifts offs from major lows. Big gains can be made at the beginning of a resource bull market and arriving on time for lift off is critical.

Indications of possible turning points, are therefore, very helpful to assuage one’s fears and move money from the sidelines into the trade. I believe no better assurance can be found than examining the bellwethers of the gold industry.

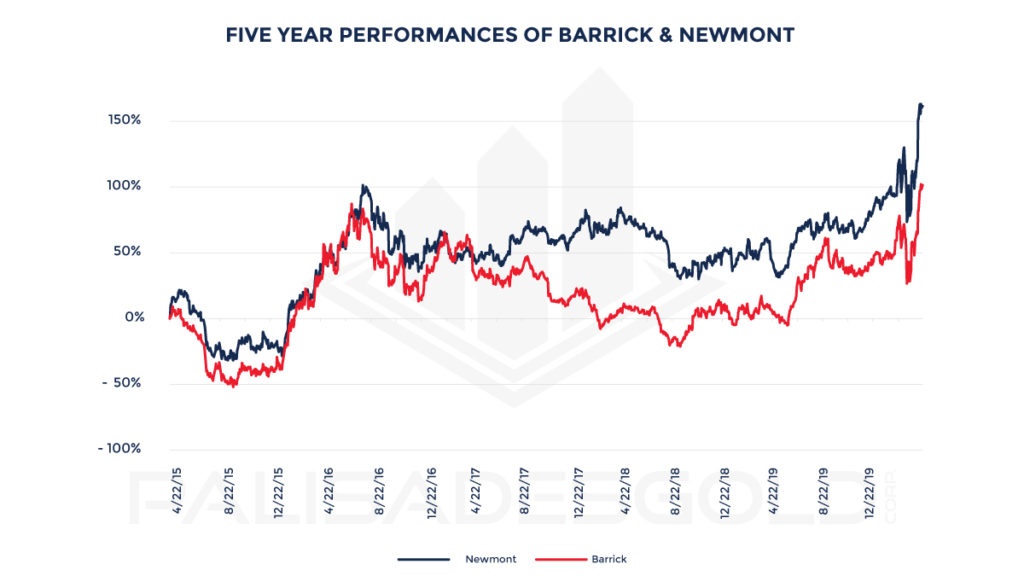

Barrick Gold (NYSE:GOLD) and Newmont Mining (NYSE:NEM) have both reached critical inflection points. While general equities have made a 50% retracement towards pre-crash levels, these major miners have regained their losses and broken out to multi-year highs.

In light of this, fear that gold stocks could follow general equities lower should diminish.

Furthermore, the implications of the economic destruction unfolding and the Fed’s unprecedented response is becoming more mainstream. Just today, Bank of America released an 18 month price target of $3,000 per ounce!

What this means for us junior investors is that money pouring into gold and major mining stocks, will soon begin reaching the juniors. When it starts, it will only gain steam, and soon enough a bubble of epic proportions will unfold.

As my article last week pointed out, junior miners have been mired in a decade long bear market, one that is likely reaching a conclusion.

With higher gold prices, major miners will be further starved for reserve replacement and growth. This will require discoveries – discoveries that must come from junior explorers. As M&A heats up in a rising gold price environment, risky exploration capital will become easier to access, as the potential rewards for investors increase.

We are witnessing a generational opportunity in junior resource stocks and this is why I established Palisades Goldcorp – a $150M portfolio of resource stocks set to go public later this year.

Capitalizing off of moves in the junior space is more art than science. Understanding capital structure, knowing the players involved, and spotting which projects will pique the interest of investors are key in picking out the money-making opportunities. That, coupled with deploying capital through the use of private placement financings will be the key differentiator between those able to capture hundred percent gains and those who produce thousand percent gains. If you are interested in learning more about Palisades, feel free to reach out by emailing me personally at collin@palisades.ca.

Until next week,

Collin Kettell

Founder & Executive Chairman

Palisades Goldcorp Ltd.