Important developments are taking place this week as investors return from the end of the summer doldrum season. Conference season picks up this weekend and next at the Metals Investors Forum and the Precious Metals Summit in Beaver Creek. Both are sold out!!!

I expect to see a consistent flow of news and for gold to consolidate while silver and the junior miners play catch up to the higher gold price. I believe many investors have missed out on the move in gold this summer and are looking to position in some forgotten junior miners still unknown by the masses.

Take notice of the chart above of the gold-silver ratio which just recently almost hit 95-1 gold to silver ratio. Now silver is outperforming this week causing the gold silver uptrend to breakdown.

The Venture Exchange and small junior miners perform better when the gold-silver ratio breaks down which it appears to have recently done. Notice some of the great junior rallies occurred 2003-2007 and 2009-2011.

Could we be in for a few good years? As I heard one speaker say once we had the pain of the bear market lets enjoy the gain of the next bull market.

This weekend we have the Metals Investors Forum where already we see some interest coming in to some of the companies about to present with the newsletter writers. Eric Coffin will be there with his picks such as Great Bear $GBR.V which came out with great drilling news taking the stock from 50 cents to $8 bucks… Minera Alamos $MAI.V, Barrian Mining $BARI.V and Libero Copper $LBC.V are three which are all drilling for #gold right now and put out news they are presenting. So I expect some good content soon.

Then next week you have one of the best mining shows in Beaver Creek Colorado. The junior mining market appears to be in the early stages of a bull market and many investors are still underweight or have zero exposure to gold.

Junior mining has been chronically underfunded for years and the majors have not put much money into exploration. Some of these miners will die if they don’t grow or get in early on discoveries. That is why significant discoveries like Great Bear have gone from 50 cents to $8.

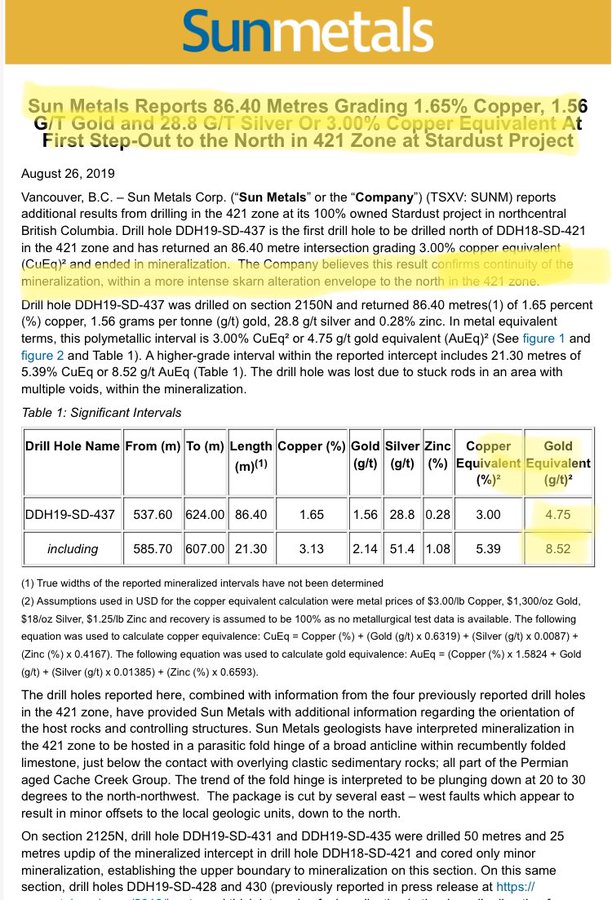

I believe there are other discoveries out there that have not really taken notice from investors or situations with tired shareholders who used good drilling news to sell out. Take a look at the results these past few weeks with $GTT.V #GT Gold backed by Newmont and $SUNM.V #sunmetals backed by Teck that both have great results but market has ignored them. Unfortunately among retail investors BC still has a bad rap but that could change with some of these great results.

Keep a close eye on Strikepoint Gold $SKP.V which is drilling right near Pretium in the #goldentriangle. Lots of smart investors know this is a discovery 20 years in the making. They released news that they have sent in assays and are getting them rushed! I’m hoping for a discovery and a break of a major 2 year downtrend.

Triumph Gold $TIG.V could be a big discovery in the Yukon. They are drilling the deepest hole into the richest porphyry in Yukon history !!!! Jordan Roy Byrne says Triumph looks phenomenal!

Finally, silver is making a major breakout and you must follow the #kenohill #silverdistrict in the #yukon. Alexco $AXU could be a takeout target and $MMG.V #metallicminerals may be next. The same guys who built Novagold and Trilogy are building a model around Alexco which could generate possibly a consolidation of the district by a major…just my thinking but what do I know. Remember Barrick tried to buy out Novagold this is the same team who built that asset? They are doing amazing work in #kenohill.

Finally, its time for silver and the junior explorers as evidenced above by the breakdown in the gold to silver ratio. These next few weeks could see lots of new interest in the juniors as investors waken up to the rising precious metal prices breaking out into six year highs. We will watch carefully over the next few days for exciting news. Stay tuned.

Jeb Handwerger

@goldstocktrades

Disclosure:

Jeb Handwerger is not a registered investment advisor! I am an investor and help companies with digital marketing. Junior Mining Stocks are very risky! Buyer Beware! Assume Author (Jeb Handwerger) owns shares in these companies and that I want to sell them for a profit. We have website advertisers so that means I may be compensated to help boost digital awareness (traffic). The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Jeb Handwerger about any company, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. Author is not responsible under any circumstances for investment actions taken by the reader. Author has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. Author is not directly employed by any company, group, organization, party or person. The shares of these companies are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. Author is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Author is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Author is not an expert in any company, industry sector or investment topic.