By Reuters

LONDON, Oct 5 (Reuters) – The great and the good of the global metals industry are descending on London, making their annual pilgrimage to the London Metal Exchange’s LME Week jamboree.

They do so because the 141-year-old market sets the world’s reference prices for everything from aluminium to zinc. And away from the many seminars and cocktail parties, metal producers, traders and users will meet behind closed doors to hammer out details of next year’s contracts.

For all that, the venerable institution has not been without its detractors and it has had to quell the discontent of recent years by pivoting back to its core industrial user base and reversing fee increases instituted after the 2012 purchase by Hong Kong Exchanges and Clearing (HKEx).

The revamp is timely and the LME is now able to look to the future with multiple new product launches planned for 2019, countering its increasingly assertive rivals in the form of North America’s CME Group and China’s Shanghai Futures Exchange (ShFE).

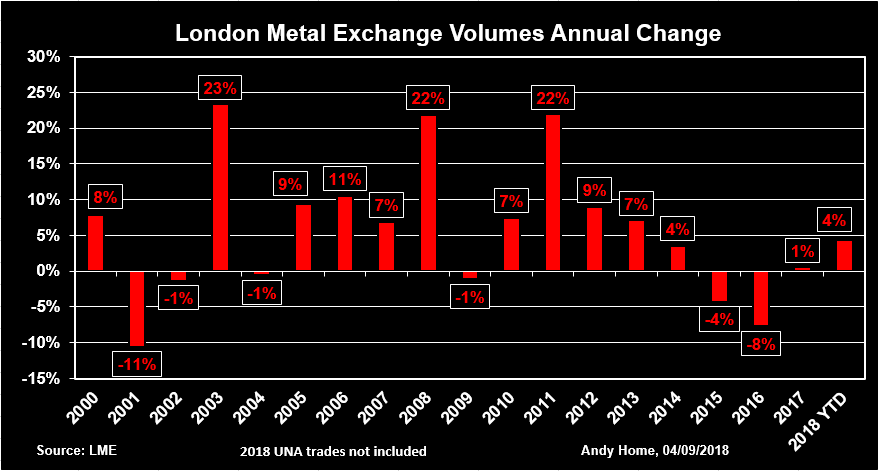

Graphic on LME Trading Volumes:

Volumes up, at a price

The good news for the LME has been a recovery in trading volumes after declines in 2015 and 2016 and anaemic growth of less than 1 percent in 2017.

Headline activity was up almost 10 percent in January-August. But as ever with this curious institution and its byzantine prompt-date system, the apparent surge comes with some important caveats.

Strip out what the LME terms “UNA trades”, a free way of aligning some of the exchange’s arcane practices with the MiFID II regulations — designed to harmonise financial services across the EU — and the growth was a slightly less stellar 8 percent. Or 4 percent after a weak year-on-year performance in September.

New contracts such as gold and silver have helped. So, too, have those fee reductions on spread trading introduced in the fourth quarter of last year.

Success, however, has come at a price.

HKEx reported a 2 percent decline in revenue and a 20 percent decline in operating profit from its commodities business in the first half of 2018, largely because of lower fee generation on the LME franchise.

Having taken the short-term pain to assuage its members, the LME is going to claw back revenue in other ways, such as a fee on some over-the-counter contracts and a potential charge for those currently free UNA trades.

And, of course, by expanding its portfolio to include gold and silver options, three new steel contracts and five new non-ferrous contracts.

The eagerly awaited lithium contract, a grab for the electric vehicle space, is not on the initial list but is very much a work in progress.

Western challenge

Several of those new contracts — hot-rolled coil steel, aluminium premiums for both the U.S. and European regions and alumina — will set the LME on a collision course with CME.

The CME exchange rolled out four regional aluminium premium contracts over 2013-2016, capitalising on industry unhappiness with the disconnect between the LME’s primary aluminium contract and surging physical market indicators, widely attributed to the LME’s own warehousing issues.

The LME responded with its own physically-settled contracts, but none traded — if you ignore the eight lots mistakenly registered by one fat-fingered trader in April 2017.

All the LME’s new contracts will use the standard vanilla CME futures model. There will be no physical delivery, no multiple prompt dates, but rather monthly futures cash settled against industry benchmarks.

The CME has first-mover advantage, but the LME is the generator of the underlying aluminium price, making it a logical one-stop market for those wanting to trade both components of the “all-in” price.Aluminium and steel are new fronts in an evolving competition between the two exchanges. The main battle ground is currently copper.

Aluminium and steel are new fronts in an evolving competition between the two exchanges. The main battle ground is currently copper.

Long a distant poor cousin to the LME’s flagship contract, the CME copper contract has grown exponentially in recent years. Volumes grew by 27 percent in 2016, 26 percent in 2017 and are up another 35 percent this year.

Even more spectacular has been the rise in CME copper options activity. Average daily volume this year has mushroomed by nearly 340 percent and open interest by 175 percent, the exchange said last month.

True, volumes have been boosted by the CME’s market-maker programme, a stimulus that doesn’t exist on the LME.

But with the CME claiming that more than 20 percent of its copper options business is now originating outside of the United States, it is clear it has been gaining market share at the expense of London, where copper volumes slid 8 percent last year and have flatlined so far this year.

Eastern promise

The ShFE has just launched its own copper options contract, only the third such commodity derivatives offering in China after sugar and soymeal.

Like many Chinese markets, the ShFE has a reputation for sometimes wild fluctuations in activity, depending on what the country’s mass retail investment crowd considers the hot market at the time.

The options offering, however, appears to be targeted at the industrial and institutional players who currently trade the international market. Volumes and open interest after the first month of trading were 21,028 lots and 19,584 lots respectively.

Now, as the LME has consistently argued, there is no pre-defined limit on how much copper can trade across the world’s exchanges, particularly given the different user profiles.

If ShFE is successful, it does not automatically mean a hit on the LME. It could, indeed, boost both LME and CME volumes by lifting arbitrage.

Nor has it stopped more Chinese players from joining the London market; witness broker Nanhua Futures’ move to become a member of the LME.

But ShFE’s ambitions to translate China’s dominance of physical metal supply chains into trading clout are clear from what it has not done.

It has, via Chinese regulators, denied the LME permission to open warehouses in mainland China and has conspicuously declined to “connect” with HKEx in the way Chinese stock markets have.

There is much eastern promise for the LME, but it comes with …read more

From:: Mining.com