Great Panther Silver (TSX:GPR; NYSE:GPL) (“Great Panther”; the “Company”) announces production results for the third quarter (“Q3”) 2018 from its two wholly-owned Mexican silver mining operations: the Guanajuato Mine Complex (“GMC”), which includes the San Ignacio Mine, and the Topia Mine in Durango.

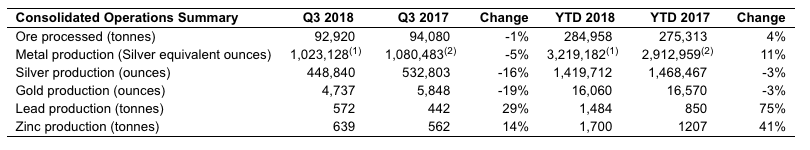

Nine Months ended September 30, 2018 (Compared to the Nine Months ended September 30, 2017)

- Silver production decreased 3% to 1,419,712 silver ounces (“Ag oz”)

- Gold production decreased 3% to 16,060 gold ounces (“Au oz”)

- Lead and zinc production increased 75% and 41%, respectively

- Consolidated metal production increased 11% to 3,219,182 silver equivalent ounces (“Ag eq oz”)(1)

- Ore processed increased 4% to 284,985 tonnes

Third Quarter 2018 Production Highlights (Compared to Third Quarter 2017)

- Silver production decreased 16% to 448,840 Ag oz

- Gold production decreased 19% to 4,737 Au oz

- Lead and zinc production increased 29% and 14%, respectively

- Consolidated metal production decreased 5% to 1,023,128 Ag eq oz(1)

- Ore processed decreased 1% to 92,920 tonnes

| (1) | Ag eq oz for 2018 presented in the press release are calculated using an 80:1 Au:Ag ratio, and ratios of 1:0.0636 and 1:0.0818 for the price/ounce of silver to price/pound of lead and zinc respectively. Comparative Ag eq oz for 2017 are calculated using a 70:1 Au:Ag ratio, and ratios of 1:0.0559 and 1:0.00676 for the price/ounce of silver to price/pound of lead and zinc respectively. The changes reflect changes in the prices of gold, lead and zinc in relation to the price of silver in 2018 relative to 2017. Prior disclosure of 2018 Ag eq oz production results were computed on different ratios. Please refer to notes in the applicable disclosures. |

“We remain on track to meet our production guidance for 2018 with good year-to-date production performance, despite a decline in silver and gold production for Q3 compared to Q3 of last year”, stated James Bannantine, President & CEO. “Given the sustained low metal price environment, we adjusted our mine plan in the third quarter to exercise the flexibility between our mines and plant to reduce mining of higher cost stopes at the Guanajuato Mine. This was a factor accounting for the relative decline in silver and gold production in the third quarter, along with lower grades and recoveries at the GMC and a particularly strong quarter of production for Q3 of 2017. We also initiated other cost reduction measures at our Mexican operations to address the low metal prices. Our focus over the coming months will be on completing the acquisition of Beadell Resources Limited, as well as continuing to progress the Bulk Sample Program at our Coricancha Mine in Peru and advance to a production decision in early 2019.”

| (1) | Silver equivalent ounces for 2018 were calculated using an 80:1 Au:Ag ratio, and ratios of 1:0.0636 and 1:0.0818 for the price/ounce of silver to price/pound of lead and zinc, respectively. The ratios are reflective of average metal prices for 2018. |

| (2) | Silver equivalent ounces for 2017 were calculated using a 70:1 Au:Ag ratio, and ratios of 1:0.0559 and 1:0.0676 for the price/ounce of silver to price/pound of lead and zinc, respectively, and are reflective of average metal prices for 2017. |

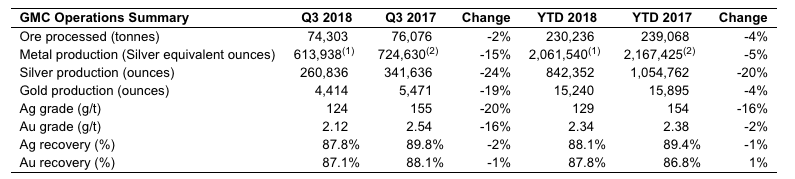

Guanajuato Mine Complex

In Q3 2018, production at the GMC included silver production of 448,840 oz and gold production of 4,737 oz, which represent a 16% and 19% decrease, respectively, compared to the same quarter in the previous year. During Q3 2018, we took steps to reduce mining of higher cost areas of the Guanajuato Mine. This was partly offset by an increase in ore feed from the San Ignacio Mine. Although San Ignacio has a lower overall mining cost, metal production was also affected by lower grades reflecting variability in the mineralization. The increase in Ag eq oz production reflects the change in the relative Au to Ag price as reflected in the Au:Ag ratio used to compute Ag eq oz.

The San Ignacio mine accounted for 76% of the total ore processed at the GMC in Q3 2018, compared to 58% in Q3 2017.

| (1) | Silver equivalent ounces for 2018 were calculated using an 80:1 Au:Ag ratio, and ratios of 1:0.0636 and 1:0.0818 for the price/ounce of silver to price/pound of lead and zinc, respectively. The ratios are reflective of average metal prices for 2018. |

| (2) | Silver equivalent ounces for 2017 were calculated using a 70:1 Au:Ag ratio, and ratios of 1:0.0559 and 1:0.0676 for the price/ounce of silver to price/pound of lead and zinc, respectively, and are reflective of average metal prices for 2017. |

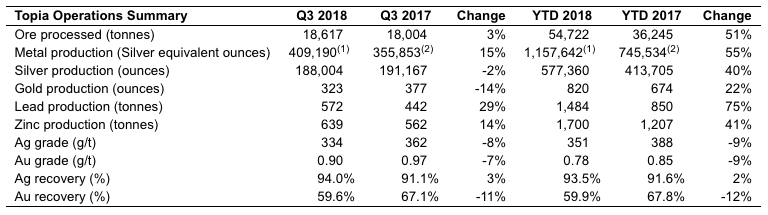

Topia Mine

In Q3 2018, silver and gold production from the Topia Mine declined 2% and 14%, respectively, compared to the same quarter in the previous year. Lead and zinc production increased 29% and 14% compared to the same quarter in the previous year, which contributed to the 15% increase in metal production in the quarter. The rise in metal production is attributed to higher tonnage processed coupled with higher lead and zinc grades.

The increase in ore processed is the result of a combination of mining areas with wider veins, as well as higher mill availability due to improved operational efficiencies.

The production tonnage in Q3 2018 saw lower silver and gold grades compared to the same quarter in the prior year. However, the decrease in silver and gold grades was more than offset by the increased lead and zinc grades.

| (1) | Silver equivalent ounces for 2018 were calculated using an 80:1 Au:Ag ratio, and ratios of 1:0.0636 and 1:0.0818 for the price/ounce of silver to price/pound of lead and zinc, respectively. The ratios are reflective of average metal prices for 2018. |

| (2) | Silver equivalent ounces for 2017 were calculated using a 70:1 Au:Ag ratio, and ratios of 1:0.0559 and 1:0.0676 for the price/ounce of silver to price/pound of lead and zinc, respectively, and are reflective of average metal prices for 2017. |

OUTLOOK

Cash cost and AISC for Q3 2018 will be higher than full year …read more

From:: Investing News Network