Interest rates are rising in the USA along with higher costs of living. Real Estate in many metropolitan areas is overpriced and unaffordable for the average professional. Apple has become a trillion market cap and the stock markets is in bubble territory on its greatest run since the roaring 20’s. The times couldn’t be better for those who have lived a high lifestyle in stocks and real estate brought about through zero interest rates and record amounts of debt. For the average gold investor they could be down in the dumps as the price breaks below $1200 and the junior mining market has been down for close to 8 years since its record high of $1900. We had a reprise for half a year in early 2016 but the record short position has once again decimated the exploration and development mineral industry.

A rally from this continued slump is long overdue. Its very important during these challenging time to look for opportunities that have huge discovery potential. During these downturns it is the few companies that are active that really are able to draw the attention from the smart mining investors. I’ve avoided cannabis and crypto as this is not real in my book and I just don’t get it. I’d rather stick to real discovery potential.

Remember it is with the drill bit that you can turn pennies into dollars and reap ten bagger gains.

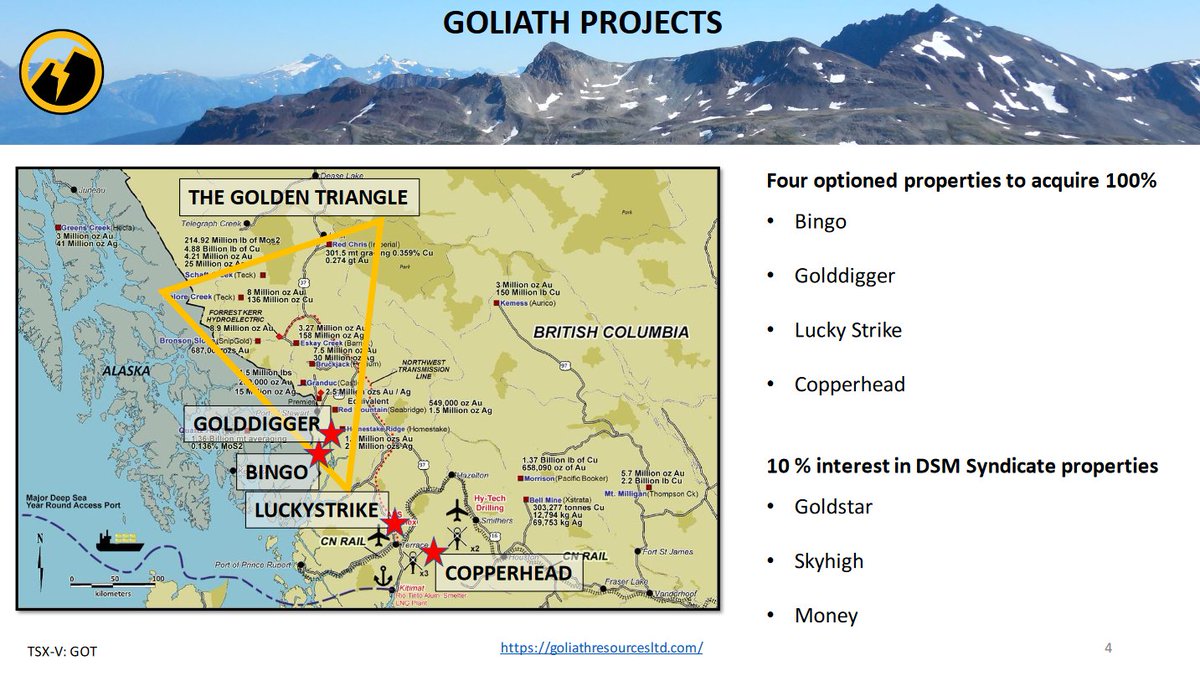

The Golden Triangle in BC Canada has so much potential as global warming has led to a receding of the glaciers and discovery of new outcrops. Its one of the few areas if you hit high grade gold it can move a stock from dimes to dollars. Just look at Garibaldi and GT Gold from last year. Some good results such as Aben came out this week. Also keep an eye on news today from Goliath.

Goliath Resources $GOT.V may be onto something as they raised over $3 million in a tough junior exploration market to drill in 2018.

How did they raise this money for grassroots exploration in a declining junior market? They have new greenfield discoveries which many scientists and technical experts are quite excited about.

They are fully funded to drill this year. All four of their properties have brand new discoveries with gold, silver and/or copper in exposed bedrock at surface. Check out Goliath Resource $GOT.V presentation by clicking here…

Also today they just announced a new discovery and released a video which highlights the incredible potential…

https://www.youtube.com/watch?v=aDsyKWlLCBo&feature=youtu.be

Also see my recent interview with the CEO of Goliath $GOT.V by clicking here…

Another company I’m interested in is Lorraine Copper $LLC.V $LRCPF who owns the Stardust Project also in North Central BC. They recently announced the launch of the 2018 field program. The objective of the 2018 field program is to further explore and expand mineralization identified in a 2.2 kilometre corridor of polymetallic Carbonate Replacement System mineralization.

They are partnered with the famous Mark O’ Dea (Fronteer Gold and True Gold) from Sun Metals under the Oxygen Capital Banner. Some of my subscribers remember when we followed Mark at Fronteer Gold. They are an extremely successful geological team.

There is a high grade nature of mineralization that was previously intersected and may indicate a strengthening system with copper, moly, gold, zinc, lead and silver. I hope to get in touch with management soon to do an interview with subscribers.

Check out the recent news by clicking here…

https://www.lorrainecopper.com/lorraine-copper-announces-start-to-2018-field-work-at-stardust-project/

Best wishes,

Jeb Handwerger

Disclosure: Author (Jeb Handwerger) owns shares in these sponsored companies Goliath and Lorraine and I want to sell them for a profit. Sponsors are website advertisers so that means I have been compensated and have a conflict of interest to help boost awareness of this story. The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Jeb Handwerger about any company, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. Author is not responsible under any circumstances for investment actions taken by the reader. Author has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. Author is not directly employed by any company, group, organization, party or person. The shares of these companies are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. Author is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Author is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Author is not an expert in any company, industry sector or investment topic.