This post Buy Alert: 3 “Amazon Survivors” to Grow Your Wealth appeared first on Daily Reckoning.

“Dad, I got a raise!”

I’ll never forget the look in my son’s eyes when he came home from Dunkin Donuts that evening. He was proud of himself, confident, and looking forward to having a bit more spending money in his pocket.

David is a hard working young man. At his first job, he was willing to get up at the crack of dawn to help open the store, even on Saturday when most of his high school friends were sleeping in. He often filled in for other workers too who simply failed to show up.

And in a short amount of time, the managers noticed this dependability and rewarded David with a raise.

“Way to go, David!”

As the U.S. economy continues to expand, more and more workers are getting similar raises. And with more money to spend, a handful of key retail stocks are poised to shoot higher.

Today, I’ve got three favorite plays for you to put in your portfolio right away!

Have Cash, Will Spend

Like any good teenager, David loved to spend the money he earned.

I remember a few weeks after his raise, the doorbell rang. It was a delivery guy with three boxes of new shoes. I had to laugh as I can’t remember the last time I bought three new pairs of shoes at once!

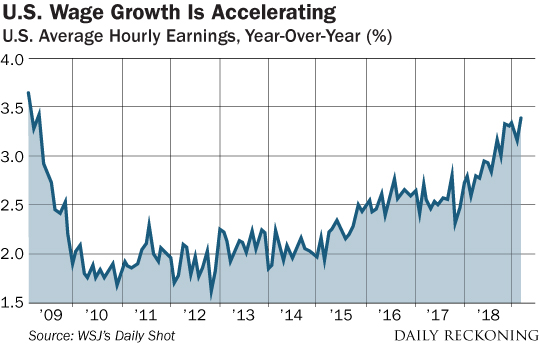

Today, consumers across the country have more money to spend thanks to rising wage growth. In fact, wages are growing at the fastest pace since the financial crisis 10 years ago!

As companies continue to spend more to hire and keep workers, we should see more cash finding its way to consumers. Of course, this is great news for retail companies who rely on discretionary spending to boost profits.

So let’s take a look at how retailers are faring, and where you can find the best opportunities.

Amazon Hasn’t Killed Everyone Yet

There’s been a lot of discussion about how Amazon’s online platform has been a brutal competitor for many large retailers in the U.S.

Heck, Sears and JC Penney are mere shadows of the companies they used to be. And many malls have actually had to close their doors because people just aren’t shopping at these retail hubs anymore. Instead, they’re buying clothes and other merchandise on Amazon.

On top of the Amazon competition, retail investors have also been concerned with the December retail sales numbers which came in well below expectations.

Is this a sign that the consumer has stopped spending? Or that the economy is headed for recession?

Not so fast…

The uncertainty during December (including the government shutdown, the trade war, and a sharp selloff in the stock market) may have caused some shoppers to stay home. But even still, the Commerce Department’s numbers look suspicious. After all, other private statistics like the Johnson Redbook same store sales report showed a much stronger picture.

All told, shoppers may have spent a bit less than expected for the December holiday period, but the overall “wealth effect” isn’t dead yet. And as wages pick up, consumers are certainly going to increase their spending habits.

The key for us as investors is to figure out where that money will be spent, and to invest in companies that will not be harmed by Amazon’s expansion into the retail market.

Today, I’ve got three stocks that fit the bill, allowing you to cash in on rising wages and strong retail spending this year.

Abercrombie & Fitch (ANF) — Maybe I’m biased because I have so many teens in the house. But Abercrombie’s brand is resonating with today’s younger demographic. And after pulling back for the better part of this decade, ANF is making a comeback.

The retailer recently reported earnings that beat investor expectations and plans to remodel stores this year to make its locations more attractive for shoppers. Malls might not have the same draw they did ten years ago, but teens are still hanging out and shopping together. And ANF is now in a prime position to benefit.

Shake Shack Inc. (SHAK) — One of the things that Amazon can’t replace is the experience of spending time with friends and family. One of my favorite things to do with my kids after school or on the weekends is to go out together and get ice cream or a meal.

Shake Shack is cashing in on this trend with a chain of restaurants that caters to customers who can appreciate a good burger and a great milkshake — at a slightly higher than normal price. By offering premium quality food and beverages, SHAK is able to boost profit margins while still attracting a loyal following.

SeaWorld Entertainment (SEAS) — If you’re a parent, you know that taking your kids on a memorable trip can be both exhausting and very rewarding. This year, SeaWorld should see traffic pick up as more families have budgets that can include a theme park experience.

In addition to its water-themed parks, SeaWorld also owns the Busch Gardens brand. This gives the company some diversification when it comes to which experiences parents will pick for their children (or themselves). Look for SEAS to grow profits this year as higher wages lead to family excursions.

And there you have it. Three ways to play the strongest season of wage growth since the financial crisis!

Here’s to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ❘ Facebook ❘ Email

The post Buy Alert: 3 “Amazon Survivors” to Grow Your Wealth appeared first on Daily Reckoning.