Source: The Critical Investor for Streetwise Reports 10/04/2018

A mining analyst with decades in the industry, Kees Dekker, in this interview with The Critical Investor, discusses not only his experience as an analyst in the field, but also numerous criteria that he recommends for investors to use when doing their due diligence.

Once in a while I run into countrymen in the mining business, and as a Dutchman this doesn’t happen too often. Notwithstanding this, I was connected to a gentleman named Kees Dekker through a mutual contact, and it appeared soon enough that Kees shared a preference for critical analysis with me. Having worked a long career in the mining business when located predominantly in South Africa and Namibia after graduating in the Netherlands but doing projects all over the world, he now aims to work as a freelance mining analyst. I am more than happy to provide him with a platform to introduce himself, as examples of his analysis indicated to me that he could be of great value for anybody who’s interested in thorough research on a mining company. Some of these sometimes very extensive examples will be published, starting shortly after this interview, to give a good idea of the level of Kees’ analyzing capabilities. For now, it is time to introduce Kees Dekker, so here we go. – The Critical Investor

The Critical Investor: Thank you, Kees, for participating in this interview. It is a pleasure to get to know a countryman who knows his way around the mining industry and who also likes to analyze mining companies. For starters, can you tell us your background and experience?

Kees Dekker: Let me first begin with some basics. I am 64 years of age, and currently reside with my wife in Namibia, the country where I started my career after obtaining BSc and MSc degrees in Geochemistry (BSc, MSc) in Utrecht, Netherlands. I subsequently got BCom and MBA degrees from South African universities. We returned to Namibia after our two adult sons left for Germany to pursue careers there.

My career started back in 1979 as an exploration geologist for a subsidiary company of Gold Fields of South Africa (GFSA), which was at the time the third largest global gold producer, but also controlling a number of major base metal and coal companies. In 1983 I was appointed senior geologist at a large base metal mine, the Black Mountain Minerals mine in South Africa.

After completing an MBA in Cape Town, sponsored by GFSA, I joined head office in 1986 as a senior mineral economist at Gold Fields in the Coal and Base Metals Evaluation Section. There I was involved in the annual valuation of Group Companies, coordinating feasibility studies and carrying out project evaluations.

In 1988, I was appointed Section Head of the Coal and Base Metal Valuation Department, managing and mentoring five analysts. In 1990 I was appointed to Group Economist when I managed economists involved in macro-economic analysis, monitoring commodity market development and producing metal price forecasts, as well as advising the pension fund trustees on equity investments and supervising a country risk analyst.

In 1992, I was appointed as Assistant Manager of the GFSA Group, when I had reporting to me an Architectural Section, a Quantity Surveying Section, a Project Management Section and a Property Administration Section, which also looked after the assets of Gold Fields Property Company, listed on the Johannesburg Stock Exchange. The position was often used by GFSA to provide commercial exposure before moving to a more senior position elsewhere in the Group.

In July 1995, I was appointed Regional Manager in Quito, Ecuador for Latin America, except for Brazil. Unfortunately, following the severe downturn in 1999 in the mineral industry and with Gold Fields doing particularly poorly, new management decided to retrench many people including myself.

In 2002, I was appointed as New Business Manager by Oryx Natural Resources, focused on finding diamond projects in Africa. Oryx offered me a job in 2003 as President of its operating diamond mine in the DRC. I left this job after I concluded that the operation did not have the chance to ever be feasible, and I joined another diamond-focused company called Matikara Limitada in Angola, as Chief Operating Officer. Matikara was a JV company between the second largest diamond producer in South Africa, Transhex, and Lev Leviev, who had the monopoly for marketing Angolan diamonds for a long time.

After this, in 2006 I joined RSG Global, a reputable mining consultancy, which got acquired by Coffey Mining in 2007, as Manager for southern Africa. Because of a very different corporate culture I decided to follow my former Manager – Audits at RSG, Mick McMullen, and joined Lachlan Star, one of his companies, in May 2008.

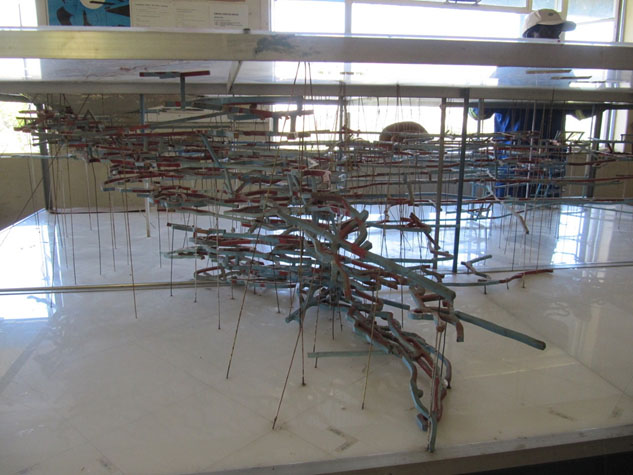

CMD gold mine, Chile (credits: Kees Dekker)

At Lachlan Star I was coordinator of a pre-feasibility study of a gold project in Zambia, followed by the review, acquisition and resource expansion of a gold mine in Chile until the summer of 2012.

Since 2012 I have acted as a freelance consultant involved in technical reviews of among other, the Stillwater Mining Company operations and projects, Nevada Iron Limited, New Chris Minerals and for private equity funds such as QKR (acquisition of the Navachab mine in Namibia), the Casablanca Capital (Cliffs Natural Resources) and Blackstone Special Opportunity fund (Talvivaara mine in Finland and the Renard diamond project of Stornoway). I have also visited projects in many other exotic places like India, Eritrea and Zimbabwe. Right now I am looking to intensify my work as a consultant as I feel too young to retire yet.

Sandawana Emerald mine, Zimbabwe (credits: Kees Dekker)

TCI: That’s an impressive resumé in mining, and you seem to have covered a variety of fields, from doing exploration yourself to managing studies to managing large exploration projects to acquisition of assets. What would you consider your field of …read more

From:: The Gold Report