There is good news on the horizon for junior miners seeking investment in 2020, despite majors having underinvested in exploration for years, there are signs that this is changing.

Sprott US Holdings Chief Executive Officer, Rick Rule stated at the recent Mines and Money London event that many majors had recognised that they need to change and now have a renewed focus on exploration.

In 2019, the second-largest gold mining company in the world, Barrick Gold, allocated US$205 million for exploration, up 5% from US$195 million in 2018.

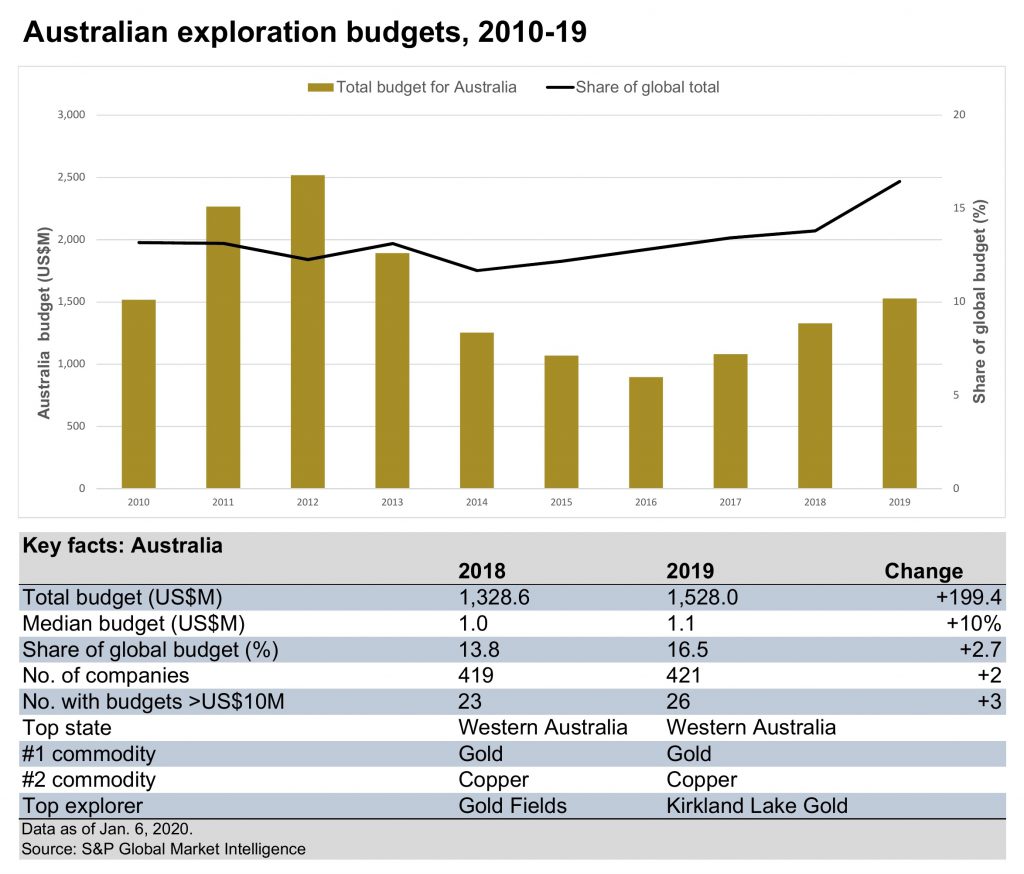

In Australia, exploration budgets increased by nearly US$200 million in 2019. Explorers allocated just over US$1.5 billion to Australia in 2019, a seven-year high. These increases were driven by higher allocations for copper and gold by producers. Also reaching a seven-year high are the recent gold prices which indicate that 2020 will see a rise in gold exploration and investment.

For junior exploration companies the situation is tougher, as investors increasingly shy away from ‘riskier’ early stage exploration companies, preferring the ‘safe havens’ of investing in majors, royalty and streaming companies or ETFs.

Rick Rule has suggested that most of the funding for juniors will therefore have to come from the majors, believing that “the exploration cycle is returning”.

However, this increased focus on exploration investment by the industry doesn’t necessarily mean that getting a mining project through the exploration stage is becoming any easier as mining companies must dig deeper and move into less explored geographies.

Conversion rates between discovery and discoveries that become mines are still low due to difficulties with permitting issues, adding to jurisdictional risk, as well as Preliminary Economic Assessments (PEA) and Pre-Feasibility Studies (PFS) still notoriously inaccurate. Even after the discovery has been made, securing financing during the mine development and construction phase is fraught with pitfalls.

Getting a mining project through the exploration stage will be a focus for discussion at the upcoming Mines and Money Asia event in Hong Kong at the end of March.

Resource Capital Funds’ Managing Director Peter Nicholson, Lowell Resources Funds Management Director John Forwood and IRC’s Chief Financial Officer Danila Kotlyarov will discuss how miners and financiers can lessen their risk for projects transitioning from exploration to production in a panel discussion.

Exploration projects from around the world will be showcased to more than 400 potential resource investors throughout the two-day conference and exhibition. Senior mining executives will be sharing their latest project developments through spotlight presentations within the conference program and will be available to meet with potential investors on the exhibition floor. Enabling investors to be the first to hear major announcements and to get in first to beat the competition.

Canadian projects participating this year include Agnico Eagle Mines’ joint venture with Barsele Minerals, alongside Iso Energy drilling newly discovered high-grade uranium at the Hurricane zone in the eastern Athabasca Basin as well as Amex Exploration who have made a recent significant discovery in Quebec at its 100% Perron project.

There will also be several Australian exploration projects with participation from Southern Gold, Cape Lambert Resources and White Rock Minerals; and amongst the less explored geographies include Royal Road Minerals Nicaragua gold and copper project, Ceylon Graphite’s project in Sri Lanka as well as Goviex Uranium’s advanced stage property in Niger.

A further 100 mining projects from around the world and across the commodity spectrum will be at the region’s largest mining investment forum, seeking funding from more than 400 institutional and private investors.

For more information please visit asia.minesandmoney.com

Mines and Money Asia is the region’s largest mining investment forum, bringing together investors and miners to Hong Kong from 31 March – 1 April 2020, for two days of networking, learning, and deal-making. Showcasing more than 100 mining projects from around the globe and across the commodity spectrum; there’ll be conversations and new opportunities waiting at every turn. It’s the only place to gain access to more than 400 leading investors, and with networking from breakfast right through to evening drinks, delegates will leave with new connections, deals and business opportunities. https://asia.minesandmoney.com/

Media Contact

Samantha Morgan

Head of Marketing – Asia Pacific

P: +61 3 9021 2031

E: Samantha.morgan@minesandmoney.com