Source: Michael J. Ballanger for Streetwise Reports 09/24/2018

Vanadium and uranium are two of the few commodities whose prices have advanced recently, and Michael Ballanger discusses one company that is developing projects for both elements.

Western Uranium Corp.

Symbol: WUC.CNX / WSTRF.US

Industry: Developer, U.S.-based uranium and vanadium

Primary Asset: Sunday Mine, Colorado, U.S.A.

Western Uranium and Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) was first introduced to me by a colleague back in the spring of 2016 after which I determined that this was a classic valuation story where the fundamentals greatly dwarfed the share price and market capitalization. At the 2016 prices for uranium ($22/lb) and vanadium ($3/lb), I determined that WUC at CA$1.70 was undervalued by a factor of around 70% and set a $5.25 target price. After a number of corporate mis-starts and two years of poor pricing, the share price hit an all-time low this past summer at $0.54 despite a substantial recovery in uranium and vanadium prices. Accordingly, I decided to look more intensely at the factors inhibiting the share price and at the outlook for both commodities in light of trade wars, sentiment, demand and macroeconomic changes. As a result of this, I advised followers to consider acquiring a CA$0.68 unit financing being offered last June and later published a report entitled: “Western Uranium and Vanadium Corp.: Undervaluation Woes are Ending” (link) and set target prices at six months US$3.40 and twelve months at US$6.80.

Since then, the shares have advanced from CA$1.40 to CA$2.44, hitting a new 52-week high today. The shares appear poised for a technical breakout and continued ascent as the undervaluation continues to dissipate.

Why so bullish?

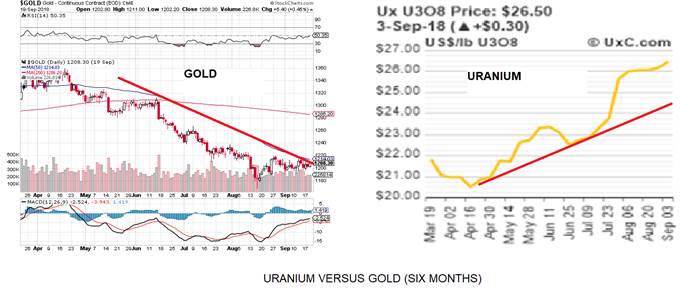

One glance at the charts of gold, silver, uranium and vanadium and you are immediately struck with the stark contrast in performance and trend between these four commodities. I view silver as gold’s high-octane little brother while vanadium is uranium’s twin counterpart. Not only do both pairs frequently occur in nature side by side, they usually have correlated price movements with silver outperforming (and underperforming) gold, and vanadium outperforming uranium. Now, if you are an investor covering gold and silver (as I am), you are considerably more inclined to take a position in uranium and/or vanadium than you are in gold and/or silver. Regardless of the fundamentals for the precious metals, they have acted horribly since April while uranium vastly outperforms gold, and vanadium absolutely smokes silver with a 600% move since the lows of 2016.

At current prices for uranium and vanadium, WUC controls approximately US$2.475 billion worth of inventory and at the current $37.5 million market cap, it is valued at a mere 1.5% of in-ground metal value with both commodities in uptrends.

Keeping the Sage: The company recently issued a press release updating its corporate affairs profile in which it terminated its LOI with Australia-based Battery Metals Resources Ltd. whereby BMR was attempting to purchase the vanadium-rich Sage Mine from WUC with cash payment. At the time, it was deemed a solid move because WUC had not yet closed its financing and the sale of the Sage was a well-thought-out fallback position in the event the funding came up short. As it turned out, the funding ended up oversubscribed and the urgency of the backstop facility was eliminated. As a result, WUC retains ownership of the Sage (and 5,000,000 lb of vanadium) with the proviso that something could still be on the horizon but at far more favorable terms given the outstanding performance of vanadium.

{cs.r.request_info_text} Submit Your Info Here

No More Debt: WUC also announced that the “$500,000 promissory note which was secured by the Colorado and Utah mineral properties acquired in the August 18, 2014 transaction between Pinon Ridge Mining LLC, a wholly owned subsidiary of Western, and Energy Fuels Holding Corporation was paid in full on August 31, 2018. The San Rafael Uranium Project, Sunday Mine Complex, Van 4 Mine, and the Sage Mine Project which were formerly secured by a first priority interest are now held by the Company free and clear of encumbrances.” This leaves WUC debt-free and with the improved balance sheet, they have significantly de-risked the company, which should further serve to eliminate the deep discount in valuation that still prevails despite the quadrupling of the share price since April.

Uranium Imports in the Crosshairs: President Trump has been a champion of American businesses since his inauguration with the imposition of tariffs intended to level the playing field to the benefit of U.S.-based companies. The Section 232 Uranium Investigation is now in front of Commerce Secretary Wilbur Ross with over 800 letters having been delivered. A period of 270 days may pass now after which a report must be delivered to President Trump after which a decision will be made. This issue also carries National Security implications such that in the event of the imposition of tariffs upon uranium imports, domestic-based uranium resources are going to receive an automatic and substantial increase in valuation which in kind greatly accelerates the removal of the current discount in market capitalization for WUC.

Minuscule Share Structure and Technical Picture: With only 28,129,870 shares issued on a fully diluted basis, which includes all warrants and options, the share float is relatively small creating significant upside traction in the event that investor demand begins to accelerate. Furthermore, management and other insider control over 30% of the issued capital and this always represents positive optics for the prospective investor.

Technically, the stock needed to overcome the downtrend line drawn off the 2015 peak above $5 and the 2017 high of $2.75 that projected out to $0.90, which it did in the early summer. It then needed to overcome the 200 dma at $1.24, which it did later in the summer. The next formidable resistance is at the 2017 …read more

From:: The Gold Report