Ely Gold Royalties (TSXV:ELY, OTC:ELYGF) (“Ely Gold” or the “Company”) is pleased to announce that it has entered into a letter agreement (the “Agreement”) with Balmoral Resources Ltd. (“Balmoral”) whereby Ely Gold will acquire 100% of all rights and interests in the 1% (one percent) net smelter royalty (the “Royalty”) on the Fenelon Mine Property, operated by Wallbridge Mining Company Limited (“Wallbridge”), located in west-central, Quebec (see figure #1).

Under the Agreement, Ely Gold will pay Balmoral a cash consideration of Cdn$500,000, issue 1,000,000 Ely Gold common shares in favour of Balmoral and issue to Balmoral 1,000,000 full common share purchase warrants. The closing date of the proposed transaction is expected to be on or around October 15, 2018 and is subject to completion of a definitive purchase and assignment agreement, the acceptance by the TSX Venture Exchange and Wallbridge. The 1,000,000 Ely Gold shares to be issued under the Agreement will be subject to a regulatory hold period of four months following the date of closing. The strike price was set at Cdn$0.10 for the 1,000,000 common share purchase warrants based on the closing price of October 9, 2018 and they will have a term of 18 months.

Trey Wasser, President and CEO of Ely Gold commented on the Transaction, “We are very pleased to add another quality asset to our growing royalty portfolio. The Fenelon Property is demonstrating excellent grades in minable intercepts and the project operator has indicated its belief that the resource has significant potential for increased resources. We look forward to delivering more news on the high-profile Fenelon Property Royalty in the near future.”

The Fenelon Balmoral Royalty

The Fenelon Balmoral Royalty was created pursuant to a purchase agreement, dated July 25, 2016, between Wallbridge and Balmoral. The 1,052 hectare Fenelon Mine property hosts the Discovery Gold deposit and surrounding four km strike length of a gold-bearing shear corridor (see figure #2). Subsequently, Wallbridge completed an updated resource estimate for the Fenelon Property in 2016 (see Technical Report and Mineral Resources Estimate for the Fenelon Mine Property, August 2, 2016) and produced a positive pre-feasibility study (PFS) on the Mineral Reserves in 2017. (see Technical Report on Wallbridge’s Sudbury Area Properties, Ontario (Canada), December 31, 2017), both reports are available under the Wallbridge issuer profile at www.sedar.com.

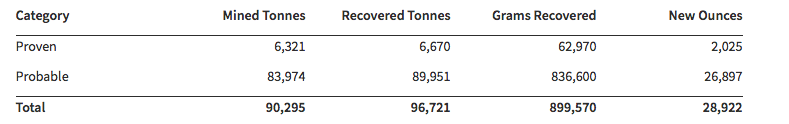

The 2017 Mineral Reserves are as follows:

FA-17-07 intersected three zones including 141.16 g/t of gold over 7.06 metres in the Viper Zone;Since the acquisition, Wallbridge has announced the completion of 33 drill holes totalling 6,348 metres in three surface exploration drilling campaigns at Fenelon. Results from the surface drilling program confirmed the high-grade nature of the near surface mineralization at Fenelon and led the identification of new zones of mineralization proximal to the existing mine workings established in 2004. Highlights from the recent drill program include:

- FA-17-17 intersected four zones including 311.08 g/t of gold over 3.06 metres, also in the Viper Zone;

- FA-17-26 intersected two zones including 260.44 g/t of gold over 7.02 metres, also in the Viper Zone; and

- FA-17-27 intersected 80.42 g/t gold over 4.73 metres in the Habanero Zone

Wallbridge is currently conducting an underground bulk sample program expected to produce approximately 20,000 ounces of gold from 35,000 tonnes. The bulk sample program is designed to mine selected stopes in several zones, across six levels. Wallbridge also reports that the cash flow from its bulk sample program will fund a 10,000-metre underground and surface drill program.

Underground drilling outside the confines of the historical and current resource envelope was anticipated to have commenced during the current quarter.

Stephen Kenwood, P. Geo, is a director of the Company and a Qualified Person as defined by NI 43-101. Mr. Kenwood has reviewed and approved the technical information in this press release.

About Ely Gold

Ely Gold Royalties Inc. is a Vancouver based, emerging royalty company with development assets focused in Nevada and the Western US. Its current portfolio includes 24 Deeded Royalties and 22 properties optioned to third parties. Ely Gold’s royalty portfolio includes fully permitted mines, mines under construction and development projects that are being permitted for mine construction. The Company is actively purchasing existing third-party royalties for its portfolio and all the Company’s Option Properties will produce royalties, if exercised. The royalty and option portfolios are currently generating significant revenue. Ely Gold is well positioned with its current portfolio of over 20 available properties to generate additional operating revenue through option and sale transactions. The Company has a proven track record of maximizing the value of its properties through claim consolidation and advancement using its extensive, proprietary data base. All portfolio properties are sold or optioned on a 100% basis, while the Company retains net smelter royalty interests. Management believes that due to the Company’s ability to generate royalty transactions, its successful strategy of organically creating royalties, its equity portfolio and its current low valuation, Ely Gold offers shareholders a low-risk leverage to the current price of gold and low-cost access to long-term mineral royalties.

On Behalf of the Board of Directors

Signed “Trey Wasser”

Trey Wasser, President & CEO

For further information, please contact:

Trey Wasser, President & CEO

trey@elygoldinc.com

972-803-3087

Joanne Jobin, Investor Relations Officer

jjobin@elygoldinc.com

604-488-1104

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer: This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, including statements regarding the Company’s contemplated acquisition of the Royalty relating to Wallbridge’s Fenelon Property, and Wallbridge’s stated plans for further near-term exploration and development of the Fenelon Property. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “aims,” “potential,” “goal,” “objective,” “prospective,” and similar expressions, or that events or conditions “will,” “would,” “may,” “can,” “could” or “should” occur, …read more

From:: Investing News Network