Source: Michael J. Ballanger for Streetwise Reports 09/26/2018

Precious metals expert Michael Ballanger discusses distortions in the markets.

Here is a question for any and all of you that have ever purchased a lottery ticket or played the slots or bet on a horse: If you had proof that the outcomes were all rigged, would you still play? If someone showed you a video of pit bosses stacking decks or tampering with dice, would you ever enter that establishment again? If your wife or mother or employer knew that you would constantly blow your paychecks in a rigged casino, would you ever be able to face them? The answer to all of the above-mentioned scenarios is a resounding “NO!” Yet millions of people (albeit that figure is rapidly shrinking) are still committing many hundreds of millions of dollars every week to the Crimex Casino, which has now proven that every single input into determining prices for gold and silver (Bitcoin, too) is completely controlled by the bullion banks, the Crimex bosses and the regulators.

The Transitive Quality of Equality states that “if a = b and b = c, then a = c.” The Transitive Quality of Gold Pricing is “if I buy gold based upon demand and supply, and demand and supply have no bearing upon price, then I am buying gold with no concern for price,” which is total insanity. We have seen in the past 30 years how the Crimex banks are able to use the paper markets to influence not only near-term demand but also long-term supply. By suppressing price, they are now influencing supply with no better confirmation than the paucity of new BIG gold discoveries since the 1990s.

The price managers in New York and Washington and London and Brussels and Tokyo and Beijing seem to all agree that citizens of all nations should be urged to avoid gold and trust paper currencies because of national security issues. The truth is that the paper merchants cannot charge a fee if your net worth is held in physical metal. Now that they control the Four Pillars of Commerce—banking, investments, insurance, and real estate—the big banks view gold and silver in a totally hostile view because these alternatives threaten to dissipate their power of monetary control, and if there is ANYTHING that will send a banker into a murderous rage, it is the mere THOUGHT of losing control of the “flow” of money, which they currently command and in spades.

As a young student in the 1970s, I listened to the Jesuit Fathers teaching us about “sound money” and “fiscal jurisprudence” and “inflationary spirals” and what was indelibly etched upon my early-adult psyche was that “Cash is Trash” in periods of government largesse and mismanagement. They would abandon the prescribed curriculum in favor of open debate on numerous occasions because in the 1970s a powerful new voting (and consuming) block of citizens known as the “Baby Boomers” was rapidly assuming power and influence to the extent that they were able to halt the war in Vietnam and change abortion laws, to name just a few. In that period prior to computer-assisted and software-managed trading, humans made ALL of the investment decisions irrespective of term. Decisions to hold for the long term or scalp a point or two were made by individuals and the only technology made available to them was (perhaps) a hand-held calculator or, in some cases, a slide rule.

So when the inputs in 1971 involved then-President Nixon abandoning the gold standard, what he really did was make it impossible to convert U.S. dollars into gold, which is what President De Gaulle of France had ordered his treasury department to do as U.S. Treasury bonds matured and repayment was required. Rising gasoline prices due to Middle East embargos and domestic political chaos (Watergate) forced investors to shun traditional investments such as stocks and bonds because rising inflation brought on by the credit creation from wars and budget deficits was eating away at returns. Investors chose sound money—gold and silver—and those who acted in 1971 at US$35 per ounce were handsomely rewarded; the natural flow of human interaction allowed gold’s popularity to gradually increase over the balance of the decade rising to $857 per ounce before the U.S. Fed woke up and decided that gold was an Enemy of the State, covertly at first and then suddenly.

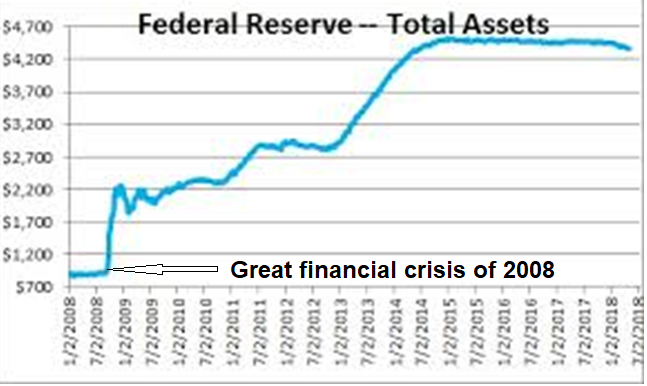

Compared to the inputs of the 1970s, those that we track from the post-2008 Financial Crisis make war expenditures from WWI, WWII, Korea, and Vietnam pale by comparison. The costs of two world wars and the Asian wars were measured in billions of dollars while credit creation since ’08 implemented to save the American banking establishment is being measured in the TRILLIONS. However, since humans making investment decisions in the 1970s could not be programmed, gold and silver could not be controlled as they are today.

Here in 2018, the inputs that should have driven gold and silver to new highs are numerous and powerful, but the controls put in place by the global elite are even more numerous and infinitely more powerful. Just as Baron Rothschild said the year before the establishment of the First Bank of the United States in 1701, “Let us control the money of a country, and we care not who makes its laws.” Paul Volker made sure that in the 1980s and beyond that the government would never again attempt to manage a financial crisis without first managing gold. Since gold ownership by U.S. citizens undermines the very essence of banking, gold ownership has been discouraged for the past nigh-on forty years. And it is NOT about to change.

Another reason that the Western world today takes such a dim view of gold ownership is that the two most voracious accumulators of gold in the world are the two countries most at …read more

From:: The Gold Report