This past year has been remarkable for gold mining investors in that the gold price has broken out into multi year highs and record highs outside the USA. Ideally these companies should be making money hand over fist, however we are finding many miners dealing with increasing all in sustaining costs and less of a bottom line profit and free cash flow to fund resource growth or pay back debt or possibly dividends to shareholder.

We are seeing miners like Agnico Eagle $AEM one of the high fliers come back to Earth. The CEO said, “Production ramp up in Nunavut has been slower than expected, which has resulted in higher than anticipated costs in the fourth quarter of 2019 and slight revisions to our 2020 production guidance.”

The Canadian Arctic was supposed to be the next big boom. Since TMAC Resources became a producer in Nunavut in 2017 they have been facing problems. They are losing a lot of gold. Costs are way too high which means the mine runs out of money.

We need as a mining community to learn the lesson from the failures at TMAC and AEM and why they are struggling.

To build value you have to look at Capex and payback to build operations.

Yamana $AUY had a strong quarter but there costs are still high around $1000 an ounce.

Gold mining is not all drilling, making a new discovery and building a resource. While exploration is exciting for speculators and big resources sell stock, the main concern is can a mine be profitable and deliver free cash flow to expand like at Kirkland Lake Fosterville, K92 and Newmont’s Long Canyon which are some of the most profitable gold mines in the world now.

With the recent breakout in gold and blockbuster M&A activity with Barrick and Randgold and Newmont and Goldcorp take all the headlines. While drill results and economic studies get junior mining speculators, the key to the success of the industry is if a gold miner can get into production and extract the gold profitably. Its one thing to find the gold, but its a whole other challenge to extract the gold from the ore profitably.

Extracting gold before the 20th Century was mostly done by using gravity separation placer mining. This is like the old California miners panning in the river. However, in the 20th Century a scientist discovered cyanide could leach gold from hard rock. This was a huge breakthrough and makes up a large part of today’s mining industry. Cyanide leach helped the South African mines boom in the early 1900’s.

Then through American ingenuity around the turn of the century two American Metallurgists Charles Merril and Tom Crowe came up with a new and improved method which added vacuums and zinc. This Merril Crowe approach is pretty much widely used today.

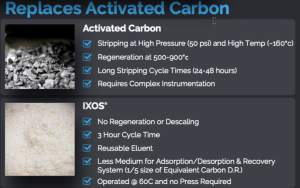

For the past 100 years or so after hard rock is treated with cyanide the rock dissolves into solution and is eventually recovered using activated carbon which binds with gold molecular particles.

This is where the problem lies with a lot of gold miners. More than 10% of gold mined is lost in this 100 year old cyanide solution using activated carbon. This comes at a huge cost for big producers like Agnico, Kinross and TMAC. A 200k oz/year producer could lose over $26 million annually just lost in cyanide solution and carbon particles.

This is where the problem lies with a lot of gold miners. More than 10% of gold mined is lost in this 100 year old cyanide solution using activated carbon. This comes at a huge cost for big producers like Agnico, Kinross and TMAC. A 200k oz/year producer could lose over $26 million annually just lost in cyanide solution and carbon particles.

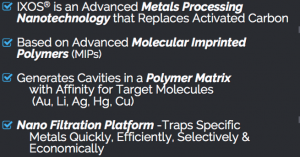

A new company that just came public this week has an answer and its called IXOS®. This technology uses molecular imprinted polymers instead of activated carbon that has a polymer matrix which targets specific metals like gold, silver, lithium and copper much more quickly and at lower cost.

One of the key features why I believe miners will adopt Molecular imprinted polymer nanotechnology over activated carbon is that you can use a lot less water. Water is a major issue in South America especially Chile where indigenous people are concerned that they will lose their drinking water. The eluent is reusable and the size of the plant is much smaller. Take a look at the tour of their pilot plant at one of Kinross’s gold mines.

In conclusion, this new company just went public and there is already great interest in their technology. This patented technology can transform the gold extraction industry. Its six time faster to strip the gold from cyanide and saves the miners $100 per ounce.

Suffice it to say, this technology is just starting to get noticed by the big producers. The company signed a deal with Sumitomo the Japanese mining giant to market this technology to their network.

When big companies like this start to take notice it may be wise to start learning more about this new company with what could the best gold extraction technology in the industry.

When big companies like this start to take notice it may be wise to start learning more about this new company with what could the best gold extraction technology in the industry.

Listen to my interview with the CEO by clicking here…

Sixth Wave $SIXW.CN $ATURF

Business Inquiries

Disclosure: Author (Jeb Handwerger) owns shares and that I want to sell them for a profit. I may have received or intend to receive compensation for digital marketing services from these companies. The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Jeb Handwerger about any company, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. Author is not responsible under any circumstances for investment actions taken by the reader. Author has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. Author is not directly employed by any company, group, organization, party or person. The shares of these companies are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. Author is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Author is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Author is not an expert in any company, industry sector or investment topic.