February 11, 2020

The coronavirus epidemic in China has triggered restrictions in the country’s public transport and air travel, both at a domestic and an international level, reducing demand for oil, which has lost about a fifth of its value since the start of the year.

What does that mean for the world’s 2020 oil demand?

Assessing the impact of the virus, Rystad Energy is heavily revising its annual global oil demand growth forecast down by 25% to 820,000 barrels per day (bpd) in 2020.

Our previous growth forecast, published in December, before the coronavirus outbreak, stood at 1.1 million bpd. The coronavirus’ impact on demand growth could be even wider, however, slashing growth to as low as 650,000 bpd year on year (y/y) in our worst case scenario.

“Our current assessment implies that the impact of coronavirus will persist throughout all of February and March and will then gradually subside towards June 2020. We hence expect travel restrictions and extended holidays in China to significantly impair demand in 1Q20 and partially in 2Q20. Demand is forecast to start recovering in April and May,” said Bjornar Tonhaugen, Rystad Energy’s Senior Vice President, Head of Oil Markets.

What does that mean quarterly?

We now believe that the projected global oil demand growth in the first quarter will be almost entirely wiped out. Rystad Energy’s estimates show that demand will grow by only 0.1 million bpd, a steep decline from a previously projected y/y growth of 1.2 million bpd for 1Q20.

Of the above, 0.9 million bpd of the growth’s decline is attributed to lower demand in China and 0.2 million bpd to the rest of the world. Overall, we expect Chinese demand to drop in 1Q20 by 0.3 million bpd y/y, instead of growing by a previously projected 0.6 million bpd. This will be the first quarterly y/y drop in seven years.

Similarly, the rest of the world’s demand, excluding China, which had been projected to grow by 0.6 million bpd in 1Q, is now expected to grow by only 0.4 million bpd.

We see an additional downside risk to short-term oil demand growth also from a macro-economic perspective as we continue to see weak economic indicators from India – one of the main engines of demand growth – along with weak European manufacturing PMIs. Consensus GDP forecasts have recently put Indian GDP growth at just 5% this year, 0.5 percentage points lower than in the previous forecast. European manufacturing PMIs remain at 46, well below the inflection point of 50.

China to take the biggest hit

Chinese oil demand accounted for 13% of the global total in 2019, standing at 13.6 million bpd. Before the coronavirus outbreak, we expected Chinese demand to grow by 400,000 bpd this year, including a 100,000 bpd y/y growth in jet fuel demand.

