Every investment carries a certain level of risk that can impact the return. For mining projects, the actual return on investment may differ substantially from that estimated during earlier project phases. While this could be due to unexpected changes in the political or social context, it may also be due to inaccurate deposit parameter assumptions, such as grades and ore reserves, or errors in estimating capital costs, operating costs, mineral revenue, and operating productivity. Getting a good sense of how these risks affect the value of a mining project is vital to make sound investment decisions.

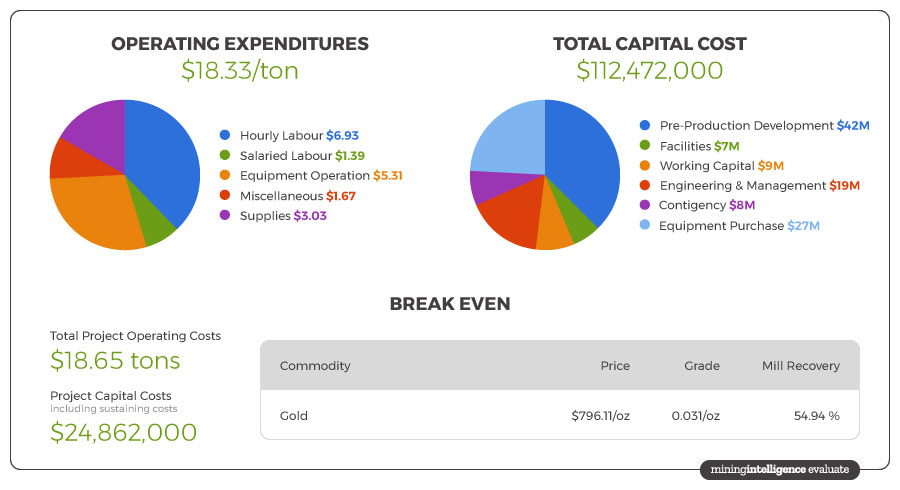

So how do you get to the point where you can confidently invest more money in your project? With Mining Intelligence’s Surface Evaluation Application you can perform break even and Monte Carlo risk analyses to identify potential pitfalls associated with a project, such as lower than expected recovery or increases in operating costs. Take the application’s capabilities further and run sensitivity analyses on key parameters, such as grade and commodity price. You will be able to observe how changes to these values affect net present value, rate of return, cashflow, and payback period.

This cloud-based application also allows you to save multiple “clones” of a surface mining and mineral processing project, enabling you to easily compare various project scenarios.

All of this will guide you towards investing in the most promising projects quickly and consistently. Get ready, Evaluate launches in 5 days.

Sign up now for a one-week free trial

The post Make sound mine project investment decisions in a risky business appeared first on MINING.com.

From:: Infomine