Nordic Gold Corp. (TSXV:NOR) (“Nordic” or the “Company”) today announced that it has received written confirmation from Finnish supervisory authority ELY, that it has provided all documentation required and that it can recommence mining and processing operations at its Finnish mining project, Laiva Gold Mine. This is the result of ongoing communications with, and environmental reporting for, the Finnish regulators in the region. Finland is rated as the top jurisdiction in the world for mining investment based on the Fraser Institute, Investment Attractiveness Index.

Mining activities started at Laiva several weeks ago in mid-August, to establish access and clear working areas. The company has been conducting three blasts a week and is stockpiling mineralised material in readiness for plant start up. At this time there are around 62,000 tonnes of mineralised material stockpiled and ready for processing. Roughly 15,000 tonnes of mineralised material has been run through the primary crusher as part of recommissioning. This mineralised material is stockpiled in the crushed material storage facility, ready for the imminent recommissioning the mills. With the approval now given by ELY, the mill and plant can now begin operating.

Michael Hepworth, President and CEO said, “This is a significant advance for the company. We are now able to operate the plant and prepare for processing. The plant is being restarted in stages with the grinding circuit now in its final stages of testing. The CIL circuits are ready to operate and will be filled as mineralised material passes through the comminution circuit. We plan to pour our first gold on 27th November.”

About the Company

Nordic was formally known as Firesteel Resources and changed it name to reflect its regional base. Nordic is a junior mining company with a near production gold mine in Finland. The mine is fully built, fully permitted and financed to production via a gold forward sale. Production is scheduled to start in the 4th quarter of 2018.

A recently released PEA was conducted by John T. Boyd Company of Denver, Colorado (“Boyd”).

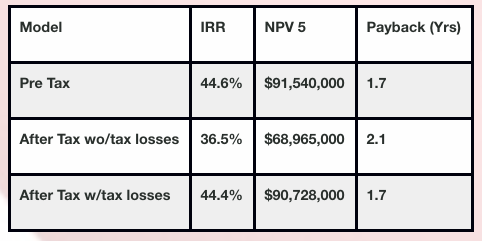

Summary of the PEA results include:

Other Highlights include:

Pre-production capex $7,115,103

75,981 ounces of average annual gold production at a cash cost of $863 per ounce and AISC of $974 per ounce

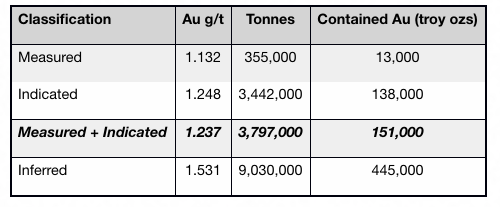

Measured mineral resources of 355,000 tonnes at 1.132 g/t Au and Indicated mineral resources of 3,442,000 tonnes at 1.248 g/t Au

Inferred mineral resources of 9,030,000 tonnes at 1.531 g/t Au

Mill grade of 1.45 grams per tonne with a recovery of 90.4%

Life of Mine production of 456,600 ounces gold over a 6-year mine life

The PEA is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

As previously announced, when Nordic (Firesteel) acquired the Laiva Mine, the Company was granted, EUR131,716,248 in tax loss provisions which may be used to offset future taxes should taxable income be earned in Finland prior to expiration of the tax loss carry forwards. The tax loss provisions expire between 2020 and 2028 (see the Company’s audited financial statements for the year ended January 31, 2018 for detailed disclosure of the expiration schedule). The recognition of the tax loss carry forwards have a material impact on the economic assessment of the Laiva Gold Mine project and are contingent upon the Company achieving taxable net income per Finnish tax laws.

Nordic Gold’s management has identified several opportunities outside of the scope of the mine plan studied in the PEA, which could further improve the mine plan and the economics of the project. Most important of these being the three additional 100% owned exploration properties close to the mine. Nordic is currently conducting magnetic surveys on all of the company’s properties. All three properties are fully permitted for exploration.

The report also identifies near mine targets for exploration as potentially 3.2 to 5.1 million tonnes grading at 1.25 to 1.45 grams per tonne. This estimate is based on drilling beneath the south and north pits at depths up to 250 m below surface and is open at depth. Further infill and step-out drilling is required to test these targets. Grade estimate is based on assuming the same weighted average grade of the measured, indicated and inferred resources reported in the Boyd report. The report also identifies a target in the eastern extension as potentially 0.85 to 3.2 million tonnes grading 1.25 to 1.45 grams per tonne. This estimate is based on three to five mineralized zones of 200 m to 300 m length, 50 m to 75 m vertical extent and 10 m width. Drilling has identified multiple mineralized zones up to 750 m from the north pit that extend to depths of at least 100 m. Grade estimate is based on intercepts of reconnaissance drilling and the weighted average grade of the measured, indicated and inferred resources reported in the Boyd report. The exploration targets are conceptual in nature as there has been insufficient exploration work to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The economics of the PEA do not include these exploration opportunities.

Mineral Resources:

Mineral Resources were prepared by JT Boyd (Firesteel Press Release August 21, 2017).

The effective date of the estimate is August 9, 2017.

The mineral resources presented here were estimated using a block model with a block size of 9 m by 9 m by 9 m sub-blocked to a minimum of 3 m by 3 m by 3 m using ID3 methods for grade estimation. All mineral resources are reported using an open pit gold cut-off of 0.40 g/t Au.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or …read more

From:: Investing News Network