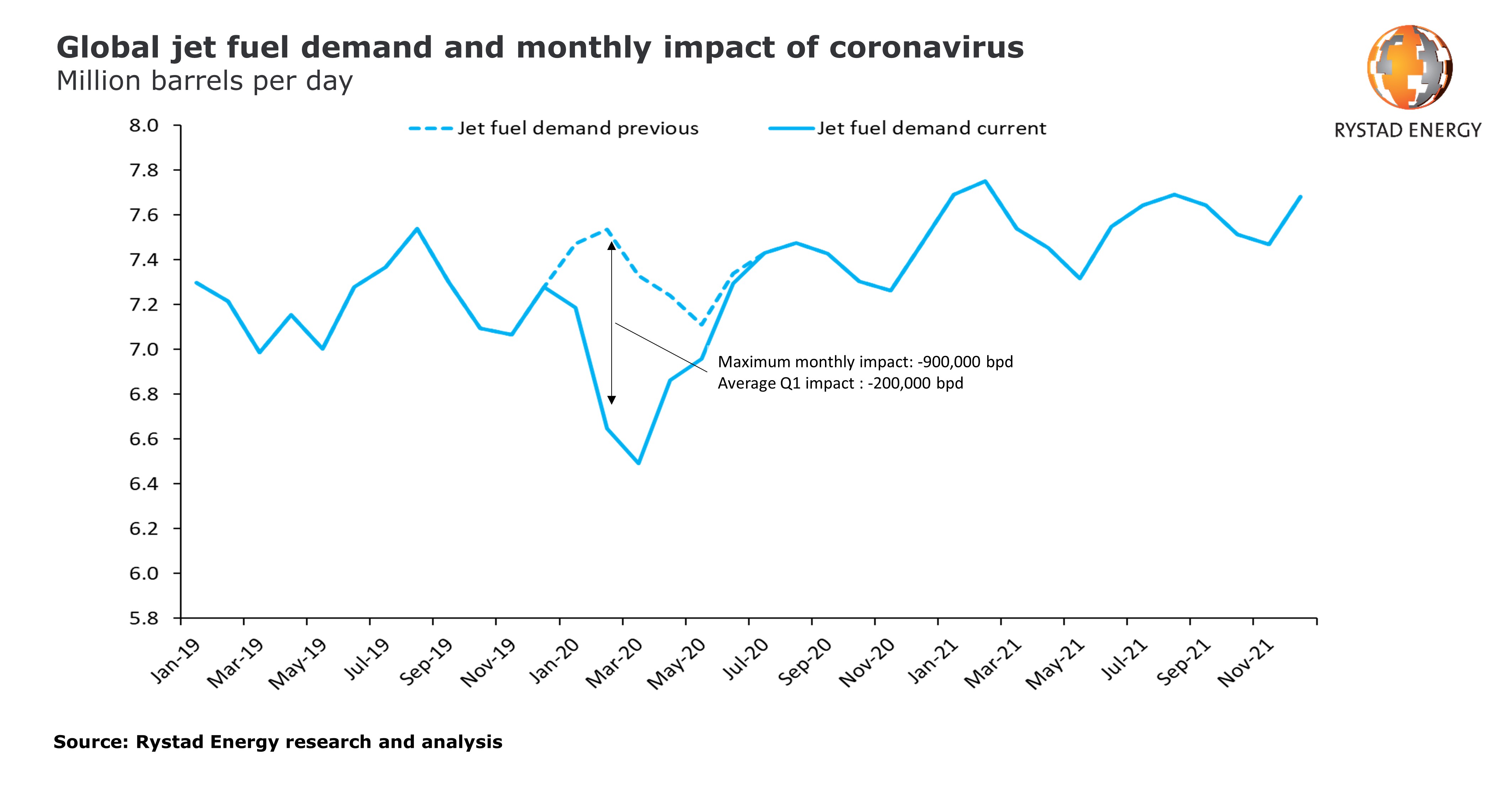

We have now reduced our forecast for Chinese demand growth to 230,000 bpd this year, and we expect the largest negative impact to be seen in demand for jet fuel. Rystad Energy’s data show that Chinese jet fuel demand fell by 30% in January and could potentially decline by 60% in February and March.

China’s travel restrictions have come at a time that would normally mark a seasonal increase in air and long-distance bus journeys, as hundreds of millions of people typically travel during Chinese Lunar New Year. This means that a fraction of oil demand this year will be lost indefinitely.

Learn more about oil demand in Rystad Energy’s Oil Market Update report.

Coronavirus versus SARS

Viruses – like hurricanes, economic crises and armed conflicts – are ad hoc events that can significantly impair oil demand. The SARS virus, which originated in China around the same time of the year back in 2003, is believed to have eliminated all of the growth of global jet fuel demand for that year, which had been forecast at about 200,000 bpd.

China’s oil demand has now more than doubled since 2003. The country accounts for 14% of global air passengers carried and around 13% of global trade in goods, which is why the impact of a similar virus outbreak as SARS will likely be even greater now. Moreover, the death toll from the coronavirus reported this weekend has already surpassed that of SARS in 2003, and we see a risk that the coronavirus impact may be understated.

At their peak in February and March, both Chinese and international air restrictions could reduce global jet fuel demand by 900,000 bpd in relation to our pre-coronavirus expected growth levels.

###

Contacts

Bjørnar Tonhaugen

Senior Vice President, Head of Oil Markets

Phone: +47 22 00 42 00

bjornar.tonhaugen@rystadenergy.com

Lefteris Karagiannopoulos

Media Relations Manager

Phone: +47 90228994

lefteris.karagiannopoulos@rystadenergy.com

About Rystad Energy

Rystad Energy is an independent energy research and business intelligence company providing data, tools, analytics and consultancy services to the global energy industry. Our products and services cover energy fundamentals and the global and regional upstream, oilfield services and renewable energy industries, tailored to analysts, managers and executives alike. Rystad Energy’s headquarters are located in Oslo, Norway with offices in London, New York, Houston, Aberdeen, Stavanger, Moscow, Rio de Janeiro, Singapore, Bangalore, Tokyo, Sydney and Dubai.